Market Data

October 17, 2013

Mill Lead Times & Mill Negotiations

Written by John Packard

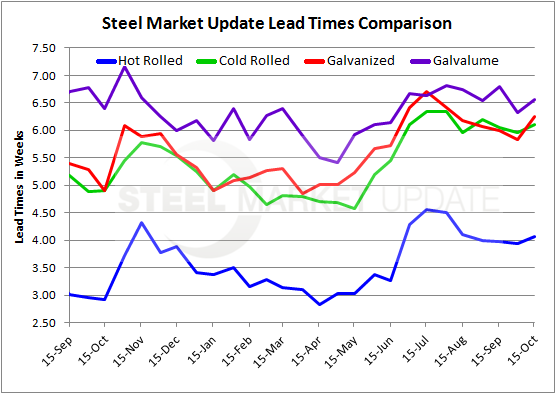

Domestic mill lead times, which had been relatively flat since the beginning of September according to past SMU steel market surveys, are beginning to indicate a modest strengthening. Our survey respondents put hot rolled lead times at 4.07 weeks (last year in mid-October they were 2.93 weeks) which is up slightly from the 3.94 weeks reported at the beginning of this month. Cold rolled lead times are now averaging 6.10 weeks (last year 4.90 weeks), galvanized moved out the most to 6.26 weeks (last year 4.91 weeks) and Galvalume moved out to 6.56 weeks (last year 6.40 weeks) from early October levels which were reported to be 6.33 weeks.

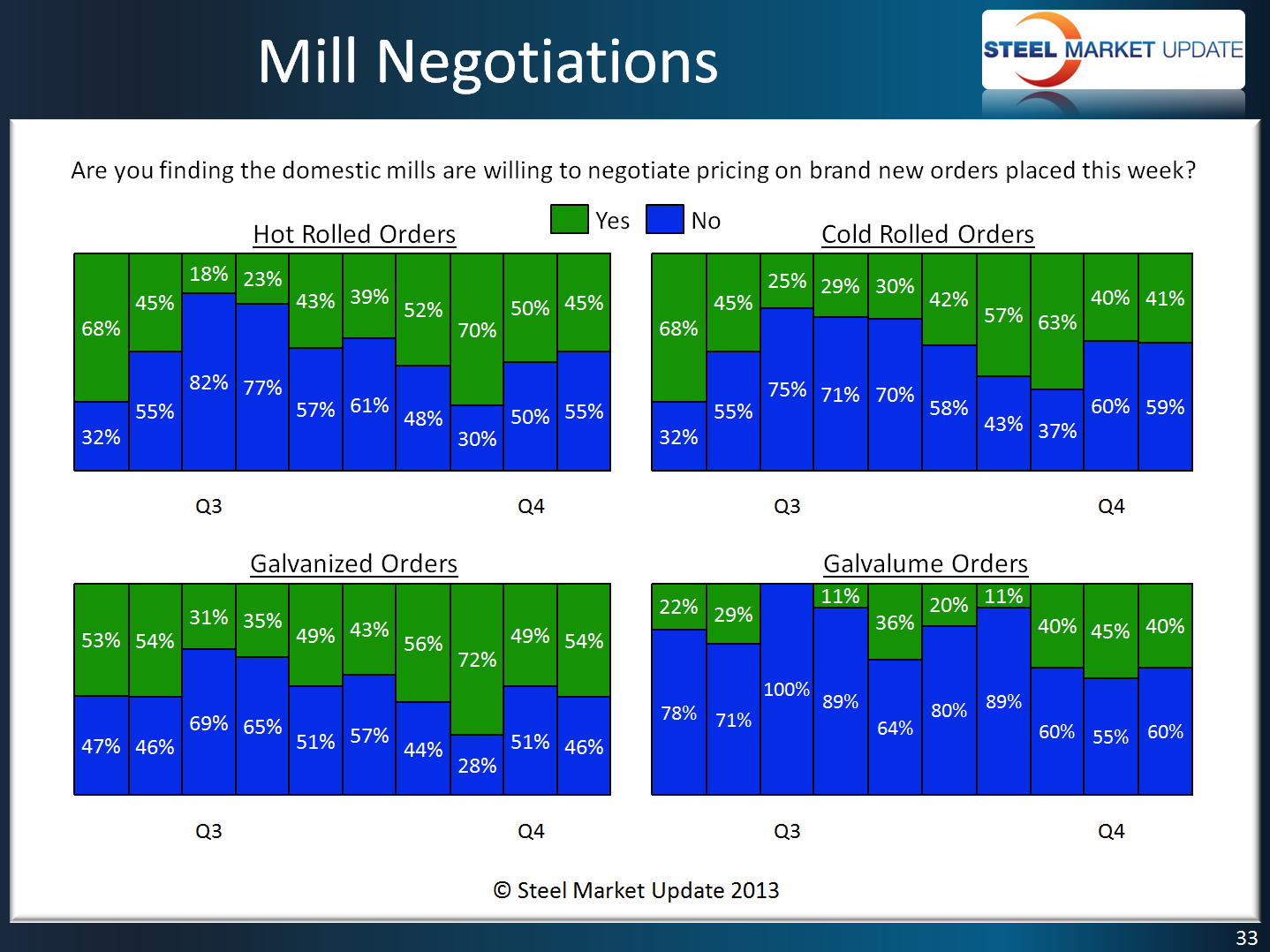

Domestic Mill Negotiations remained subdued according to our survey results. Only 45 percent of those responding reported the domestic mills as willing to negotiate pricing on spot hot rolled orders. The percentages were even lower on cold rolled (41 percent) and Galvalume (40 percent). The highest percentage was reported to be on galvanized with 54 percent of our respondents reporting the mills as willing to negotiate pricing on the product. It would stand to reason that galvanized would have the highest percentage due to the number of conversion mills specializing in the product.