Market Data

September 22, 2013

Foreign vs. Domestic Price Spread

Written by John Packard

A majority of the manufacturing companies (57 percent) responding to our most recent steel market survey told us that the spread between foreign and domestic steel is wide enough to justify buying foreign steel. The percentage of manufacturing companies answering this way has increased by 3 percent compared to our results from 30 days ago. Service centers were a little less enthusiastic about foreign with 42 percent reporting foreign prices as being competitive with domestic prices to the point where their company could justify buying foreign steel. However, when compared to our results from 30 days ago the percentage of service centers responding this way has doubled (21 percent).

Separate from the manufacturing and service center responses were those of the trading companies which responded to our questionnaire. The trading companies were unanimous, with 100 percent of those responding reporting foreign prices at levels where business could be conducted. Even so, only 28 percent of the trading company respondents reported seeing an increase in the number of requests for foreign pricing.

Separate from the manufacturing and service center responses were those of the trading companies which responded to our questionnaire. The trading companies were unanimous, with 100 percent of those responding reporting foreign prices at levels where business could be conducted. Even so, only 28 percent of the trading company respondents reported seeing an increase in the number of requests for foreign pricing.

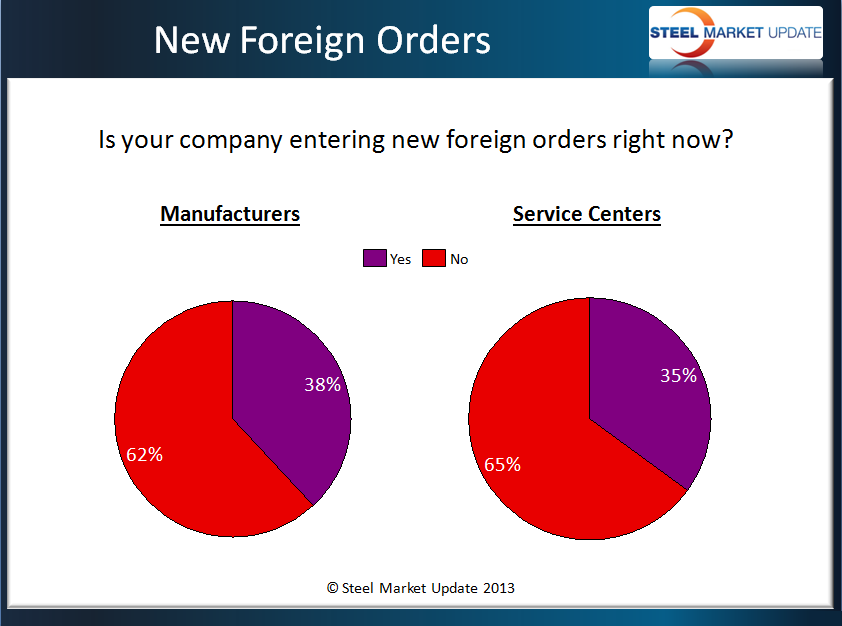

The percentage of our manufacturing and service center respondents reporting that their company was actually in the process of buying foreign steel dropped down from those reporting the spread as being wide enough to justify making a purchase. Of the manufacturing companies 38 percent reported that they were buying foreign steel at this time, which is actually lower than the 43 percent from our survey results conducted in mid-August. Of the service center respondents 35 percent reported their company as placing foreign orders at this time up from 24 percent 30 days ago.

We had a couple of comments left behind during the survey process. One was from a large manufacturing group which reported, “The latest round of offers from foreign mills is significantly lower than the current domestic spot prices.” They then went on to explain why they were not taking advantage of the lower foreign prices at this time, “The only reason we are not taking advantage of foreign offers is our current reduction of inventory levels.”

We had a couple of comments left behind during the survey process. One was from a large manufacturing group which reported, “The latest round of offers from foreign mills is significantly lower than the current domestic spot prices.” They then went on to explain why they were not taking advantage of the lower foreign prices at this time, “The only reason we are not taking advantage of foreign offers is our current reduction of inventory levels.”

A second manufacturing company told us during the survey process, “Very little foreign HRC being offered.”