Market Data

October 3, 2013

Mill Lead Times & Negotiations: Price Announcements Have Impact?

Written by John Packard

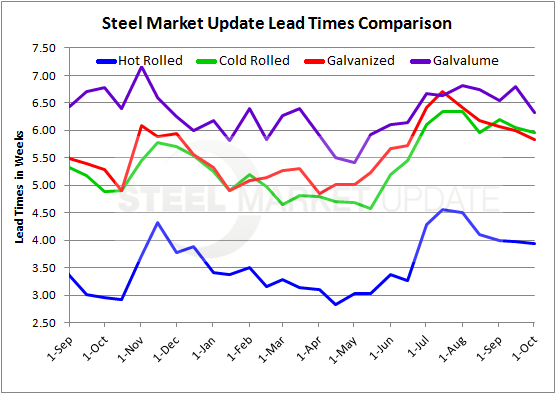

Based on our survey results, hot rolled and cold rolled lead times barely moved compared to two weeks ago. Galvanized lead times shrunk slightly from 6.00 weeks to 5.84 and Galvalume lead times dropped from 6.80 weeks to 6.33 weeks. The current lead times are longer than they were one year ago on all products with the exception of Galvalume. When compared to the beginning of July mill lead times are down on all items with the exception of Galvalume. As you can see by the graphic below, mill lead times have been on a downward trajectory since the middle of July but are above the lead times posted at the beginning of this calendar year until mid-June when they began to rapidly rise.

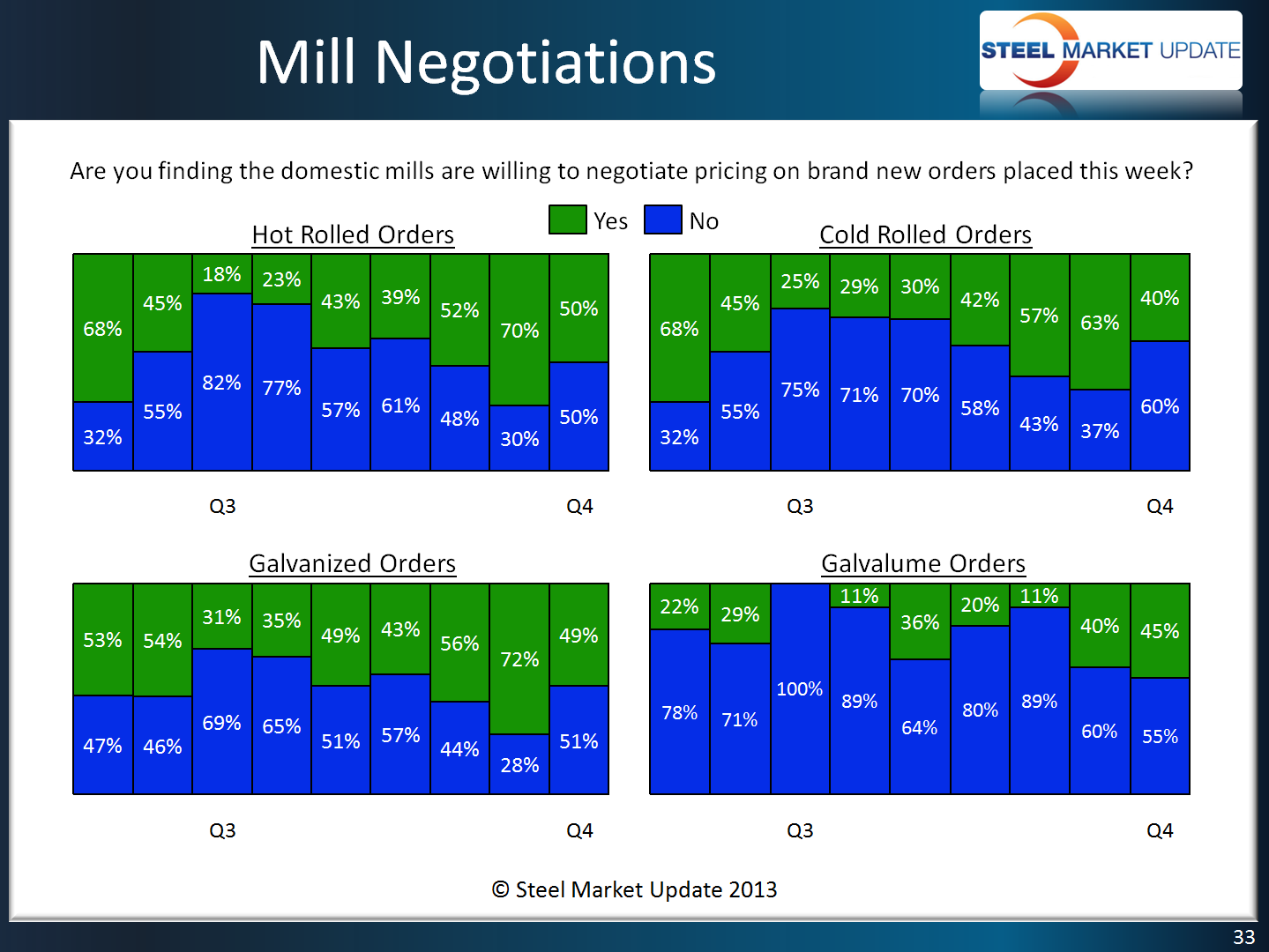

With the price increase announcements being made beginning on Monday of this week we saw the percentage of domestic mills willing to negotiate drop on all products except Galvalume. Hot rolled dropped 20 percent, cold rolled dropped 23 percent, galvanized dropped 23 percent while Galvalume rose by 2 percent.