Analysis

October 16, 2013

Automotive Production, Sales & Inventory

Written by Peter Wright

Automotive production, sales and inventory in NAFTA through September 2013

Based on Ward’s automotive reports, total light vehicle, (LV) production was 1,390,175 units in September, down by 3.3 percent from August. Autos were down by 5.1 percent and light trucks by 1.8 percent.

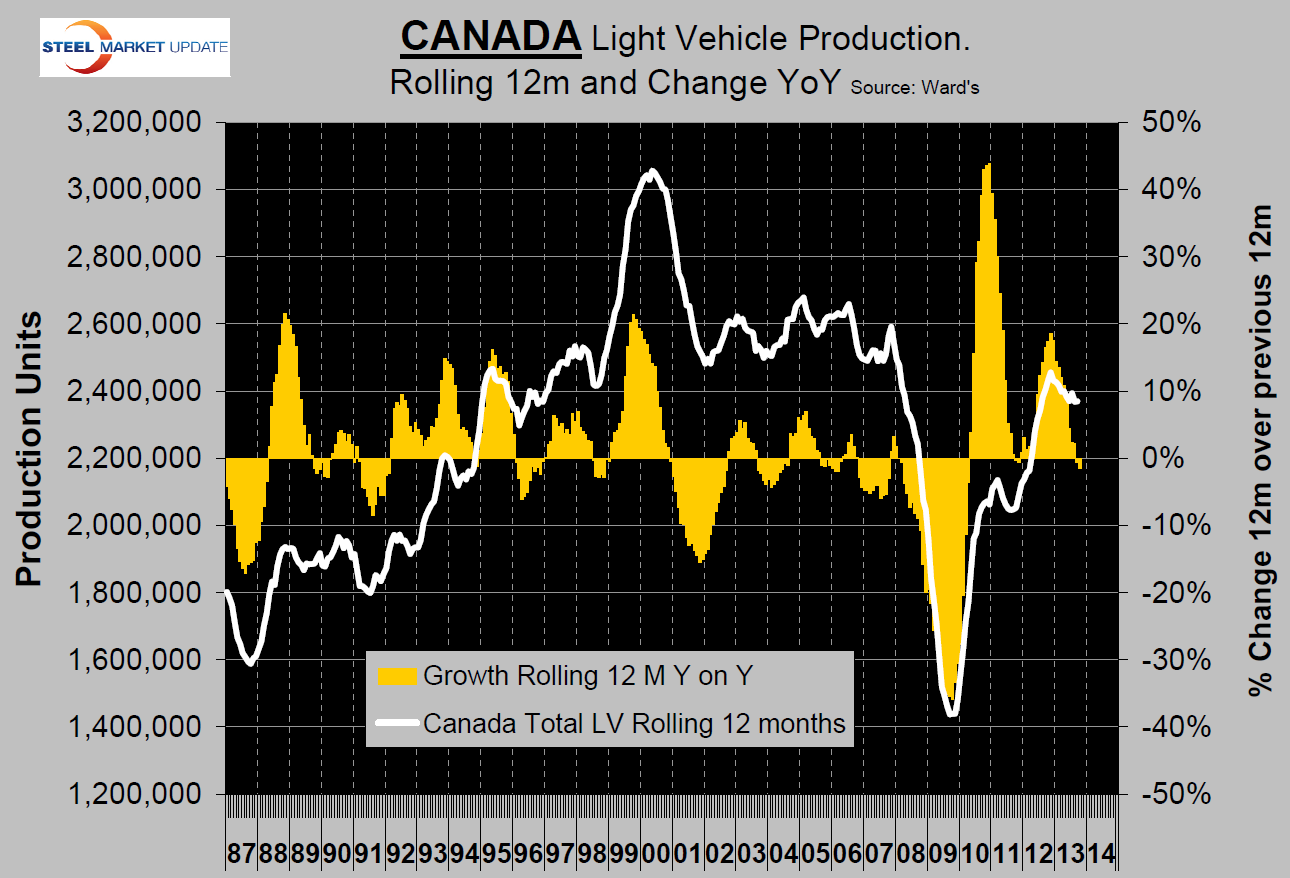

