Market Data

November 7, 2013

SMU Survey: Buyers Believe Increase is Coming – Warn of Foreign Option

Written by John Packard

Steel Market Update (SMU) concluded our early November research on the flat rolled steel market earlier today. One of the areas we queried was if those responding to our questionnaire believe that the domestic mills will raise flat rolled steel prices within the first two weeks of November.

With 72 percent of the respondents responding affirmatively, the opinions of those taking our survey leaned toward the belief that a new round of price increases could be coming soon.

As one of our respondents pointed out in the comments section for this question there is a big difference between “announced and collected.”

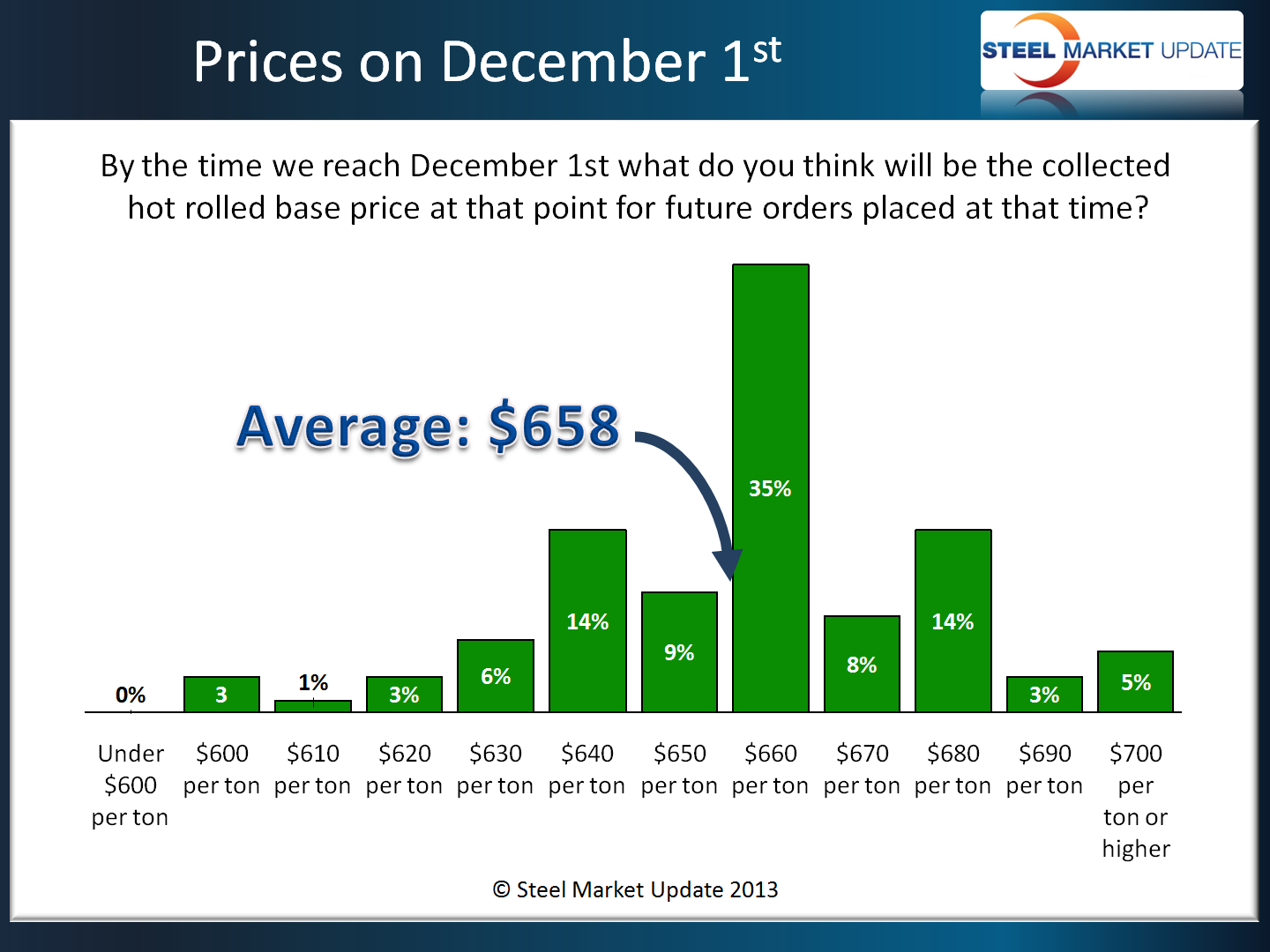

When we asked our respondents where spot pricing would be for new benchmark hot rolled orders at the beginning of December the levels suggested were essentially where spot prices were measured this week.

There were a number of comments left behind, in particular we found the comments of one construction related manufacturing company quite interesting.

In analyzing the economy today, I think we are teetering between taking off and falling off further. The auto industry is doing fairly well due to pent up demand, however, I think they could be nearing a point of slow down which would really impact the steel mills and the industry. The continued uneasiness in the economy is causing our customers to push and push for cheaper and cheaper pricing from vendors. This impacts the manufacturer and the efforts we have to get best pricing from the service centers and the mills. We see demand increasing, but the level of awards is slowing – there is a lot of fishing going on.

They went on to say they think the steel mills will raise prices, “They will keep pressing until something sticks and they can hang their hat on – I just hope they do not take a dictatorship approach to pushing pricing.” Even though this company’s opinion was for a new round of price increases they felt HRC spot pricing on December 1st would be $640 per ton which is below our average of $660 per ton reported earlier this week.

A second manufacturing company also involved in the construction industry reported their business as growing “only in small steps, not leaps and bounds”, told us, “with USS losing 1.8 billion, mills will again be stupid and announce $100 ton increase and screw up any forward momentum and make it a short term surge and set up a train wreck for 2nd qtr once inventories balance out.” This manufacturing company suggested spot HRC pricing would be $660 on December 1st.

A wholesaler suggested the “herd mentality” will drive the mills to announce higher prices, “Momentum – Lead times have not retreated and 2014 contract issues are unresolved. I expect the ‘herd mentality’ will soon kick in with an increase in orders thus allowing more price increases.”

Another manufacturing company warned the domestic mills to be aware of foreign steel, “They need to be careful with how frequently they throw these out, as the days of immediate compliance are long gone and the number of buyers at a critical point of deciding how much to place offshore is growing. I believe another ill timed announcement will push these buyers into that off shore choice and hurt the mills overall.” This buyer did not think the mills will raise prices and felt spot HRC would be $600 per ton by December 1st.

The survey was completed prior to the AK Steel and Severstal NA announcements which were made earlier today (Thursday).