Prices

October 3, 2013

Hot Rolled Futures Strengthen Amid Further Price Hikes…

Written by Bradley Clark

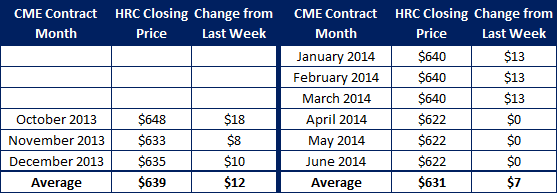

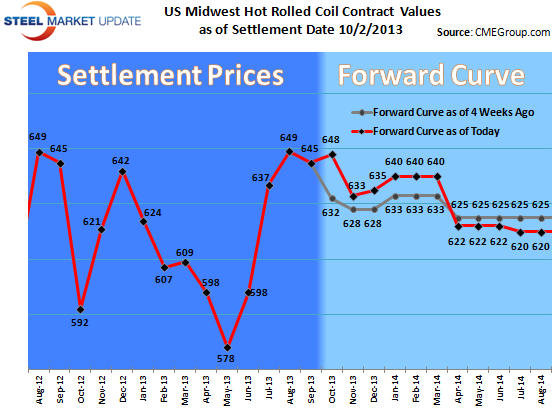

After weeks and months of a sideways market, the recent mill price hike announcements have been the spark the futures market needed to ignite trading activity. Over 8,000 tons have traded the past few days as the potential for the physical market to move higher has squeezed shorts causing them to cover and for speculators to try and pick off the last remaining sharp offers. This combination of short covering and speculating has sent all periods down the curve up by $10-20.

November and December values are approaching $640, Q1 close to $645 and cal 14 to $630. This renewed optimism might need to be taken with a grain of salt as demand follow through has yet to really come back into the market in full force. As tends to happen with futures market, prices have seemingly over shot a bit to the upside as those in the physical market remain cautious prices are set to appreciate very much higher from here. Time will tell, busheling is trading sideways and other raw materials are flat.

Whichever the way the market moves from here is yet to be seen, can the recent price hikes push prices higher, will the lack of improving demand cap how high prices go, will raw materials remain strong going into the end of the year?. These questions will need to be answered before clarity of direction returns. Either way this renewed trading interest in the futures market is a welcome turn of events after such a quiet second half of the summer.

Open interest has decreased by around 2000 lots to 12,788 indicating that some market participants have exited the market.