Market Data

October 20, 2013

Global Steel Production Rose 1% in September

Written by Peter Wright

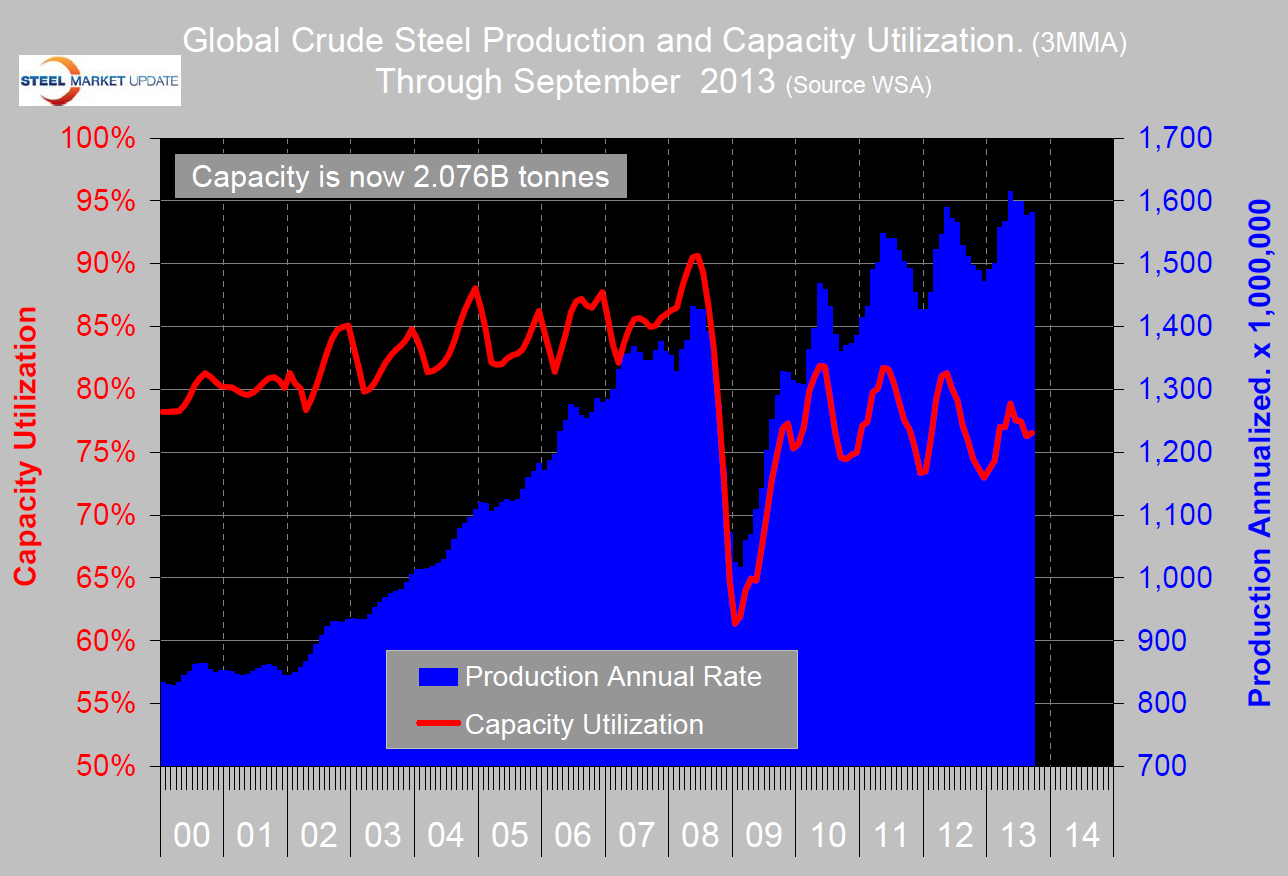

Global steel production, September 2013 rose 1.05 percent from August to 132,154,000 tonnes and a capacity utilization rate of 76.8 percent. The annualized three month moving average production was 1.581 billion tonnes in the third quarter (Figure 1). Capacity is now 2.076 billion tonnes. Global production this year is following the same pattern as the last three years by accelerating rapidly in the first half and declining in the second.

