Market Data

October 16, 2013

Global Economic Outlook

Written by Peter Wright

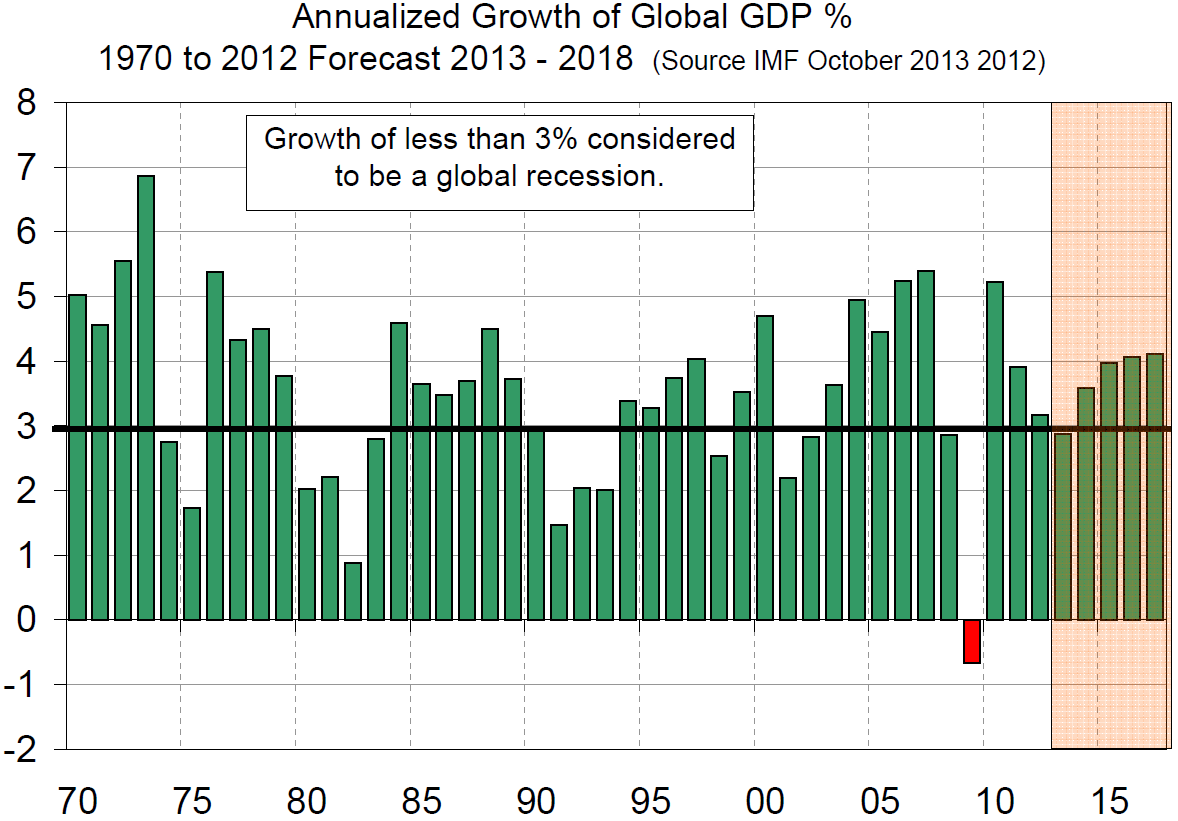

Last week the International Monetary Fund (IMF) revised its forecast for global / regional and national Gross Domestic Product (GDP) growth through 2018. For 2013 the projection for global growth was reduced by 0.3 percent to 2.9 percent and for 2014 was reduced down by 0.2 percent to 3.6 percent. As it stands 2013 will be the 3rd consecutive year of declining growth (Figure 1).

