Market Data

November 7, 2013

Mill Lead Times Stretch & Mill Willingness to Negotiate Pricing Shrinks

Written by John Packard

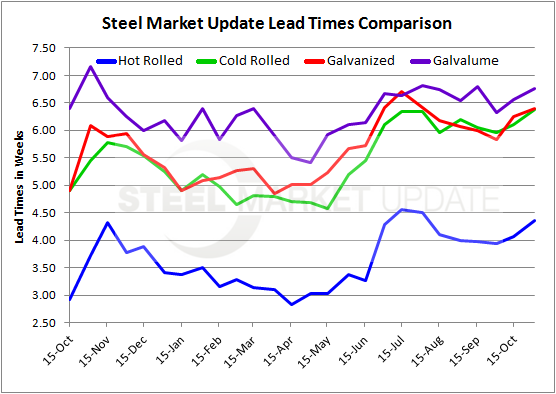

According to our latest steel market survey results, lead times have begun to move out on all of the flat rolled products scrutinized by Steel Market Update.

Hot rolled lead times extended from 4.07 weeks to 4.36 weeks, cold rolled moved from 6.10 weeks to 6.38 weeks, galvanized moved from 6.26 weeks to 6.39 weeks and Galvalume went from 6.56 weeks to 6.77 weeks. All of the data shown are averages of the data collected during the survey which just concluded earlier today.

One year ago the same items lead times were referenced as follows: HRC = 3.72 weeks, CRC = 5.45 weeks, HDG = 6.09 weeks and AZ = 7.17 weeks.

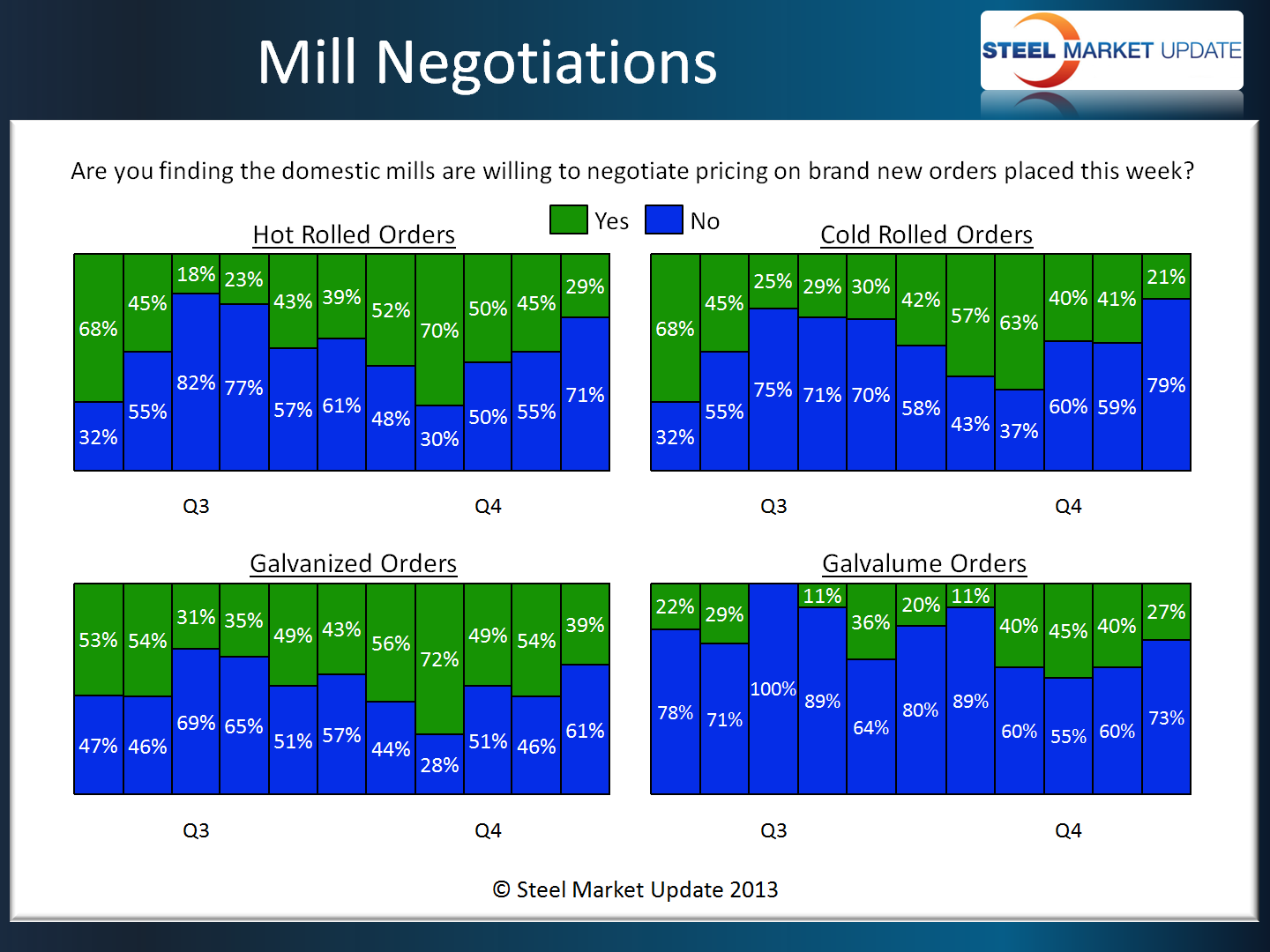

Lengthening lead times provided strength to mill negotiations as our survey respondents reported less willingness to negotiate spot prices at the domestic steel mills. As you can see by the graphic below the percentage of respondents reporting mills as willing to negotiate pricing were as follows: hot rolled dropped to 29 percent, cold rolled was the lowest at 21 percent and galvanized the highest at 39 percent. Galvalume was reported to have dropped to 27 percent.