Prices

October 6, 2013

SMU Survey Results Skeptical of Latest Price Announcements

Written by John Packard

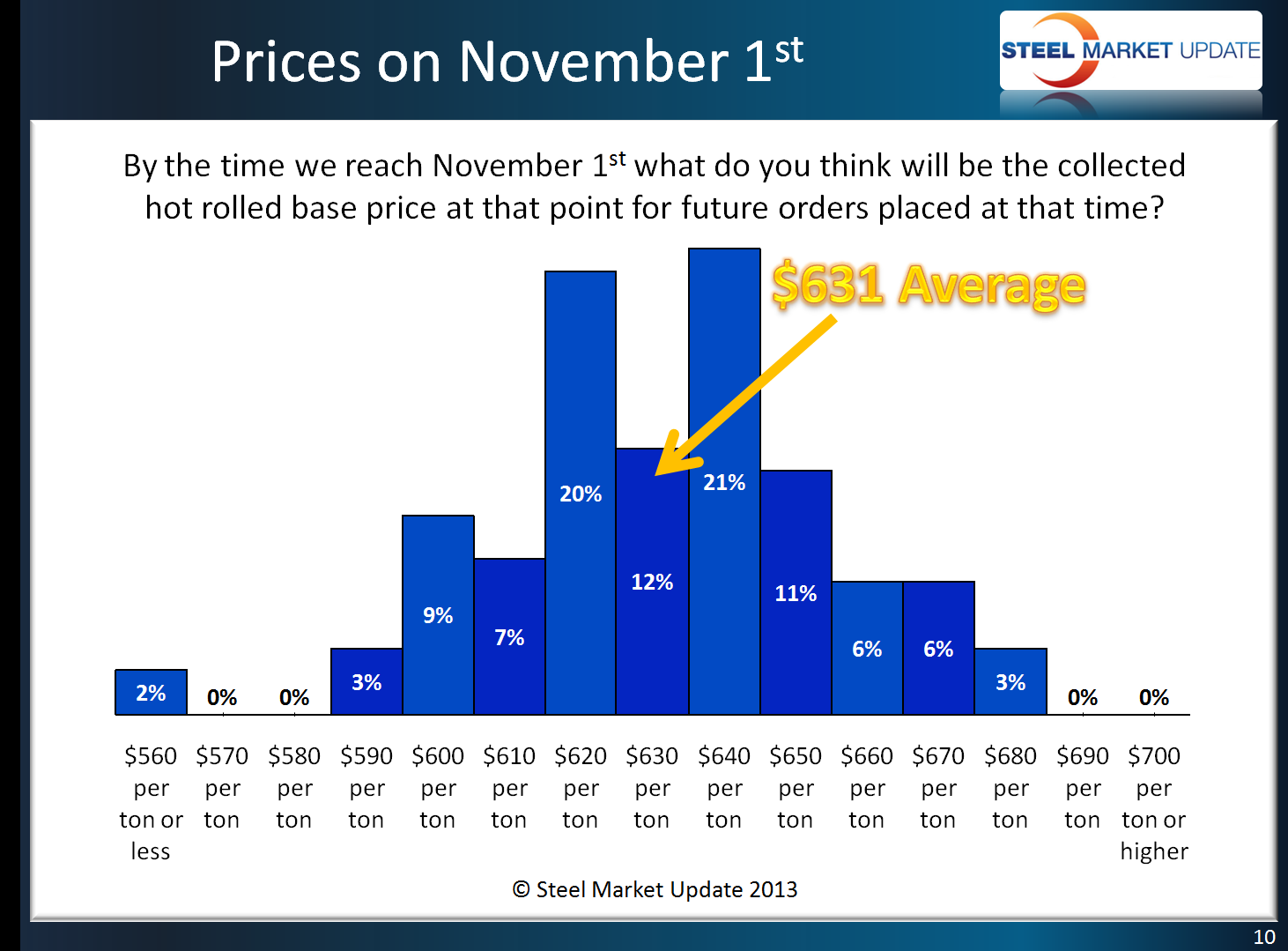

Steel Market Update (SMU) began our most recent survey on Monday morning of this past week. Shortly after our survey began the domestic mills announced price increases. As the week progressed more announcements were made. None-the-less, our survey respondents did not seem to believe flat rolled steel prices will rise over the next few weeks. When asked where benchmark hot rolled pricing would be when we reach November 1st the responses ranged from $560 per ton on the low end to a high of $680 per ton (the announced increase level). Over 50 percent of the responses where right within the current range published by SMU on Tuesday of this past week – $620 to $650 per ton (64 percent).

Those believing prices would exceed the high end of our existing range – i.e. $660 per ton and higher – totaled 15 percent of our respondents.

