Prices

October 31, 2013

Steel Exports Rose in August

Written by John Packard

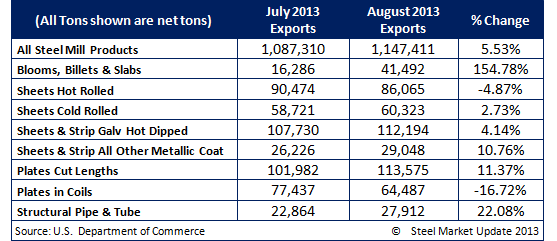

Based on recently released data from the U.S. Department of Commerce, exports of steel rose slightly during the month of August to 1,147,411 net tons (all products). This represents an increase of 60,102 tons compared to the exports shipped during the month of July which totaled 1,087,309 tons.

August exports of hot rolled totaled 86,065 tons down slightly from the 90,474 tons exported during the month of July. There were only two countries worth mentioning as almost all the exports went to Canada with 51,146 tons and Mexico with 34,383 tons.

SMU Note: hot rolled exports to Canada should shrink once we get into the month of October as the U.S. Steel Lake Erie blast furnace will be back in operation.

Cold rolled exports during August were 60,322 tons with Canada (28,342 tons) and Mexico (26,777 tons) accounting for the lion’s share of the tonnage.

Hot dipped galvanized exports totaled 112,194 tons which was slightly higher than the 107,729 tons of HDG exported during the month of July. Canada received 60,749 tons and Mexico 50,616 tons.

The United States exported 31,252 tons of “other metallic” which consists of Galvalume and aluminized steels. Mexico received the most tons with 13,618 and Canada getting 10,945 tons.

Plate exports were a big item for the domestic mills. Shipments of plates in coil and sheet totaled 178,063 net tons. Canada and Mexico were the main recipients with Canada receiving 112,797 tons and Mexico 58,630 tons.