Market Data

October 31, 2013

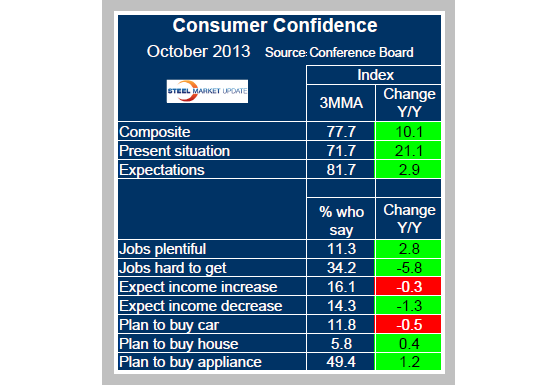

Consumer Confidence 3MMA Drops to 77.7

Written by Peter Wright

Consumer Confidence is a Strong Leading Indicator of Future Steel Demand

As expected because of the shenanigans in Washington, consumer confidence declined strongly in October, particularly as regards consumer’s future expectations. The Conference Board composite measure of consumer confidence decreased to 71.2 from 80.2 in September. The three month moving average, (3MMA) fell from 81.0 to 77.7 but was up by 10.1 year over year. The view of the present situation and expectations both declined. The consumer’s view of the present situation fell from 73.5 to 70.7 as expectations declined from 84.7 to 71.5, year over year improvements in the three month moving average were 21.07 and 2.87 respectively, (Figure 1). Figure 1 shows that at this stage of recovery from a recession the consumer’s views of the present situation and of expectations converge before the present component moves ahead. This is happening today.

As expected because of the shenanigans in Washington, consumer confidence declined strongly in October, particularly as regards consumer’s future expectations. The Conference Board composite measure of consumer confidence decreased to 71.2 from 80.2 in September. The three month moving average, (3MMA) fell from 81.0 to 77.7 but was up by 10.1 year over year. The view of the present situation and expectations both declined. The consumer’s view of the present situation fell from 73.5 to 70.7 as expectations declined from 84.7 to 71.5, year over year improvements in the three month moving average were 21.07 and 2.87 respectively, (Figure 1). Figure 1 shows that at this stage of recovery from a recession the consumer’s views of the present situation and of expectations converge before the present component moves ahead. This is happening today.

Table 1 is the SMU summary of the elements measured by Nielson. The consumer’s view of job availability has been more or less unchanged for four months, as has the expectation of income increase. However the proportion expecting an income decrease has risen from 13.7 percent in July to 15.4 percent in October. In three months through October the proportion of people planning to buy a home fell back to the August level of 5.8 percent from the very strong September value of 6.2 percent. Plans for an automobile purchase were the second strongest of the year at 11.8 percent following September’s value of 12.1 percent. Plans to purchase an appliance at 49.4 percent were the highest of the year.

Moody’s Economy.com summarized this month’s Conference Board report as follows. (Note, the Moody’s comments and the official press release refer to monthly numbers not 3MMA.) “The government shutdown and debt-ceiling debacle took a toll on consumer confidence in October. Buyers felt worse about their current situations, but their expectations tumbled, sending the top-line Conference Board Consumer Confidence Index to its lowest level in more than a year. In particular, shoppers indicated a more difficult job market.”

The labor differential, which is the share of respondents who feel that jobs are plentiful minus those who feel they’re hard to get, slid to -24.5, indicating the jobless rate may have ticked higher in October. Unfortunately, Congress’ 11th-hour deal to reopen the government and avert breaching the debt ceiling will do little to allay buyers’ fears in the near term. Lawmakers appropriated enough money to fund the government only until January and extended the debt ceiling only until early February. This will keep uncertainty elevated and confidence soft until a longer-term deal is ironed out. Given the government’s track record over the past several years, more gridlock is likely on the way. Hence, consumer confidence isn’t likely to improve much from now until March, which is especially bad news for retailers as they head into the holiday shopping season.

The official press release reads as follows:

The Conference Board Consumer Confidence Index®, which had declined moderately in September, decreased sharply in October. The Index now stands at 71.2 (1985=100), down from 80.2 in September. The Present Situation Index decreased to 70.7 from 73.5. The Expectations Index fell to 71.5 from 84.7 last month.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was October 17.

Says Lynn Franco, Director of Economic Indicators at The Conference Board: “Consumer confidence deteriorated considerably as the federal government shutdown and debt-ceiling crisis took a particularly large toll on consumers’ expectations. Similar declines in confidence were experienced during the payroll tax hike earlier this year, the fiscal cliff discussions in late 2012, and the government shutdown in 1995/1996. However, given the temporary nature of the current resolution, confidence is likely to remain volatile for the next several months.”

Consumers’ assessment of current conditions declined moderately. Those claiming business conditions are “good” decreased to 19.0 percent from 20.7 percent, however, those claiming business conditions are “bad” edged down to 23.0 percent from 23.9 percent. Consumers’ appraisal of the job market was less favorable than last month. Those saying jobs are “plentiful” was virtually unchanged at 11.3 percent from 11.4 percent, while those saying jobs are “hard to get” increased to 35.8 percent from 33.6 percent.

Consumers’ expectations, which had softened in September, decreased sharply in October. Those expecting business conditions to improve over the next six months fell to 16.0 percent from 20.6 percent, while those expecting business conditions to worsen increased to 17.5 percent from 10.3 percent.

Consumers’ outlook for the labor market was also more pessimistic. Those anticipating more jobs in the months ahead decreased to 15.3 percent from 16.1 percent, while those anticipating fewer jobs increased to 22.7 percent from 19.1 percent. The proportion of consumers expecting their incomes to increase rose to 15.8 percent from 15.1 percent, however, those expecting a decrease rose to 15.4 percent from 13.9 percent. (Source: October 2013 Consumer Confidence Survey® The Conference Board)

SMU comment: Consumer confidence drives consumer spending which accounts for almost 70 percent of GDP. The growth of steel consumption is closely related to the growth of GDP though steel is much more volatile. Consumer confidence is a strong leading indicator of future steel demand.