Analysis

October 3, 2013

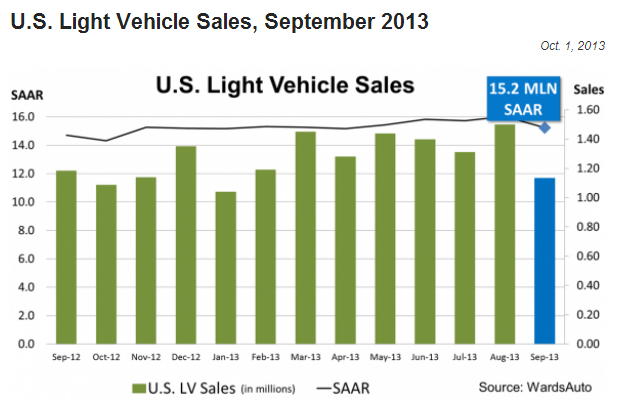

Auto Sales Slip in September

Written by Sandy Williams

US auto sales slipped to 1.14 million new vehicles compared to 1.19 million in the same month last year. It was the first time sales failed to increase on a month-over-month basis in 27 months. Sales at a seasonally adjusted annual rate were 15.4 million–still strong enough to show a 37th consecutive increase on a year-over-year basis. The SAAR rate in September 2012 stood at 14.8 million.

Limited inventory following brisk sales over the summer months, along with reduced incentives and two less selling days, appeared to play a part in the decrease for some manufacturers. Ford led automakers with a 15.2 percent increase year-over-year backed by a strong inventory that was 30.6 percent higher than a year ago. GM sales dropped 11 percent year-over-year and Toyota climbed a much weaker 4 percent in September—both short on inventory for the month. Chrysler sales were up 9.3 percent in September.

Honda, Volkswagen and Hyundai/Kia sales fell in September. Luxury car manufacturers BMW and Mercedes saw increases of 8.3 percent and 5.8 percent, respectively.

Analysts say the September decline is nothing to worry about. Forecasts for the fourth quarter are optimistic with final sales expected at 15.6 million units for the year. The federal shutdown is not expected to impact auto sales for October.