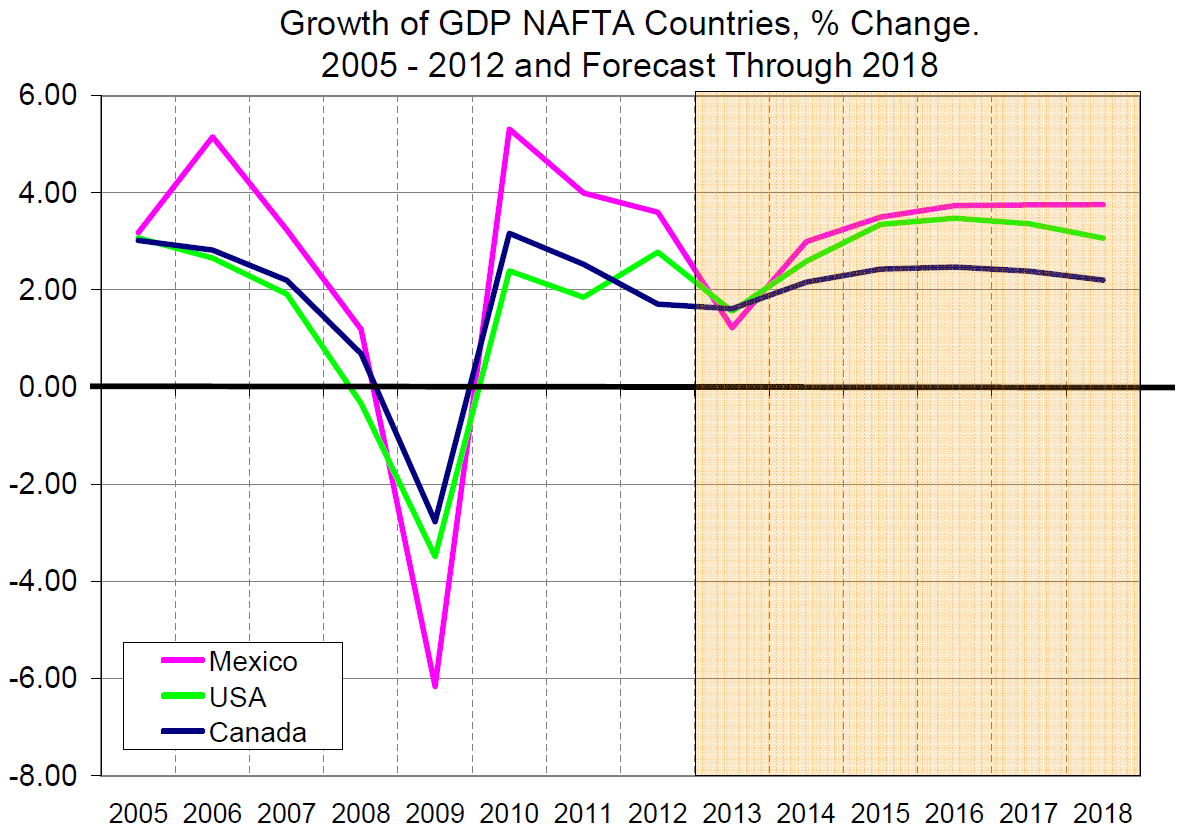

Within NAFTA the forecast for Canada was little changed but for Mexico the forecast for 2013 was reduced drastically from a growth of 3.39 percent in the April forecast to 1.22 percent. Growth projections for the U.S. were also reduced in 2013 by 0.1 percent to 1.6 percent and in 2014 by 0.2 percent to 2.6 percent (Figure 2).

Within NAFTA the forecast for Canada was little changed but for Mexico the forecast for 2013 was reduced drastically from a growth of 3.39 percent in the April forecast to 1.22 percent. Growth projections for the U.S. were also reduced in 2013 by 0.1 percent to 1.6 percent and in 2014 by 0.2 percent to 2.6 percent (Figure 2).

The IMF summary of the October forecast, paraphrased by SMU was as follows: Global growth remains in low gear, averaging only 2½ percent during the first half of 2013, which is about the same pace as in the second half of 2012. In a departure from previous developments since the Great Recession, the advanced economies have recently gained some speed, while the emerging market economies have slowed. The emerging market economies, however, continue to account for the bulk of global growth.

Within each group, there are still broad differences in growth and position in the cycle. The impulse to global growth is expected to come mainly from the United States where activity will move into higher gear as fiscal consolidation eases and monetary conditions stay supportive. Following sharp fiscal tightening earlier this year, activity in the United States is already regaining speed, helped by a recovering real estate sector, higher household wealth, easier bank lending conditions and more borrowing. The fiscal tightening in 2013 is estimated to be 2½ percent of GDP. However, this will ease to ¾ percent of GDP in 2014, helping raise the rate of economic growth to 2½ percent, from 1½ percent in 2013. This assumes that discretionary public spending is authorized and executed as projected and the debt ceiling is raised in a timely manner.

Within each group, there are still broad differences in growth and position in the cycle. The impulse to global growth is expected to come mainly from the United States where activity will move into higher gear as fiscal consolidation eases and monetary conditions stay supportive. Following sharp fiscal tightening earlier this year, activity in the United States is already regaining speed, helped by a recovering real estate sector, higher household wealth, easier bank lending conditions and more borrowing. The fiscal tightening in 2013 is estimated to be 2½ percent of GDP. However, this will ease to ¾ percent of GDP in 2014, helping raise the rate of economic growth to 2½ percent, from 1½ percent in 2013. This assumes that discretionary public spending is authorized and executed as projected and the debt ceiling is raised in a timely manner.

Mexico will receive a fillip from the rebound in U.S. activity, following a disappointing first half in 2013.

The IMF forecasts assume that Chinese authorities do not enact major stimulus and accept somewhat lower growth, consistent with the transition to a more balanced and sustainable growth path. The forecast for real GDP growth for China has thus been reduced to about 7½ percent for 2013–14. This slowdown will reverberate across developing Asia, where growth is expected to remain between 6¼ and 6½ percent in 2013–14.

In the euro area, business confidence indicators suggest that activity is close to stabilizing in the periphery and already recovering in the core economies. In 2014, a major reduction in the pace

of fiscal tightening, to less than ½ percent of GDP from about 1 percent of GDP in 2013, is in the offing. However, the support for activity from the reduction in the pace of fiscal tightening is dampened by tight credit conditions in the periphery. Thus, economic growth is expected to reach only 1 percent, after contracting by about ½ percent in 2013.

In Latin America, projections assume that the recent re-pricing of stocks and bonds was largely a one-time event, with currency depreciations partly offsetting the effect on activity of tightening financial conditions. However, there is a lot of uncertainty about this at the moment. The recovery in Brazil is assumed to continue at a moderate pace, helped by the depreciation of the exchange rate, a pick-up in consumption, and policies aimed at boosting investment.