Market Data

October 3, 2013

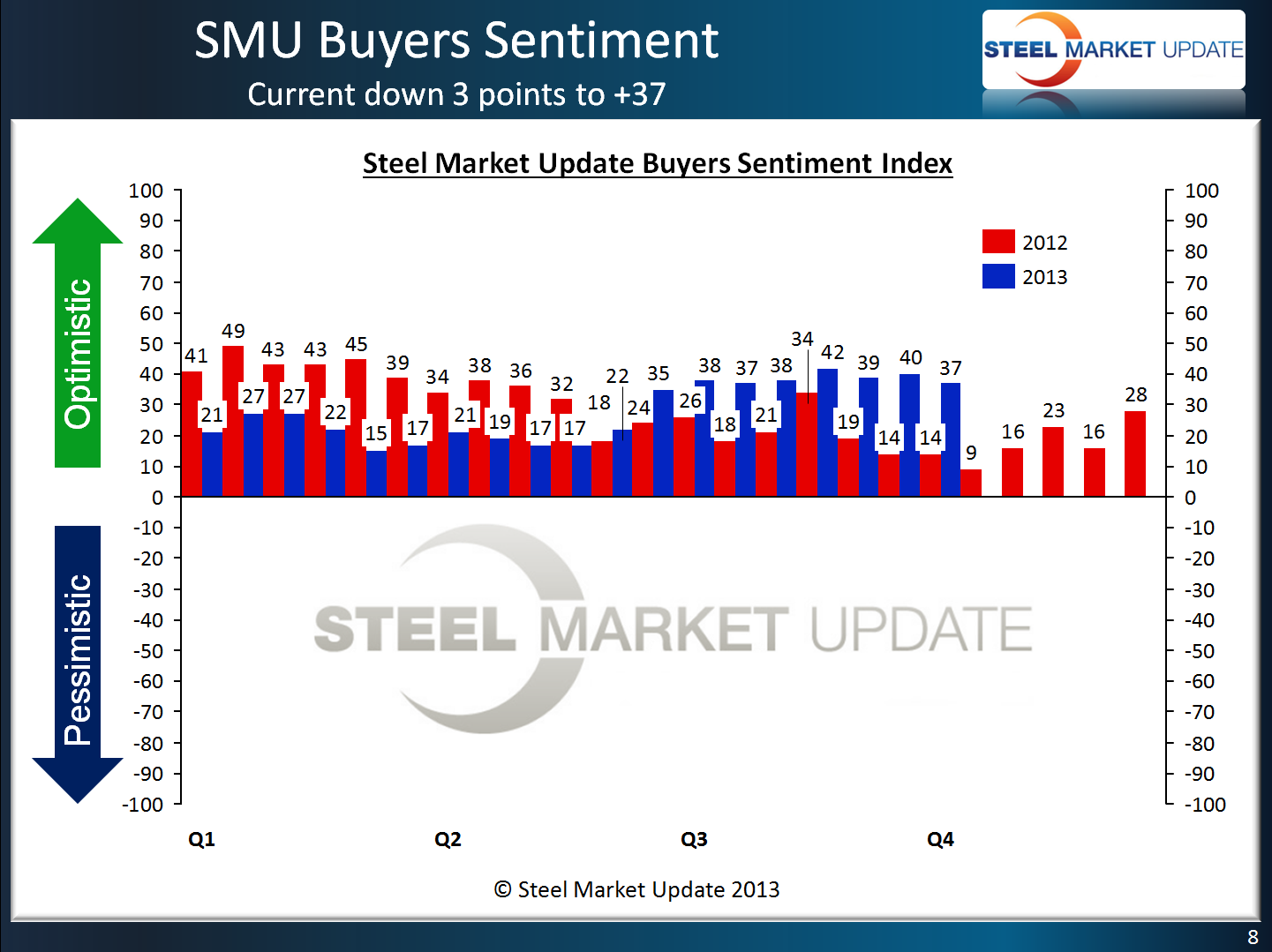

SMU Steel Buyers Sentiment Index Remains Optimistic

Written by John Packard

In spite of the federal government’s decision to shut down, those involved in the flat rolled steel industry continue to remain optimistic about their company’s ability to be successful in both the current environment as well as 3-6 months into the future.

Steel Market Update (SMU) just completed our beginning of October flat rolled steel market survey. The analysis of the responses provided by those responding to our questionnaire produced a reading of +37 which is well within the optimistic range of our index. The new reading is down 3 points from mid-September and 2 points from what we reported one month ago. This time last year Sentiment was +14 or 13 points lower than this week. The current three month moving average (3MMA) is +38.83, down slightly from the 39.00 measured two weeks ago. One year ago the 3MMA was 20.00.

We had a number of comments made during the survey process which helps shed some light as to how our respondents were thinking as they completed the questions regarding Sentiment:

“Demand is staying strong through October…should be one of the best Q4’s we’ve had.” Manufacturing Company.

“The economic recovering is taking longer than expected. Additionally, the constant political battles are wearing thin with the manufacturing industry as a whole.” Manufacturing Company.

“We are seeing strong pickup in demand over the last month or two.” Metal Building Manufacturer.

“Not Enough Demand. Inconsistent and too short of price cycles.” Service Center who went on to say, “More of the Same. TK needs to sell. AK needs to close.”

“Customers more interested in imported steel.” Trading Company.

“Service Center Margins Suck.” Service Center.

Future Sentiment at +51

SMU Future Steel Buyers Sentiment Index was measured this week at +51, unchanged from two weeks ago and well within the optimistic range of our index. Future Sentiment was +45 one month ago and last year at this time it was +31.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly more than 600 North American companies to participate in our survey. Our normal response rate is approximately 125-175 companies. Of those responding to this week’s survey 50 percent were manufacturing companies (down 2 percent from the previous survey’s 52 percent), 39 percent were service centers/distributors (up 4 percent from 35 percent at the beginning of September) and the balance was made up of steel mills, trading companies, toll processors and suppliers to the industry (such as paint companies).

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.