Analysis

October 8, 2013

Construction and Manufacturing Employment

Written by Peter Wright

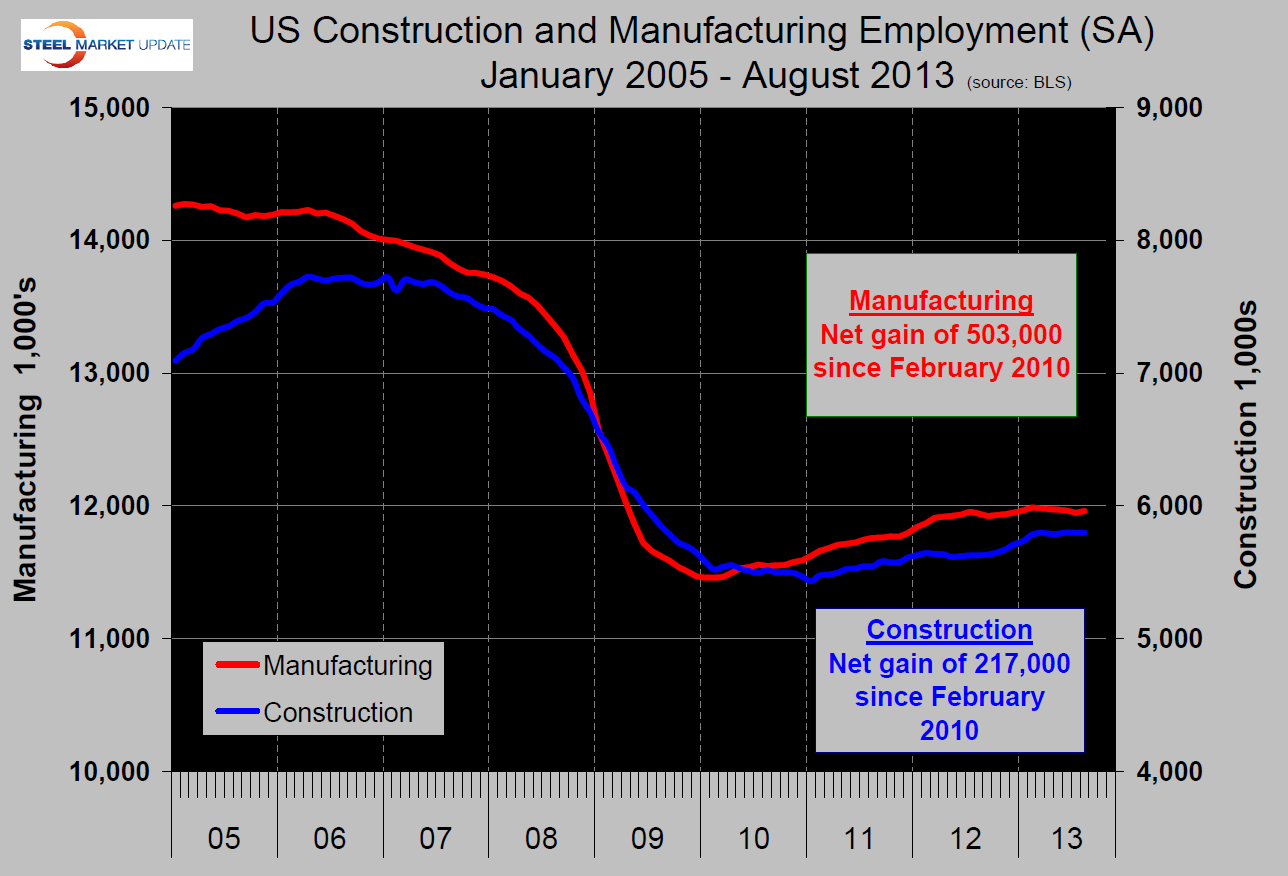

The partial federal government shutdown prevented the Bureau of Labor Statistics from publishing the September data which was scheduled for last Friday. We have therefore decided to take a more in depth look at manufacturing and construction employment through August. The graph below shows the change in total employment for these two sectors since January 2005. In 2010 and 2011, manufacturing employment took off faster than the construction sector; in H2 2012 construction closed the gap. In 2013 through August construction added 87,000 jobs, all of which occurred in Q1, year to date manufacturing has only added 12,000 jobs. The bright spot in manufacturing this year has been motor vehicles and parts which have added 30,000 jobs. In the same time frame employment in the primary metals sector has declined by 5,000.

The Association of General Contractors, (AGC) reported as follows at the end of September. The partial federal government shutdown has both immediate and longer-term consequences for construction. Highway construction funded in part by the Highway Trust Fund is not affected. But federal agencies that directly award construction contracts or that issue permits are not operating. Review of applications for the Keystone XL pipeline and liquefied natural gas export terminals is not proceeding. Depending on the length of the shutdown, companies that depend on federal contracts and purchases may cancel or delay orders for construction of plants, offices and other facilities.

In the 12 months through August construction employment rose in 194 out of 339 metropolitan areas, declined in 88 and was flat in 57, according to an analysis of Bureau of Labor Statistics (BLS) data that AGC released on September 26.

In the month of August, seasonally adjusted construction employment climbed in 35 states, fell in 14 states and D.C., and held steady in Vermont. Wyoming had the steepest year-over-year percentage increase, followed by Mississippi, Colorado and Hawaii. California added the most construction jobs for the year (29,100, 5.0 percent), followed by Texas (24,200, 4.1 percent), Florida (19,500, 5.7 percent) and Louisiana (10,600, 8.4 percent). Indiana lost the most jobs over the past year and experienced the steepest rate of decline (-10,100 jobs, -8.1 percent). Other states experiencing large job losses for the year include Ohio, North Carolina and Alabama. Of the 26 states that added construction jobs from July to August, South Dakota had the largest percentage gain followed by Vermont, Wisconsin and Connecticut. California added the largest number of jobs for the month, followed by New York, Florida and Wisconsin.

The fact that the majority of states are adding construction jobs is an encouraging sign, says AGC Chief Executive Officer Stephen E. Sandherr. Alas, the road to recovery remains a long one. “While we would all like to see even more robust growth, it is encouraging that most states have a larger construction workforce today than they did a year ago,” he says. “It will take a lot more growth, however, before construction employment levels return to their pre-recession levels in most places.”