Prices

October 17, 2013

SMU Survey: Price Increases Being Collected

Written by John Packard

One of the questions posed to the approximately 600 companies invited to participate in our mid-October flat rolled steel survey was if they believed if any or all of the announced flat rolled price increases would be collected by November 1st. A large majority of almost two-thirds – 64.8 percent – responded that at least a portion of the price increases would be collected by the end of this month. This left 35.2 percent as non-believers.

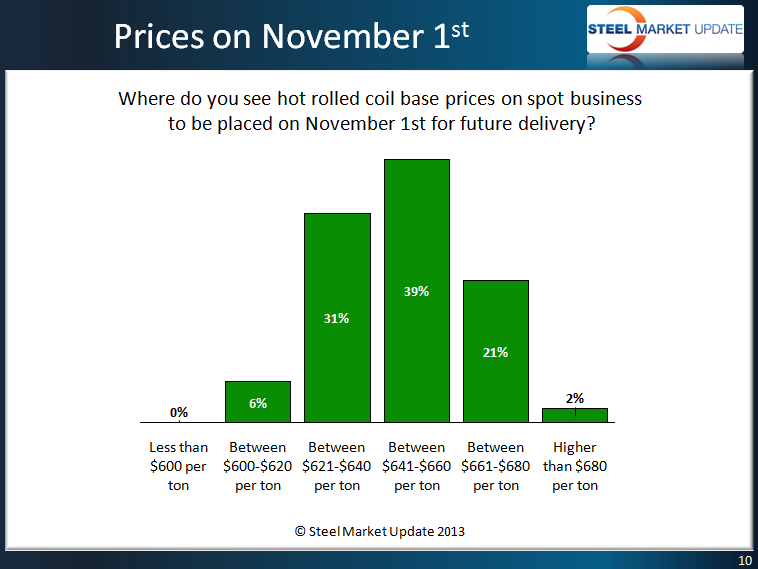

SMU also asked where our respondents feel spot prices will be once we reach November 1st. The numbers suggested by our respondents do not equal the $670-$680 per ton pricing being suggested by the domestic steel mills. One service center executive who is a respondent to our surveys spoke to SMU on this subject this afternoon. He indicated that the steel mills are “digging in their heels” and attempting to collect most of the increases. However, at the same time he told us, “I’m convinced every day that this party is going to come to an ugly end.” Maybe there is some of that thought process in the numbers captured during our survey which ended this afternoon.