Prices

November 4, 2013

Hot Rolled Futures Trading Up 465%

Written by John Packard

The increased uncertainty over future hot rolled coil pricing has elevated interest in HRC futures.

Based on CME Group data there were 8,033 hot rolled futures contracts during the month of October for a total of 160,660 net tons. This represents a 51 percent increase over the 5,301 contracts (106,020 tons) during October 2012. During the month of September there were 1,728 contracts (34,560 tons) so the October tonnage represented a 465 percent increase over the previous month.

Year to date (2013) there have been 47,294 contracts (945,880 tons) compared to the 38,622 contracts (772,440 tons) during the same time period one year ago. So far this year we are seeing a 22 percent increase in the number of contracts.

Year over year HRC open interest increased by 11.3 percent. HRC October 2013 open interest ended the month with 14,982 contracts vs. October 2012 open interest of 13,459 contracts. Month on month HRC open interest rose by 14.3 percent from the prior month (September ended with open interest of 13,103 contracts).

The higher open interest represents either new or increased participation in the futures market.

Prices on HRC futures moved higher during the month of October. Prices moved up an average of $15 per month for the first 12 forward contract months, and over $21 for the nearest 3 forward contract months.

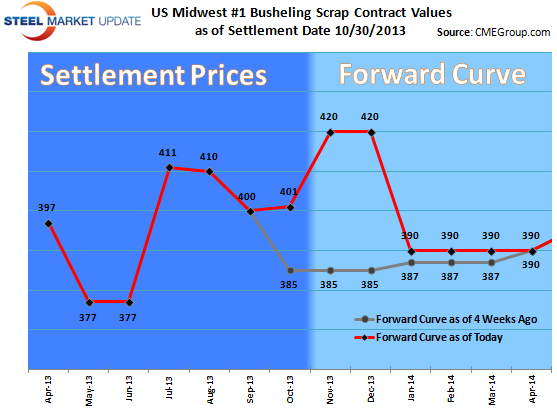

The number 1 busheling futures contract (BUS) did not trade any contracts for the month of October 2013. Open interest at month’s end stood at 254 contracts as compared to open interest of 381 contracts at the end of the month of September. November and December futures closing settlements have moved from $385 per gross ton at the beginning of October to $420 per gross ton by month’s end.