Analysis

September 26, 2013

Final Thoughts

Written by John Packard

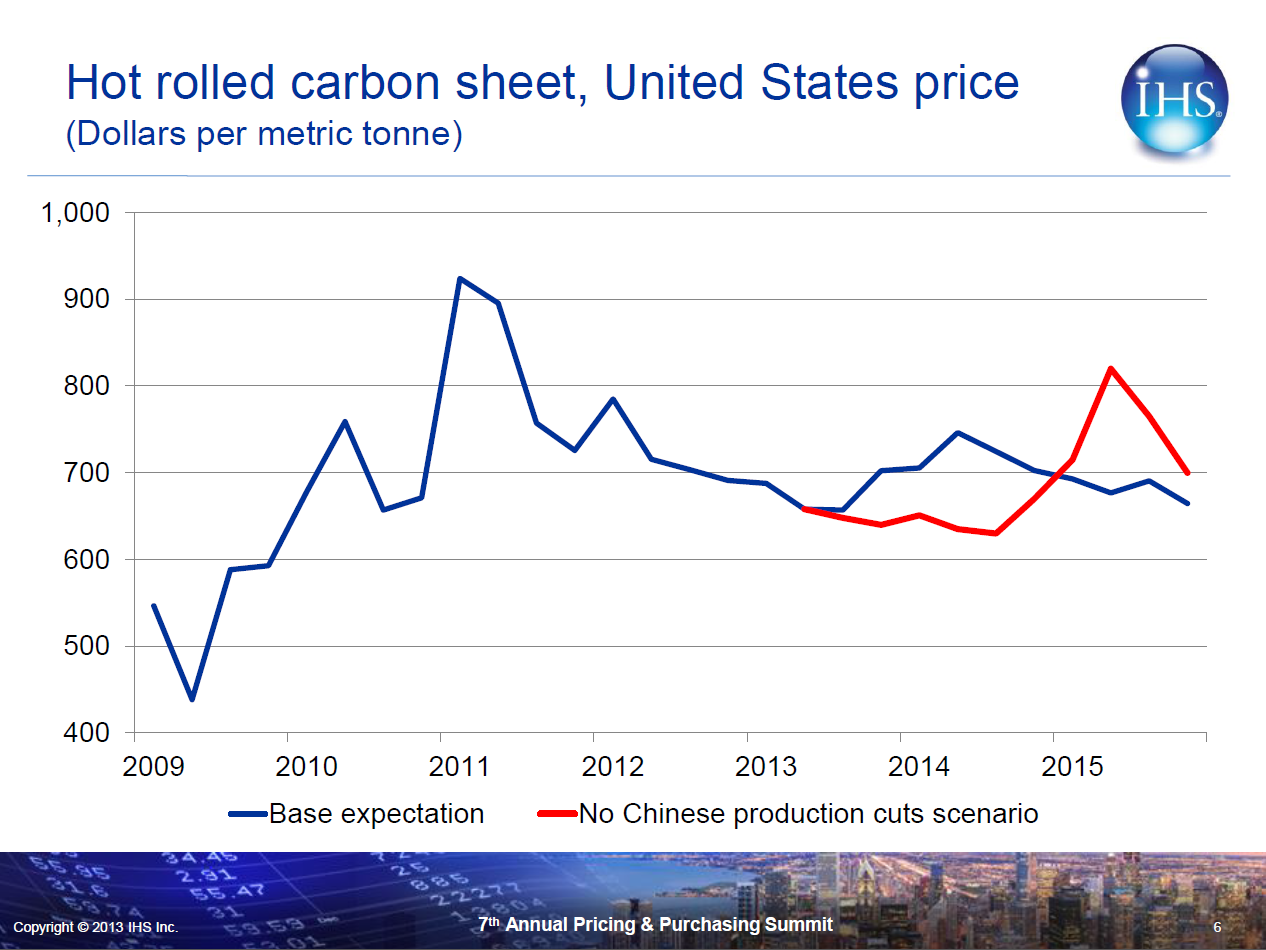

Our last newsletter was interesting enough that I fielded quite a number of phone calls and emails (I take them all and respond to them all). The main point of discussion was regarding the IHS Global Insight article from the presentation given by their steel analyst, John Anton. The essential premise of the presentation being the Chinese steel mills will cut production in the coming months easing the worldwide glut of steel and providing a floor on world prices. In the process North American steel prices are forecast to rise (IHS Global Insight forecast) going into 2014. If excess capacity in China was not reduced their forecast was buyers needed to be concerned about the risk of supply disruptions due to failures of existing mills in Europe or potentially North America.

John Anton’s forecast looks like this:

The blue line being his forecast if Chinese production is cut back and the red line being the forecast if it is not. Note, the red line forecast extreme volatility in the late 4th Quarter 2014 into early 1st Quarter 2015. The volatility is related to mill failures which always cause supply disruptions and price spikes.

A number of callers called on the industry to remember the fundamentals which are there is an over-supply of steel in North America, Europe and Asia and it is not getting any better – and most likely would be worse in the coming months.

SMU continues to encourage our members to send emails, contact us by phone or just discuss the issues around the company water cooler. You can reach me at: John@SteelMarketUpdate.com.

I will be at Metalcon in downtown Atlanta on Monday afternoon (AKZO Nobel party on Monday evening) and again on Tuesday afternoon and Thursday morning. I would like to meet with anyone and everyone attending the show. You can arrange a convenient time to meet by sending me an email or calling me at 800-432-3475. During Metalcon I can be reached on my cell phone which is 770-596-6268.

As always your business is truly appreciated.