Market Segment

September 17, 2013

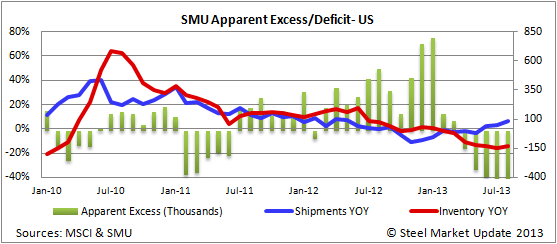

SMU Apparent Flat Rolled Deficit Now at 463,000 Tons

Written by John Packard

According to just released MSCI data, total steel shipments out of the U.S. service centers were reported to be 3,632,900 tons during the month of August 2013. The daily shipping rate rose from 157,500 tons per day in July to 165,100 tons per day in August. Compared to August 2012 shipments (all products) were lower by 0.60 percent. There were 22 shipping days in August which is the same as July.

Inventories increased to 7,941,200 tons but are 11.3 percent lower than the 8,953,900 tons held at service centers in the U.S. at the end of August 2012. The months of inventory on hand are now 2.2 months on an unadjusted basis (down from 2.3 months in July) and 2.3 months on a seasonally adjusted basis (the same as July).

Daily steel receipts totaled 169,570 tons up from the 152,760 tons received per day from the month of July and higher than the 159,700 tons received per day during August 2012.

Flat Rolled

The daily shipping rate increased during the month of August from 101,700 tons per day to 107,200 tons per day. This is 6.6 percent higher than the previous year.

Inventories stood at 4,601,700 tons which is slightly higher than the 4,534,300 tons reported at the end of July. However, inventories are 14.3 percent lower than August 2012. The months on hand remained the same as the prior month at 2.0 months on both an unadjusted and seasonally adjusted basis.

Daily receipts of flat rolled totaled 110,260 tons per day. This is up from the 95,620 tons received last month and better than the August 2012 rate of 98,740 tons.

Based on SMU calculations the Apparent Deficit shrank by 3,000 tons compared to last month and now stands at 463,000 tons. The June deficit was 397,000 tons. In August 2012 there was an Apparent Excess of 529,000 tons. This means there has been an inventory adjustment over the past 12 months of 992,000 tons.

It is Steel Market Update’s opinion that the Apparent Deficit is helping keep prices stable at this point in time. Buyers do not appear to be concerned about their inventory levels as lead times have not exceeded the days on hand at the service centers.

Plate

U.S. service centers shipped 359,300 tons of plate products during the month of August. This is down 3.3 percent compared to August 2012.

Inventories stood at 989,800 tons down slightly from July and 12.5 percent lower than the 1,130,900 tons held on distributors’ floors at the end of August 2012. Months on hand are now 2.8 (unadjusted) and 2.9 months (seasonally adjusted).

Daily receipts of plate into U.S. service centers were 16,150 tons per day which is up from the 15,600 tons received per day during July but below the 16,270 tons per day received during August 2012.

Pipe & Tube

Distributors shipped 242,000 tons during the month of August. This is 3 percent below the shipment rate achieved during August 2012.

Inventories stood at 706,900 tons at the end of August. The months on hand remained at 2.9 months on a non-adjusted basis and rose to 3.1 months on a seasonally adjusted basis.

The daily receipt level was 12,150 tons per day up from 11,040 tons per day in July and higher than the 11,640 tons per day received during August 2012.