Market Segment

October 17, 2013

Service Center Shipments, Inventory & Intake Analysis for September

Written by Peter Wright

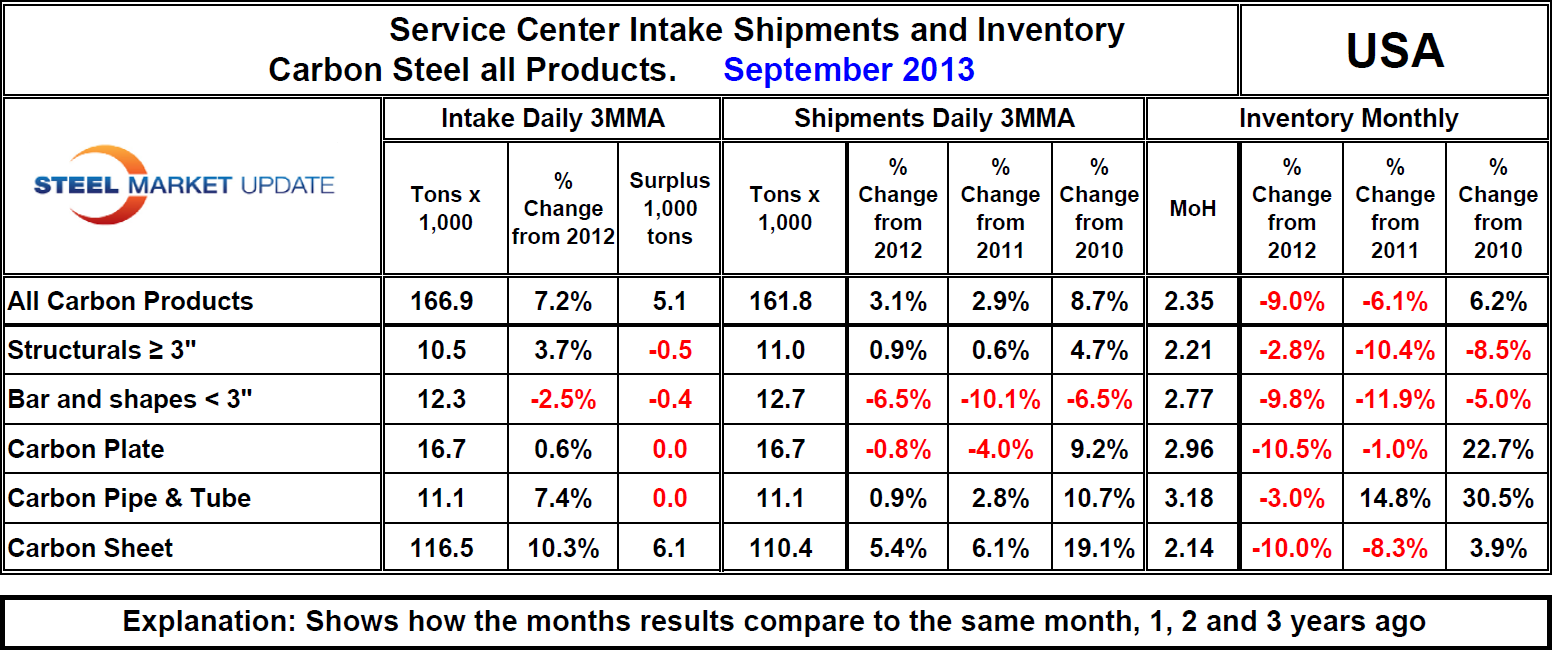

Total service center carbon steel shipments declined by 241,500 tons in September compared to August but shipping days also declined by two. As a result, tons per day shipments increased from 158,100 to 161,800. Month end inventory increased by 2,000 tons to 7,604,000 tons. Intake improved from 162,210 tons per day in August to 166,940 tons in September. Table 1 shows the performance by product in three months through September compared to the same period in previous years.

On a three month moving average (3MMA) basis year over year, total shipments were up by 3.1 percent driven almost entirely by sheet. Bar products were down by 6.5 percent. Structurals, plate and tubulars were little changed. Intake was down year over year on all products except sheet. Compared to the end of September last year inventories were down by 9.0 percent in total and were down for all product groups.