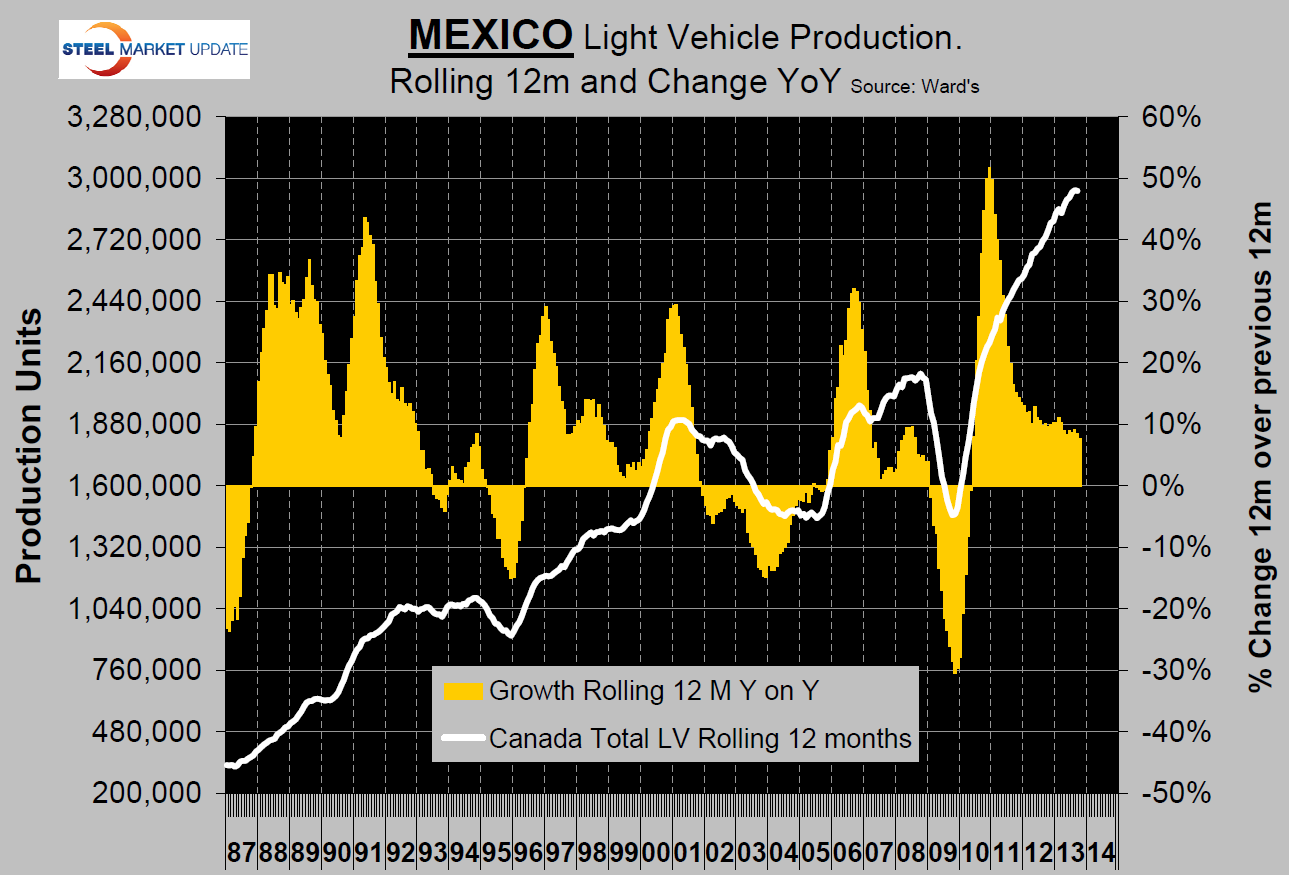

A better measure of direction is the three month rolling average of production year over year. By this measure in three months through September, (Q3) total light vehicles were up by 7.2 percent, autos were up by 2.2 percent and light trucks by 11.4 percent. In Q3 Canada’s LV production had negative growth year over year; the US grew by 3.6 percent and Mexico by 6.1 percent.

