Market Data

September 19, 2013

Housing Starts Indicate Market May be Flattening

Written by Sandy Williams

Housing starts in August fell short of economist expectations showing just a 0.9 percent increase to a seasonally adjusted annual rate of 891,000 units. The increase only comes after July’s rate was revised downward to 883,000 from 896,000, indicating the market may be flattening.

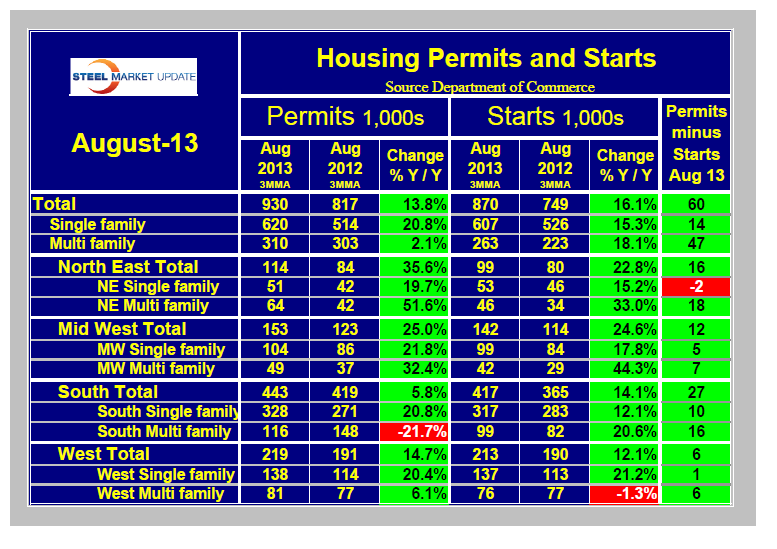

Starts for single family homes rose 7 percent offsetting a drop of 9.4 percent for multi-family units. Starts for single family homes dropped in all regions except the South which gained 12 percent from July’s revised rate. Starts were up 19 percent from August 2012.

Permits issued, an indicator of future construction, dropped to a seasonally adjusted annual rate of 918,000—3.8 percent below the July revised rate of 954,000. Permits for both single family and multifamily units fell in July by 3.0 percent and 15.7 percent, respectively. Year-over-year results showed permits up by 11 percent from 2012.

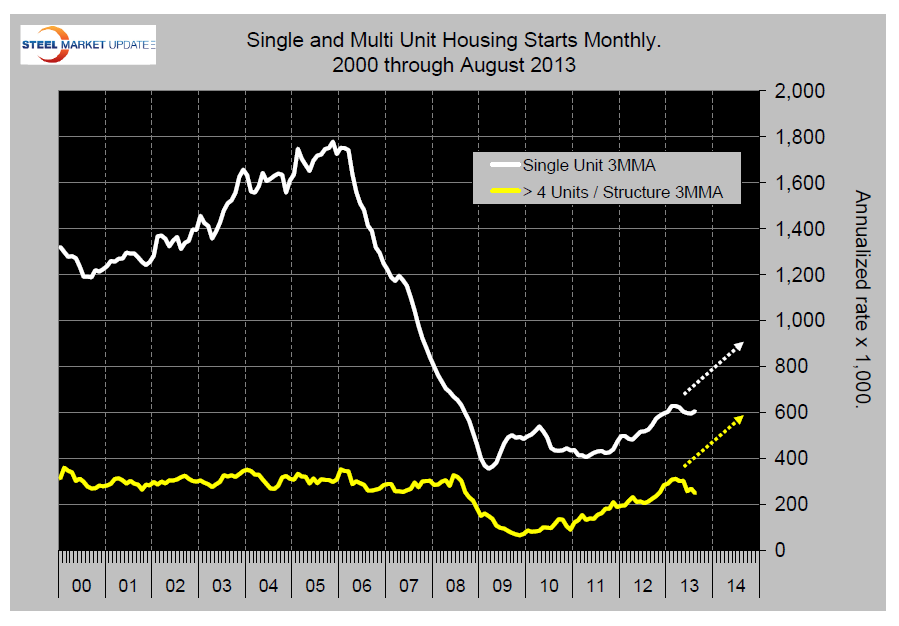

Analysis: Housing construction is suffering a major setback. As you can see in Figure 1 the growth trajectory has collapsed, particularly for multifamily which had been the growth engine.

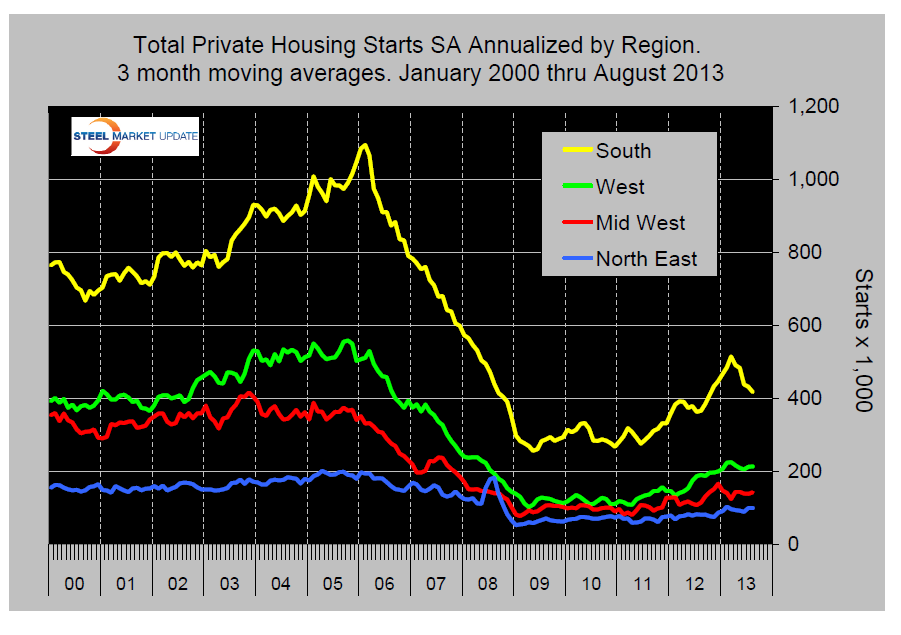

This change has almost entirely been in the South which had been the regional growth engine (Figure 2).

The growth of multi-family permits is down to 2.1 percent in 3 months year-over-year and in the South is negative 21.7 percent. Single family starts have slowed from a 34.3 percent growth rate in October 2012 to 15.3 percent now and multi-family starts have slowed from a 50.4 percent growth rate last December to 16.8 percent now (Table 1).

This is a huge slowdown and is affected by the increase in mortgage interest rates and possibly by a shortage of skilled labor as the pre-recession workers have, in many cases, moved on.

SMU found through our the HARDI wholesalers that many portions of the eastern half of the United States saw a significant slowdown during the month of August and that September has been relatively flat to date. A number of wholesalers reported good business conditions during the months of June and July with the slowdown beginning in August and so far carrying into the first half of September. September business volume was termed as being “acceptable” but not at the June or July levels.