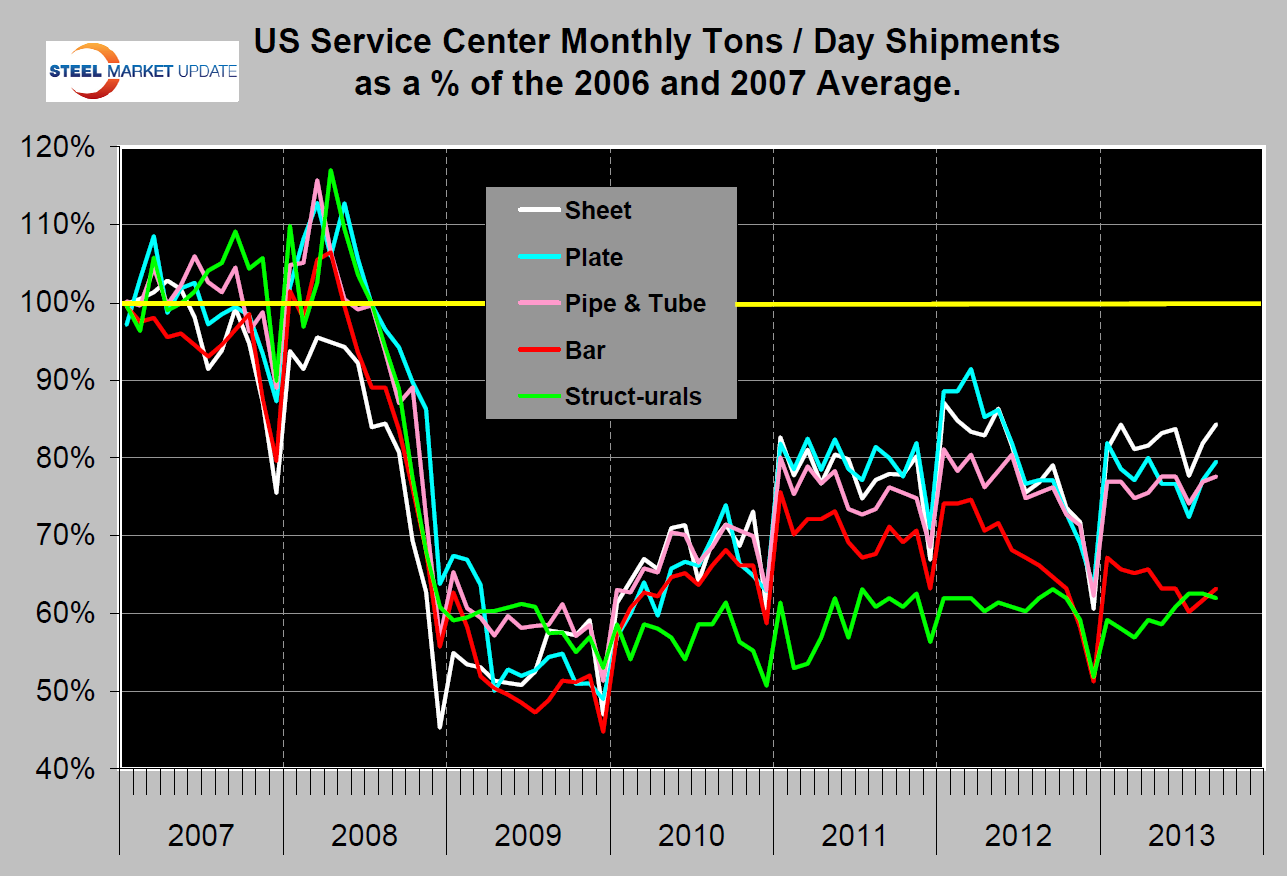

Figure 1 shows monthly shipment by product compared to the pre-recession average of 2006 and 2007. Sheet has fared best in this time frame with a recovery to 84.3 percent followed by plate at 79.5 percent and tubulars at 77.6 percent. Long products are still lagging with bar at 63.2 percent and structurals at 62.0 percent.

Figure 1 shows monthly shipment by product compared to the pre-recession average of 2006 and 2007. Sheet has fared best in this time frame with a recovery to 84.3 percent followed by plate at 79.5 percent and tubulars at 77.6 percent. Long products are still lagging with bar at 63.2 percent and structurals at 62.0 percent.

On a 3MMA basis, service center shipments of total long products have declined for 15 straight months and inventory has declined continuously for 16 months. Flat rolled shipments, not including tubulars, have improved in the last two months after 10 months of decline. Flat rolled inventory has been down for the last 8 months.

