Prices

October 20, 2013

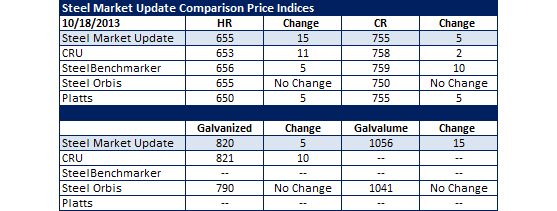

SMU Comparison Price Indices: Moving on Up

Written by John Packard

The domestic mills pushing for customers to switch to Platts indices may shudder when they realize that Platts benchmark hot rolled coil index is the lowest of the five followed by Steel Market Update.Even so, all of the indices are now within $6 per ton of each other. The average price for hot rolled, using all five indices, is $653.80 per ton.

As you can see by the table provided below all of the indices except Steel Orbis adjusted their price assessments on all products higher this past week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.