Market Data

September 8, 2013

August Job Creation: “Disappointing”

Written by Peter Wright

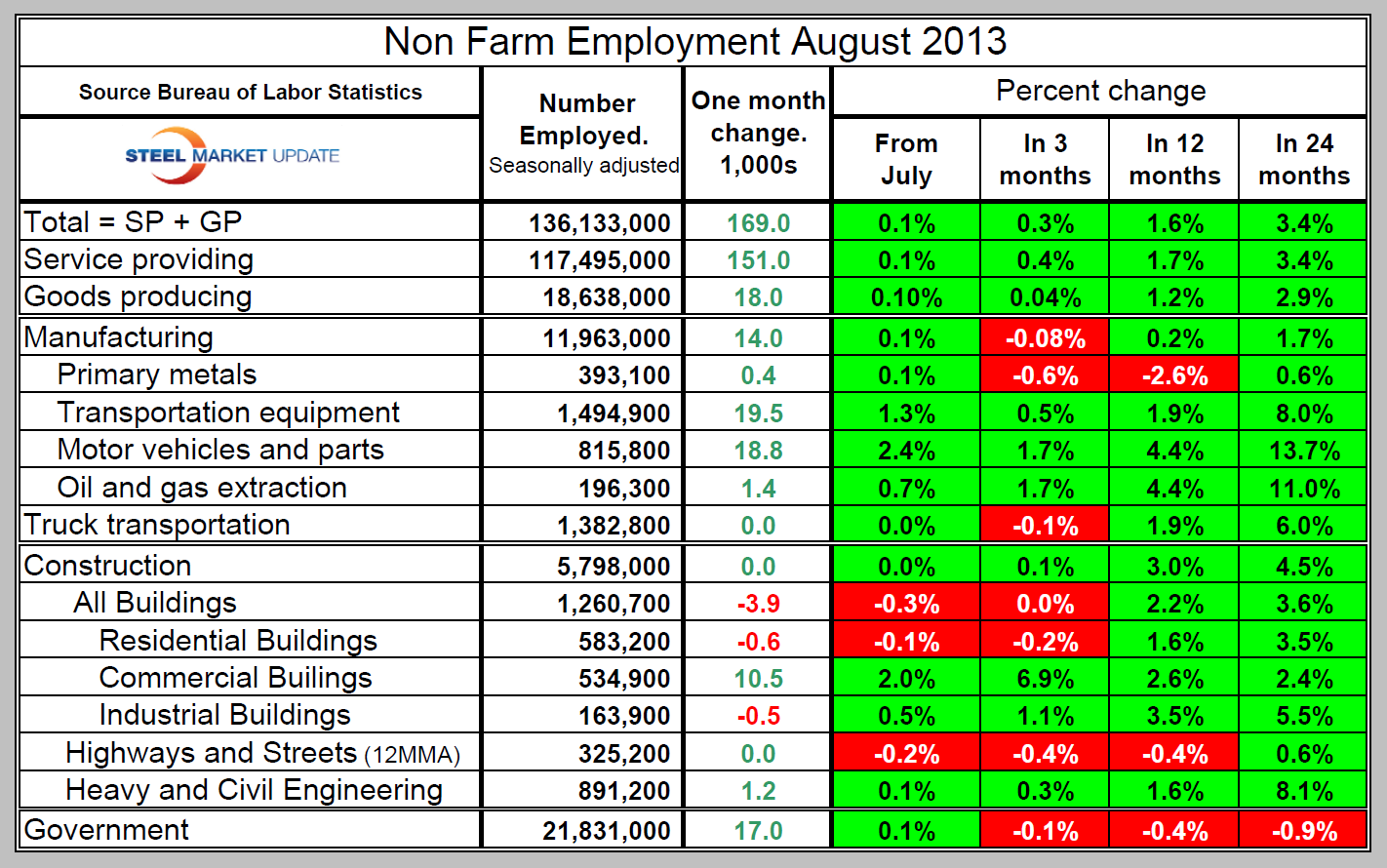

Job creation at 169,000 in August was a little below expectations but the downward revision to June and July of 74,000 was very disappointing. Employment gains continue to be heavily slanted towards service industries. In August production industries added, 18,000 jobs, service industries added 151,000 jobs, (Table 1).