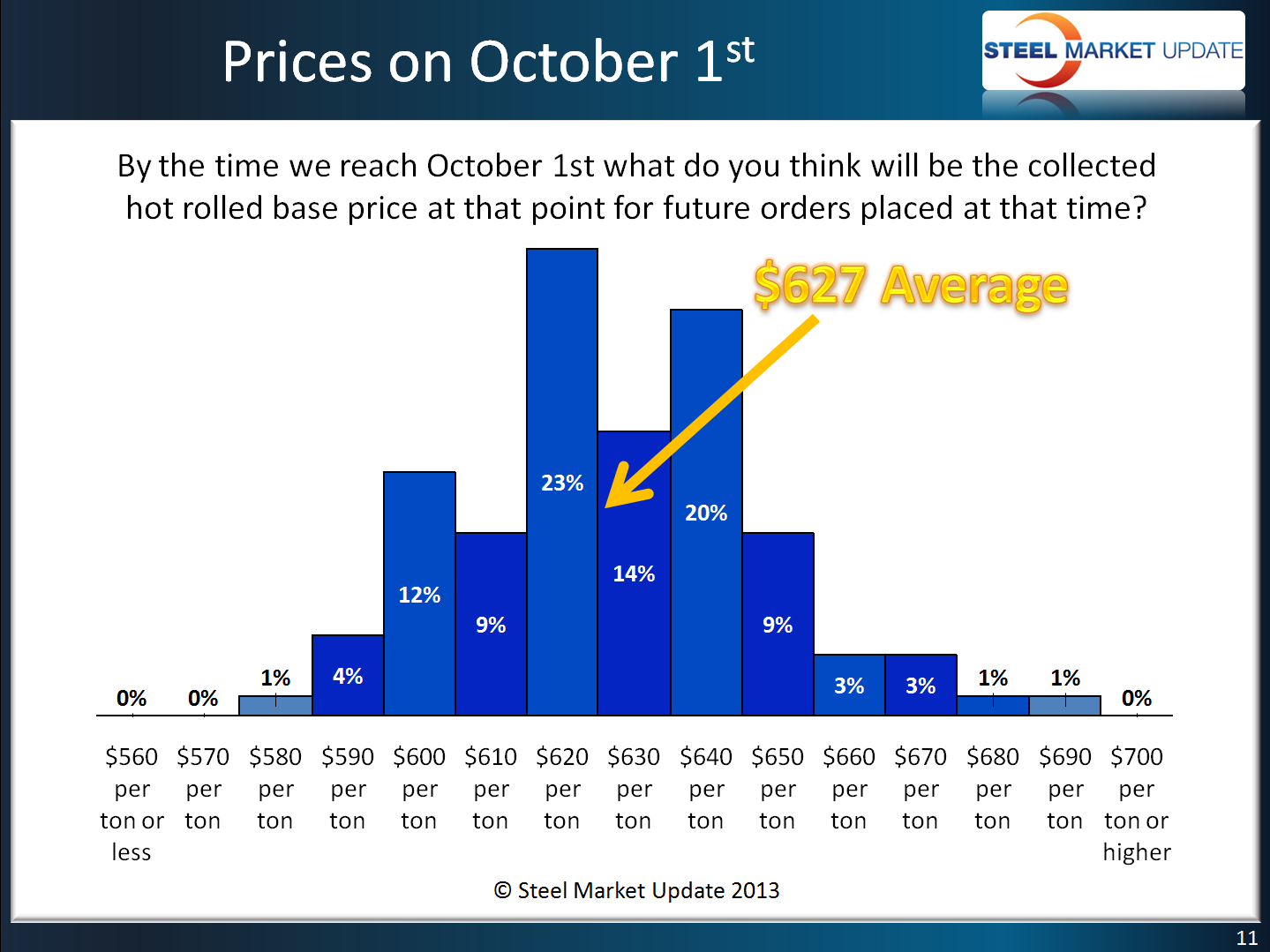

Even with the price increase announcements our results were very similar to those at the beginning of September when the average was $627 per ton. At that time the low was $580 and the high was $690 per ton. The percentage of the respondents suggesting hot rolled pricing at, or above $660 per ton was only 8 percent. Our latest survey has added an additional 7 percent to the higher end of the range.

SMU always takes these particular questions with a grain of salt. They are interesting from a sentiment viewpoint but almost irrelevant to what may actually occur in the future. Although those suggesting October 1st price levels would be within the $620 to $650 range were 57 percent of the early September responses.

SMU always takes these particular questions with a grain of salt. They are interesting from a sentiment viewpoint but almost irrelevant to what may actually occur in the future. Although those suggesting October 1st price levels would be within the $620 to $650 range were 57 percent of the early September responses.