Analysis

September 5, 2013

August Auto Sales Reach Pre-Recession Levels

Written by John Packard

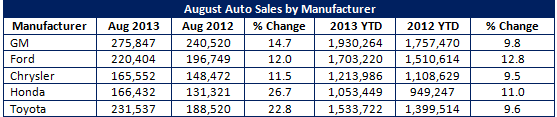

North American auto sales appeared to be healthy in August. The big five auto makers reported the following sales totals for August:

GM reported a 22 percent increase in retail sales. GM specifically reported that Cadillac was up 38 percent, Buick up 37 percent, GMC up 14 percent, and Chevrolet up 10 percent. GM’s August sales were the highest of 2013 and the highest since September 2008.

Ford also saw its highest sales since 2006. Retail sales for Ford were up 20 percent. Ford Fusion set a new sales record in the western U.S. Ford also experienced a 30 percent jump in the sales of small model cars, led by the Fiesta and C-Max Hybrids.

August marked Chrysler’s 30th consecutive month of 100,000+ sales totals. All in all an 11.5 percent lead over last August. American Honda Motor reported a 26.7 percent gain over last August, thus setting a new record for the auto leader. The actual Honda division reported 149,381 units, an increase of 29.1 percent compared with August 2012, whereas the Acura division reported sales of 17,051, a 9 percent increase over last year.

Toyota saw its best month in five years (since May of 2008). The auto maker experienced a 22.8 percent increase over last year. Toyota claims the number one retail manufacturer and the number two overall brand. Toyota experienced strong growth across all of its models.

All in all, August proved to be a very strong (if not record breaking) month for U.S. auto manufacturers.