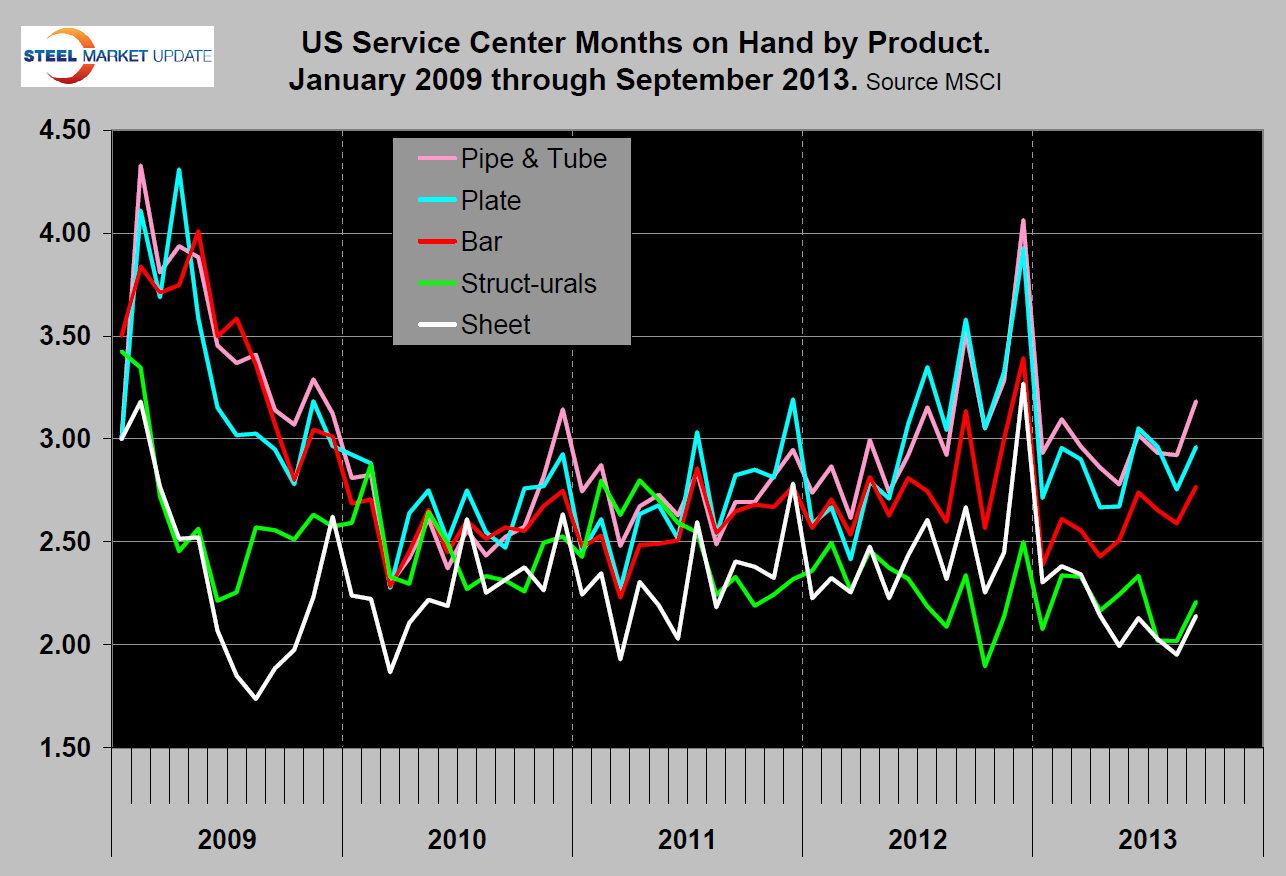

Figure 2 shows month end inventory as months on hand which is inventory divided by shipments for the month. Months on hand for all carbon products at the end of September were 2.35 ranging from 2.14 for sheet to 3.18 for pipe and tube. This graph becomes spiky because it relies on monthly shipments which are influenced by the number of shipping days in the month.

Figure 2 shows month end inventory as months on hand which is inventory divided by shipments for the month. Months on hand for all carbon products at the end of September were 2.35 ranging from 2.14 for sheet to 3.18 for pipe and tube. This graph becomes spiky because it relies on monthly shipments which are influenced by the number of shipping days in the month.