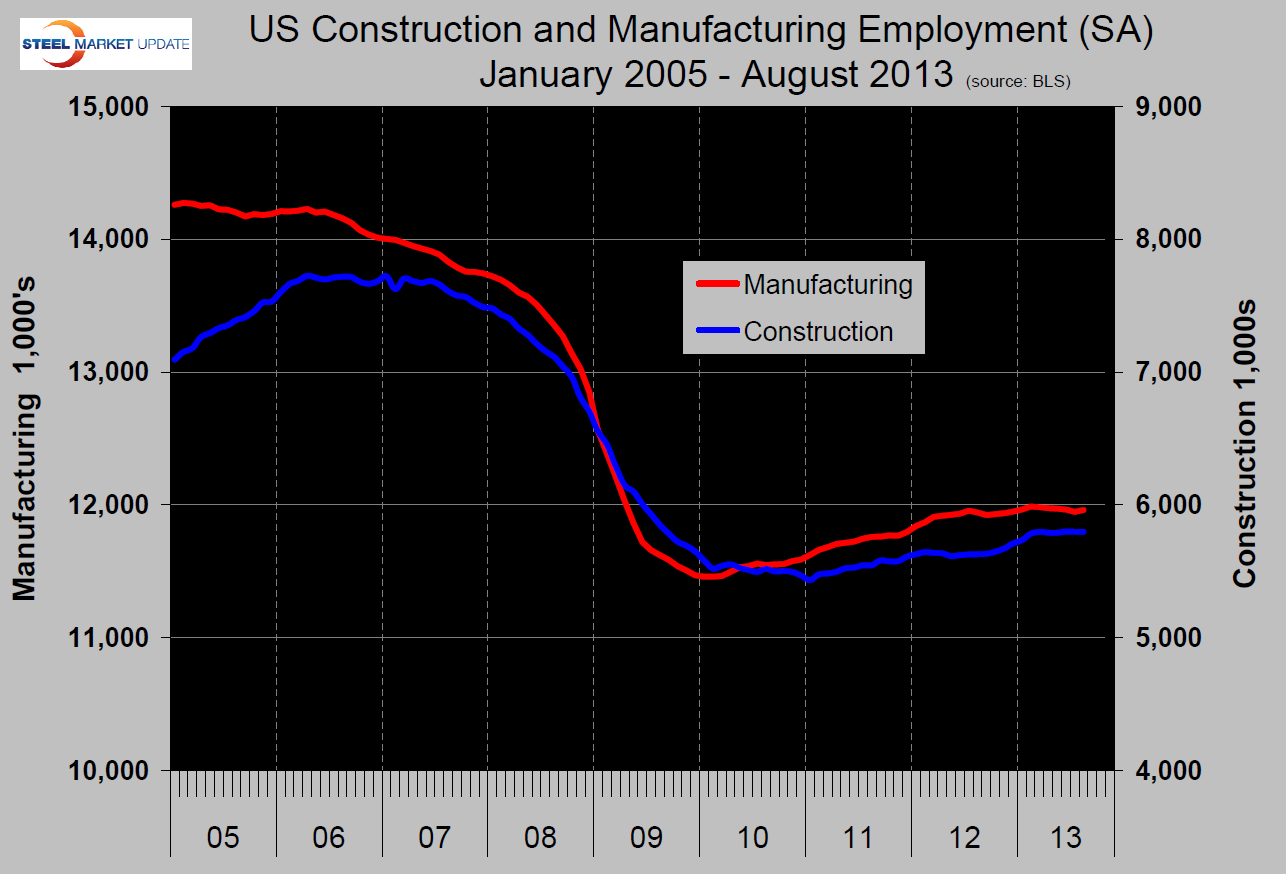

Included in the service number is government employment which grew by 17,000 in August, all at the local level. In August manufacturing added 14,000 jobs after five straight monthly losses for a net gain of 12,000 in the year. Construction broke even in August and has added 87,000 jobs year to date (Figure 1). Since the employment peak of January 2008, goods producing industries have lost 3,753,000 jobs as service industries have added 2,449,000 jobs. Since service hourly income is generally lower than production these statistics cast a long shadow over the consumer’s ability to stimulate economic growth to the historical norm.

Included in the service number is government employment which grew by 17,000 in August, all at the local level. In August manufacturing added 14,000 jobs after five straight monthly losses for a net gain of 12,000 in the year. Construction broke even in August and has added 87,000 jobs year to date (Figure 1). Since the employment peak of January 2008, goods producing industries have lost 3,753,000 jobs as service industries have added 2,449,000 jobs. Since service hourly income is generally lower than production these statistics cast a long shadow over the consumer’s ability to stimulate economic growth to the historical norm.

The statement of Erica L. Groshen, Commissioner Bureau of Labor Statistics and abridged by SMU reads as follows:

“Friday, September 6, 2013. Nonfarm payroll employment increased by 169,000 in August, and the unemployment rate was little changed at 7.3 percent. Over the prior 12 months, job gains averaged 184,000 per month. In August, employment rose by 44,000 in retail trade and 33,000 in health care, while information lost jobs.

Employment in professional and business services continued to trend up in August (+23,000). Over the past 12 months, this industry has added 614,000 jobs. Employment in temporary help services changed little in August.

Within manufacturing, employment in motor vehicles and parts was up by 19,000 over the month after decreasing by 10,000 in July. Auto manufacturers laid off more workers for model changeover in July than in recent years. The return of laid-off workers contributed to the increase in August. Over the past 12 months, auto manufacturers have added 34,000 jobs.

Average hourly earnings of all employees on private nonfarm payrolls rose by 5 cents in August. Over the past 12 months, average hourly earnings have risen by 52 cents, or 2.2 percent. From July 2012 to July 2013, the Consumer Price Index for All Urban Consumers (CPI-U) rose by 2.0 percent.

Turning now to our survey of households, the unemployment rate, at 7.3 percent, and the number of unemployed persons, at 11.3 million, were both little changed in August. The jobless rate is down from 8.1 percent a year ago.

The labor force participation rate–the share of the population that was working or looking for work–edged down to 63.2 percent in August. The employment-population ratio was about

unchanged at 58.6 percent.

The number of involuntary part-time workers fell by 334,000 to 7.9 million in August. These individuals would have preferred full-time employment but had their hours cut or were unable to find full-time work. On net, involuntary part-time employment has changed little over the past 12 months.”

In summary, non-farm payroll employment increased by 169,000 in August, and the unemployment rate was little changed at 7.3 percent.

The point for steel industry readers is that the number and quality of jobs translates to consumer spending which promotes both GDP and steel consumption. The August report suggests business as usual for the rest of the year with not much prospect of either a structural gain or loss. Having said that, we believe steel consumption is presently performing below the basic trend of the economy so there is some upward potential from that point of view.