A better measure of direction is the three month rolling average of production year over year. By this measure in three months through September, (Q3) total light vehicles were up by 7.2 percent, autos were up by 2.2 percent and light trucks by 11.4 percent. In Q3 Canada’s LV production had negative growth year over year; the US grew by 3.6 percent and Mexico by 6.1 percent.

The trend for Mexico to be preferred by the auto manufacturers is continuing. Figures 1, 2 and 3 show LV production by country with growth on a rolling 12 month basis. Eduardo Solís, president of the Mexican national automotive association reported to the third Canacero steel conference last month that production by Mexico’s automotive industry is expected to increase by 33% in the next five years. This would be an increase from close to 3 million units to 4 million LVs annually. Solis said that about 80 percent of the total production is destined for export to the US, Latin America, Europe, Africa and Asia.

Economy.com reported on September Automotive sales in the US as follows: “after breaking above 16 million annualized units in August, vehicle sales for September took a step back, falling to 15.35 million. This will leave sales averaging 15.7 million in the third quarter, better than the 15.53 million from April to June. Fundamentals and calendar effects are behind the September decline. A softer housing market likely weighed on truck sales in September. Meanwhile, promotions and discounting designed to clear out 2013 models drove strong sales over the Labor Day weekend, part of which fell during the end of August. This likely pulled sales forward and will come at the expense of September’s figure. Sales are expected to reach 15.5 million units for the year, but risks are stacked to the upside. The release of pent-up demand will drive sales through the end of 2014, when sales are expected to hit 17 million units before coming down to a more sustainable pace of about 15.5 million units.”

Economy.com reported on September Automotive sales in the US as follows: “after breaking above 16 million annualized units in August, vehicle sales for September took a step back, falling to 15.35 million. This will leave sales averaging 15.7 million in the third quarter, better than the 15.53 million from April to June. Fundamentals and calendar effects are behind the September decline. A softer housing market likely weighed on truck sales in September. Meanwhile, promotions and discounting designed to clear out 2013 models drove strong sales over the Labor Day weekend, part of which fell during the end of August. This likely pulled sales forward and will come at the expense of September’s figure. Sales are expected to reach 15.5 million units for the year, but risks are stacked to the upside. The release of pent-up demand will drive sales through the end of 2014, when sales are expected to hit 17 million units before coming down to a more sustainable pace of about 15.5 million units.”

Days of inventory in the system at the end of September were 62, up from 55 at the end of August and from 59 a year ago. The Detroit 3 had the highest inventory at 73 days, GM 82 days, Ford 71 days and Chrysler 62 days. The Asia pacific manufacturers carried 53 days and the European brands 52 days.

Days of inventory in the system at the end of September were 62, up from 55 at the end of August and from 59 a year ago. The Detroit 3 had the highest inventory at 73 days, GM 82 days, Ford 71 days and Chrysler 62 days. The Asia pacific manufacturers carried 53 days and the European brands 52 days.

SMU comment: we never read elsewhere of the continuing transfer of vehicle production from Canada to Mexico and of the unbalanced growth of Mexican production compared to the US. Canada is now almost out of the medium and heavy truck production scene with only a 2.2 percent production share in Q3. The question of how these automotive assembly statistics affect manufacturing jobs is not clear because there is a tremendous transfer of sub assemblies and parts across both borders. This undoubtedly makes the Canadian situation worse but, as far as the US and Mexico are concerned, we tend to think that these transfers benefit the US which has for example a net steel trade surplus of 800,000 tons per month with Mexico.