Market Data

August 29, 2013

August Consumer Confidence

Written by Peter Wright

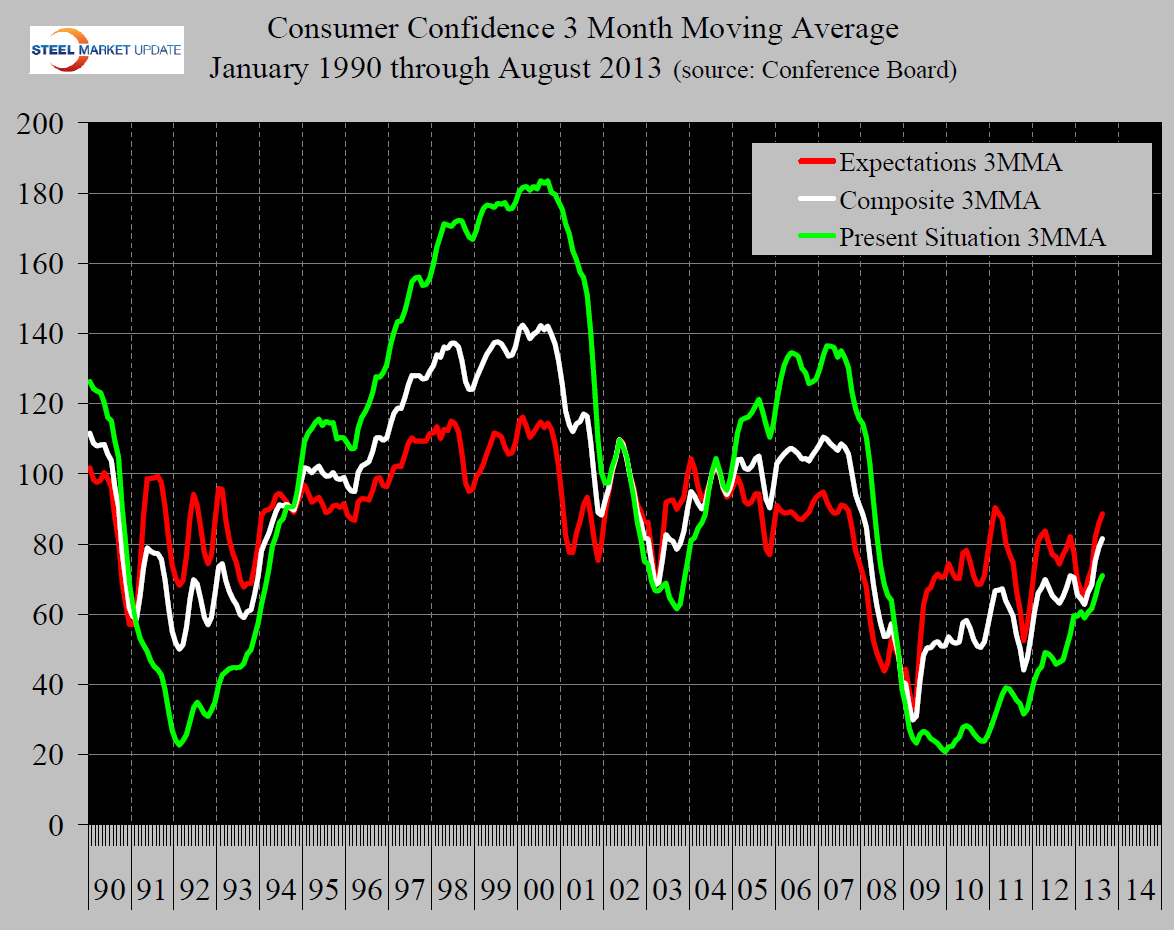

The Conference Board composite measure of consumer confidence increased slightly in August and the 3MMA improved from 79.1 also to 81.5 the highest value since February 2008 and up by 18.4 year over year. The view of both the present situation and expectations improved on a 3MMA basis. The consumer’s view of the present situation was up from 69.0 to 71.0 and expectations increased from 85.9 to 88.6.

Year over year improvements were 24.7 and 14.3 respectively (Figure 1). Please note that these numbers are three month moving averages, those below in the official press release are monthly. In hindsight there were many indicators that had a lead on the last recession and this was one of them. The composite consumer confidence was heading south six months before the recession began. Figure 1 shows that the trajectory of improvement of the view of the present situation is slower than after either of the previous two recessions.

Year over year improvements were 24.7 and 14.3 respectively (Figure 1). Please note that these numbers are three month moving averages, those below in the official press release are monthly. In hindsight there were many indicators that had a lead on the last recession and this was one of them. The composite consumer confidence was heading south six months before the recession began. Figure 1 shows that the trajectory of improvement of the view of the present situation is slower than after either of the previous two recessions.

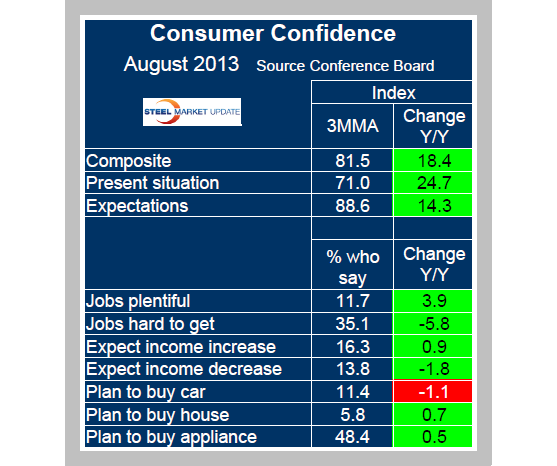

Table 1 is the SMU summary of the elements measured by Nielson. The consumer’s view of job availability improved in the last three months but there are still three times as many people finding jobs hard to get than find them plentiful. There has not been much change in the proportion expecting an income increase in the last year but over the course of 2013 there has been a steady decline in those expecting a decrease. Compared to a year ago more people are planning to buy a home and appliances and less people are planning an auto purchase.

Moody’s Economy.com summarized this month’s Conference Board report as follows. “Consumer confidence may not improve over the next several months, and holding onto its recent gains would be deemed a success. Confidence will be tested by the volatility in equity markets, rising interest rates, and higher energy prices. Oil prices are climbing because of geopolitical tensions rather than an improving global economy. Also, the debt-ceiling debate will begin to intensify, and this rattled sentiment in 2011. Barring any unforeseen shocks, the recovery should be able to overcome fiscal drag by early 2014, followed by consistent improvements in sentiment.”

The official press release reads as follows:

NEW YORK, August 27, 2013…The Conference Board Consumer Confidence Index®, which had declined in July, increased slightly in August. The Index now stands at 81.5 (1985=100), up from 81.0 in July. The Present Situation Index decreased to 70.7 from 73.6. The Expectations Index increased to 88.7 from 86.0 last month.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was August 15.

Says Lynn Franco, Director of Economic Indicators: “Consumer Confidence increased slightly in August, a result of improving short-term expectations. Consumers were moderately more upbeat about business, job and earning prospects. In fact, income expectations, which had declined sharply earlier this year with the payroll tax hike, have rebounded to their highest level in two and a half years. Consumers’ assessment of current business and labor market conditions, on the other hand, was somewhat less favorable than last month.”