Prices

September 15, 2013

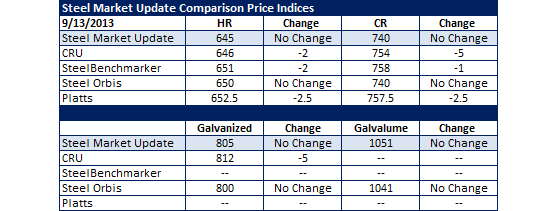

SMU Comparison Price Indices: Sideways to Slightly Lower

Written by John Packard

None of the indexes watched by Steel Market Update (SMU) on a regular basis saw flat rolled steel prices rising this past week. We saw very modest movement lower ($1-$5 per ton) or no change. Benchmark hot rolled prices range from $645 to $652.50 per ton (average $648.90 per ton).

We have discussed this issue previously but, with Nucor and other mills looking at changing the way contracts are negotiated and adjusted, it is very important that buyers be aware of exactly how each index captures and reports their numbers.

Platts is being mentioned as the index of choice for Nucor contracts. Platts’ numbers are based on Northern Indiana Mill as their FOB Point. Platts “normalizes” numbers collected to the Northern Indiana Mill location. This means if a price is collected out of U.S. Steel Fairfield in Alabama, then the number is adjusted to account for what it would take to get that steel to Northern Indiana.

SMU asked Platts to provide more insights into why their index has been consistently higher than those of the other indexes. Joseph Innace, Editorial Director of Metals for Platts/SBB provided SMU with the following comments regarding the Platts price assessments:

The main reason, I would say the number tends to be slightly higher, is because of our adherence to repeatability. We drill down in our daily conversations to determine if any low-end deals—from anywhere—are “one-offs” or special arrangements. If a price is not offered to others in the market, (not repeatable) it is not a factor in our assessment. We need to be consistent about repeatability. Some of the other, more automated price-discovery approaches may capture such low-end, one-off, unique deals and might be a factor in their weighting. Our job is to assess the spot market at large.

We also asked for a little better understanding of their FOB Northern Indiana Mill and what that means when considering prices out of mills in Cleveland, Granite City, etc.

Our Ex-works Indiana spec does not only mean northern Indiana mills. As you well know, there are mini-mills operating in central Indiana, and the EXW Indiana designation encompasses a 200-300 mile radius from the center of the state. In effect, this provides us with a “core-Midwest” price, that reaches north to the Great Lakes region, east to Ohio, southwest to St. Louis, etc. And yes, activity from mills outside this radius would be normalized accordingly.

The purpose of indexes is to provide some transparency to the pricing process. Understanding each index is part of that process for both buyers and sellers of flat rolled steel.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.