Market Data

September 4, 2013

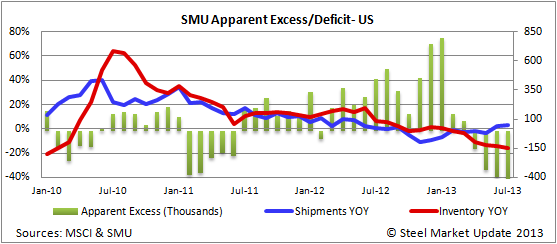

Service Center Inventory Levels Extend Apparent Deficit

Written by John Packard

Service Center Deficit Will Help Keep Mill Prices Firm

Flat rolled inventories are at a 466,000 ton deficit according to Steel Market Update proprietary analysis of the recently released MSCI service center inventory data. The 466,000 ton deficit is the largest one we have measured since August 2009 when it was measured at 604,000 tons.

This deficit will help keep mill and spot prices firm until it is addressed (or demand drops significantly).

Flat Rolled Receipts

Flat rolled distributors received 2,102,700 tons during the month of July. This is up from the 2,081,000 tons received during the month of June. There were 22 shipping days during the month. The daily receipt rate was 95,620 tons down from June’s 104,050 tons. The deficit increased from June’s 397,000 tons due to more steel being shipped out than received. During the month distributors shipped 2,236,300 tons.

Plate Receipts

Distributors received 334,000 tons of plate during the month of July. This is down from 359,600 tons received during the month of June. The daily receipt rate was 15,600 tons down from 17,950 tons the prior month. Total plate shipments during the month of July were 335,300 tons, one thousand tons greater than receipts.

Pipe & Tube Receipts

In July pipe & tube distributors received 242,100 tons of tubulars, up from 217,500 tons during the month of June. The daily receipt rate was 11,040 tons, up from 10,850 tons in June. Shipments totaled 232,500 tons (+9,600 tons in inventory).

Total Steel Products

Distributors received 3,359,800 tons of new steel during the month of July. This is up from the 3,267,800 tons received the previous month. The daily receipt rate was 152,760 tons in July, down from 163,430 tons in June. Shipments totaled 3,484,100 tons and inventories were reduced by 124,300 tons.