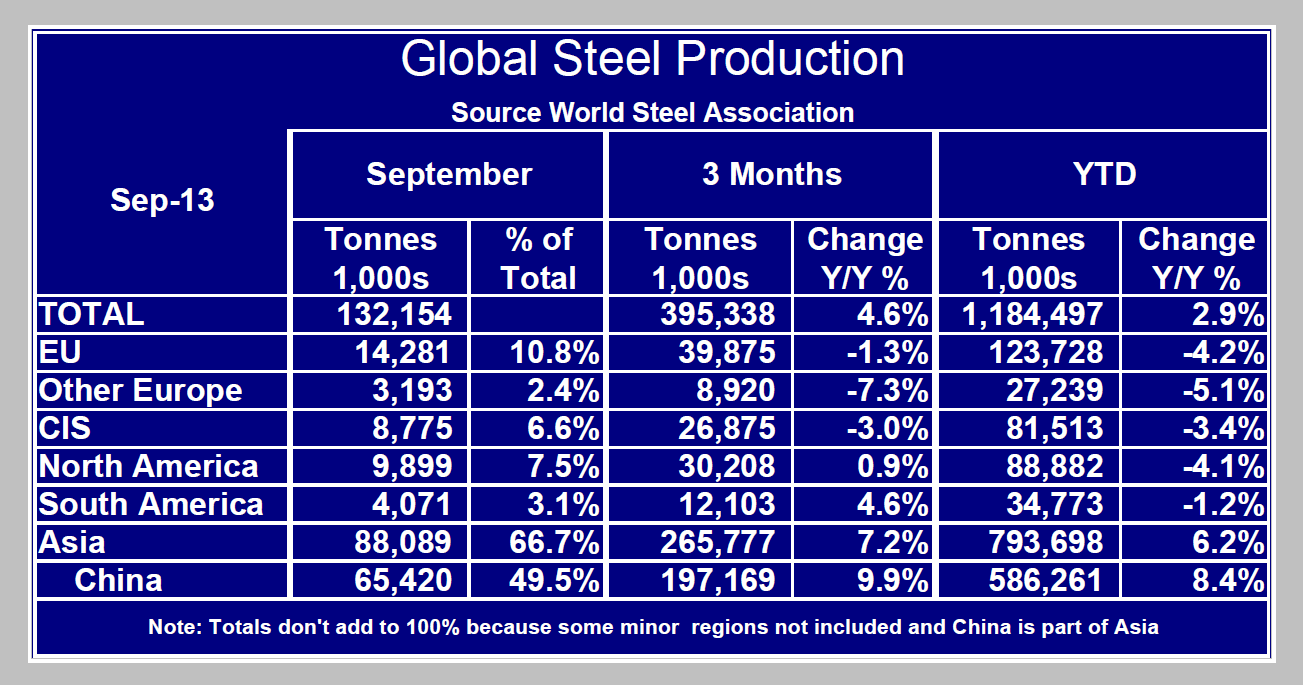

In September North America produced 7.5 percent of the global total, China produced 49.5 percent. In Q3 global production grew by 4.6 percent year over year, (y/y) with Asia continuing to be the leader. Asia as a whole was up by 7.2 percent and China by 9.9 percent y/y. South America had a turnaround to 4.6 percent growth, North America eked out a small gain of 0.9 percent as Europe and the CIS declined. Year to date, total production was up by 2.9 percent compared to the first three quarters of last year. On this basis all regions except Asia declined (Table 1).

In September North America produced 7.5 percent of the global total, China produced 49.5 percent. In Q3 global production grew by 4.6 percent year over year, (y/y) with Asia continuing to be the leader. Asia as a whole was up by 7.2 percent and China by 9.9 percent y/y. South America had a turnaround to 4.6 percent growth, North America eked out a small gain of 0.9 percent as Europe and the CIS declined. Year to date, total production was up by 2.9 percent compared to the first three quarters of last year. On this basis all regions except Asia declined (Table 1).

SMU Comment: China’s surplus capacity continues to grow and is now said to be 300 million tonnes. The growth of steel production continues exceed GDP growth. Sooner or later this must end badly but since almost half the steel industry is state owned the realization period may still be long. We are reminded of Europe in the 1970s.