Prices

September 5, 2013

HRC Futures Extremely Quiet in Uncertain Market…

Written by Bradley Clark

The summer lull continued the past couple of weeks over the holiday weekend. Activity in the futures market has been limited with few trades going through. It seems that a confluence of factors has caused many traders to sit on the sidelines, the summer holiday season, directionless physical market and uncertainty in demand going into the 4th quarter.

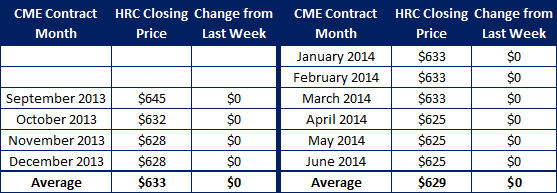

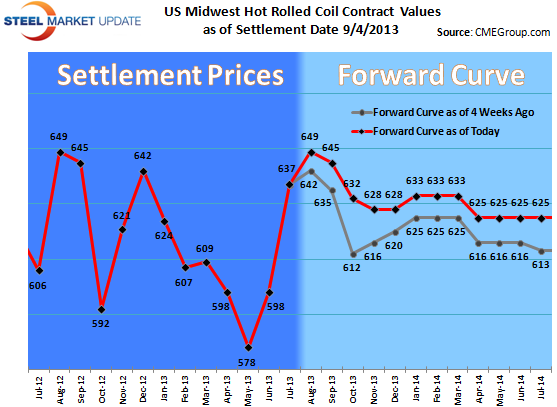

The market remains backwardated with forward prices valued at a discount to the current spot price around $645/ ton. Q4 is trading between $625-$630, Q1 $630-$635 and calendar ‘14 $620-$625. This softening of futures prices indicates sentiment remains slightly bearish as we move into the Autumn months, however demand remains stable and certain outages on the horizon may support prices. With that said it feels unlikely that spot pricing is set to ascend in the near term. All in all, a very boring futures market set against a sluggish to steady physical market.

Open interest remains stable around 14,000 lots indicating that market participants are not exiting the market even though traded volumes have remained light. The market needs a catalyst one way or the other to increase trading.