Market Segment

October 2, 2013

NLMK USA First to Announce New Flat Rolled Pricing

Written by John Packard

On Monday morning, NLMK USA announced new flat rolled steel base prices which are to become effective immediately. The minimum base prices announced are:

Hot Rolled: $33.50/cwt base ($670 per ton plus extras)

Cold Rolled: $38.50/cwt base ($770 per ton plus extras)

Galvanized: $38.50/cwt base ($770 per ton plus extras)

Specialty 1050: $48.00/cwt base ($960 per ton plus extras)

There were no reasons provided in the letter to their customers regarding why NLMK has chosen to raise prices at this time.

Steel Market Update (SMU) indices has hot rolled averaging $640 per ton ($32.00/cwt base), cold rolled averaging $745 per ton ($37.25/cwt base) and galvanized averaging $37.00/cwt base ($740 plus extras).

On the surface it appears the increase being requested is approximately $20-$30 per ton depending on the customer and what pricing they have prior to the increase announcement (SMU is assuming NLMK pricing has moved in line with the spot market and has seen some mild erosion over the past few weeks).

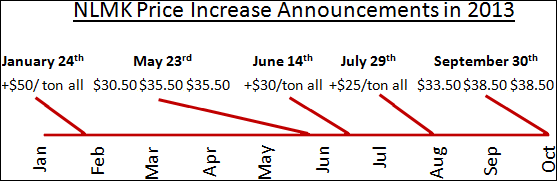

When looking at the increasing in a different light this is the fifth price increase announcement made by NLMK USA so far this calendar year. We will let our readers do the math.