Distributors/Service Centers

October 6, 2013

Service Center Support for Spot Price Increases Stable

Written by John Packard

The most recent survey of the flat rolled steel industry conducted by SMU began at 8 AM on Monday of this past week. Within a few hours of our start, NLMK and ArcelorMittal had both announced price increases and USS was busy telling their customers that they too would raise spot flat rolled pricing.

As our regular readers know, we have been following service center spot pricing into their customer base for a number of years. Over time, what we found is when service centers are actively moving spot prices higher the domestic mills have a better chance of collecting some or all of their price increases. When spot price support levels were tepid the mill increases had a tendency to remain uncollected and then forgotten.

At Steel Market Update (SMU) we look at service center spot pricing from two perspectives: those of the end users who are buying spot flat rolled from service centers as well as from the service center view.

According to the manufacturers, 23 percent of the distributors are raising prices compared to two weeks ago – or when we last conducted our market review. Only 8 percent reported prices as dropping and the vast majority reported service center pricing as having remaining stable over the past two weeks.

The service centers themselves were a bit more optimistic (which is normal) as they reported 32 percent of the distributors as raising pricing, 10 percent reported their company was lowering spot pricing and the vast majority (58 percent) responded prices were maintaining the same levels and were stable. The number of service centers raising prices rose from the 27 percent reported during the middle of September.

The service centers themselves were a bit more optimistic (which is normal) as they reported 32 percent of the distributors as raising pricing, 10 percent reported their company was lowering spot pricing and the vast majority (58 percent) responded prices were maintaining the same levels and were stable. The number of service centers raising prices rose from the 27 percent reported during the middle of September.

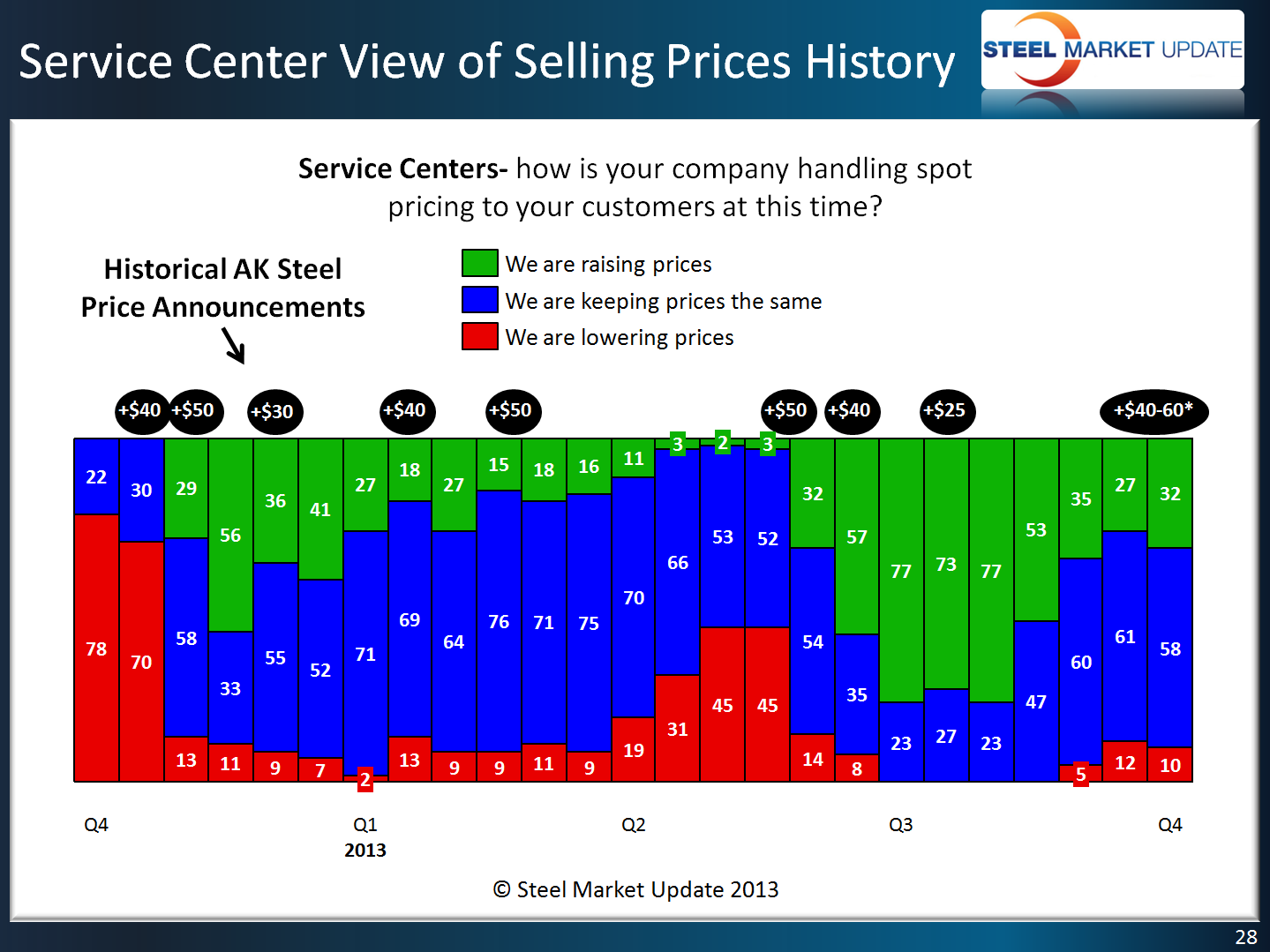

In the graphic below, Steel Market Update is showing the service center perspective over the past 12 months. We have included the AK Steel price announcements made during this same time frame. The most recent announcement by AK Steel referenced specific base prices which is unusual for the mill and, they did not all match the increases announced by the rest of the industry. In the case of galvanized the AK Steel announcement was $20 per ton higher than most of the other mills and $40 per ton higher than NLMK USA which began the latest round of increases. The range of the AK Steel increase is between $40-$60 per ton depending on your starting point and the product.

SMU has found when there is tepid support within the service centers for raising their spot prices the mills have difficulty collecting their increases. A good example is the announcements made during 1st Quarter 2013 ($40 and $50) which were not collected while those announced at the end of May ($50, $40, $25) were mostly collected.

We will need to carefully watch the green bars when we next produce measure spot sales support during the middle of October to see if service centers are actively pushing new increases into the market or not supporting any further movement indicating they are not all firm believers in higher domestic mill pricing from here.