Market Data

October 16, 2013

Service Center Apparent Flat Rolled Deficit Reduced by 81,000 Tons

Written by John Packard

September rose slightly from end of August numbers. The 8,031,400 tons reported by the Metal Service Center Institute (MSCI) is still 8.4 percent below the levels held by the distributors at the end of September 2012. The number of months of inventory on hand was reported to be 2.4 months on an unadjusted basis and 2.3 months on a seasonally adjusted basis.

The daily shipment rate improved to 169,000 tons from 165,100 tons and is at the highest level of the year and is the best level seen since May 2012.

Total daily steel receipts were 173,510 tons in September. August daily shipments were 169,570 and September 2012 was 152,060 tons.

Flat Rolled

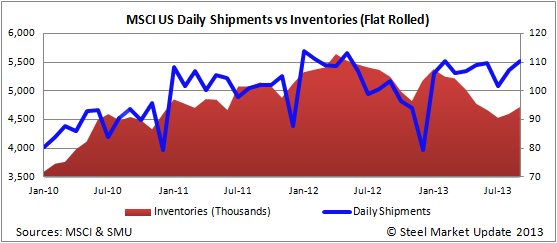

Flat rolled shipments increased to 110,400 tons per day from 107,200 tons reported during the month of August. Shipments totaled 2,207,200 tons, a 12.2 percent improvement over September 2012 shipments. The daily shipment rate during September was the highest since May 2012 when the rate was 113.000 tons per day.

Flat rolled inventories stood at 4,723,100 tons up 121,400 tons over the prior month. Inventories are still 10 percent below end of September 2012 levels. The months of inventory stood at 2.1 months on an unadjusted basis and 2.1 seasonally adjusted basis. Both the seasonally adjusted numbers and unadjusted numbers are up 0.1 months compared to the prior month and well below the 2.7 and 2.5 (SA) month’s supply reported last September.

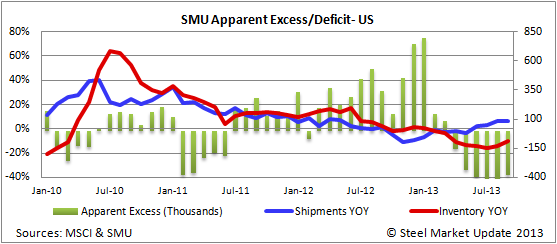

Flat Rolled Apparent Deficit Declines by 81,000 Tons

Based on Steel Market Update proprietary analysis of the just released MSCI data we found the flat rolled apparent inventory deficit to be 383,000 tons at the end of September. This is 81,000 fewer tons than what we saw at the end of August (463,000 tons) and 86,000 tons less than the end of July.

Flat Rolled Daily Receipts

The number of shipping days in September was 20. August had 22 shipping days as did July. In September 2012 the number of shipping days was 19.

Flat rolled daily steel receipts were 116,470 tons in September. August daily receipts were 110,260 tons and September 2012 had 97,150 tons.

Pipe and Tube

Pipe and tube daily shipments increased to 11,100 tons per day during the month of September and are 7.3 percent higher than one year ago.

Inventory levels stand at 706,800 tons which is down slightly from the 706,900 tons held by distributors at the end of August. The months on hand grew on an unadjusted basis from 2.9 to 3.2 months. However, on a seasonally adjusted basis, the number of months shrunk to 3.0 vs. 3.1 months.

Pipe & Tube daily steel receipts were 11,100 tons in September. August daily receipts were 12,150 and September 2012 was 10,880 tons.

Plate

Plate inventories stood at 989,100 tons at the end of September – essentially unchanged from the 989,800 tons held by distributors at the end of August.

The daily shipment rate was 16,700 tons which is higher than August 16,300 tons and was an 8.3 percent improvement over September 2012.

The number of months on hand stood at 3.0 (unadjusted) and 2.8 (SA) compared to 2.8 (unadjusted) and 2.9 (SA) at the end of the month of August.

Plate daily steel receipts were 16,670 tons in September. August daily receipts were 16,150 and September 2012 was 14,830 tons.