Market Data

August 28, 2013

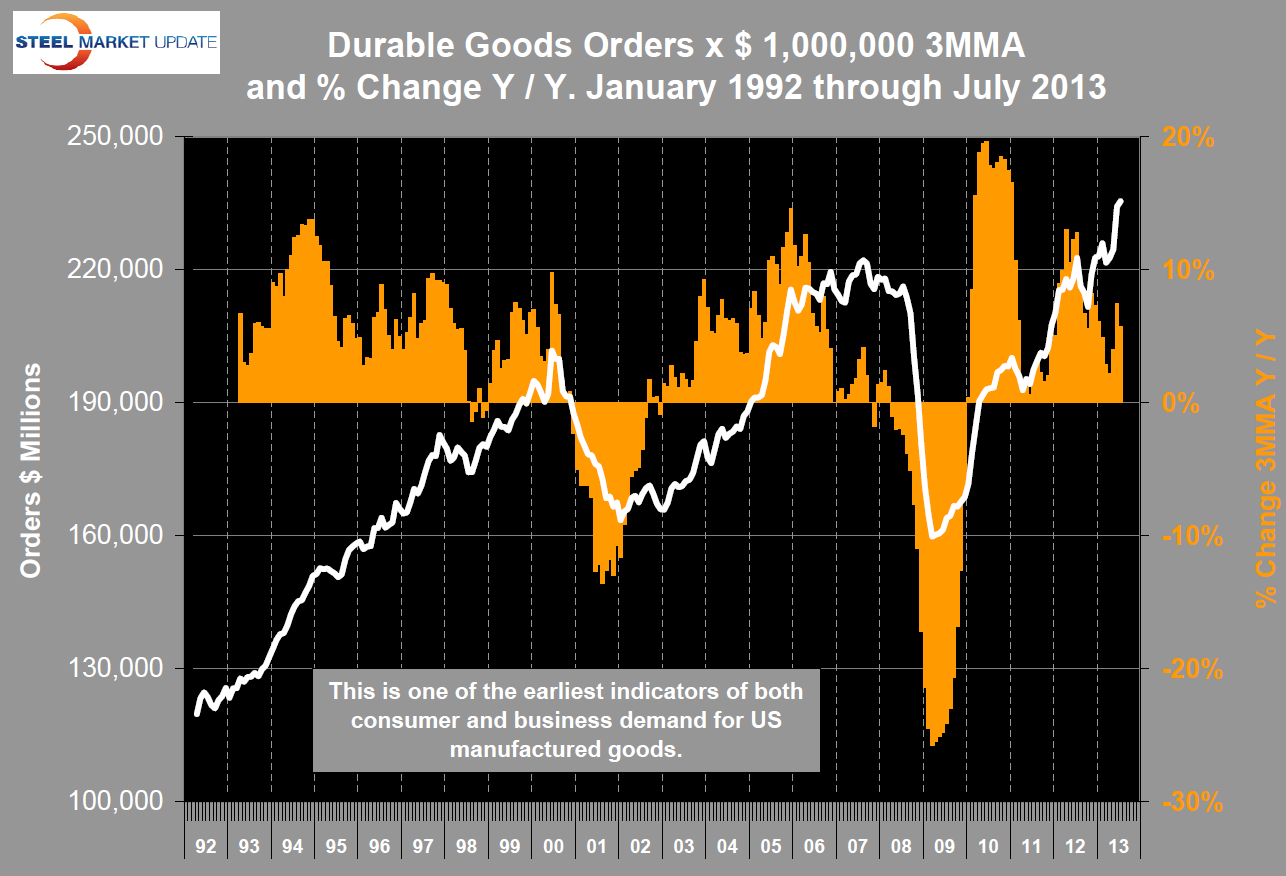

Durable Goods Orders 3MMA Rose in July to All Time High

Written by Peter Wright

New orders for manufactured durable goods declined by 7.3 percent in July from the very strong June result and following three consecutive monthly increases. The decline in civil aircraft orders was the main reason for the month on month decline. The three month moving average in July rose by 0.5 percent month on month to another all time high and by 5.7 percent year on year (Figure 1). The 3MMA year over year has increased for 43 consecutive months.

Shipments have declined for three of the last four months and were down by 0.3 percent in July to $228.8 billion. Computers and electronic products, also down three of the last four months, drove the decrease of $0.9 billion or 3.2 percent to $26.6 billion. This followed a 1.1 percent June increase.

Shipments have declined for three of the last four months and were down by 0.3 percent in July to $228.8 billion. Computers and electronic products, also down three of the last four months, drove the decrease of $0.9 billion or 3.2 percent to $26.6 billion. This followed a 1.1 percent June increase.

Unfilled orders have increased in five of the last six months, and increased $4.4 billion or 0.4 percent to $1,034.3 billion in July. This was at the highest level since the series was first published on a NAICS basis in 1992, and followed a 2.1 percent June increase. Computers and electronic products, up four consecutive months, led the increase of $1.2 billion or 0.9 percent to $135.9 billion.

Inventories of have increased in three of the last four months and rose by $1.3 billion or 0.4 percent to $379.1 billion in July. This was also at the highest level since the series was first published on a NAICS basis, and followed a 0.2 percent June increase. Transportation equipment, up fourteen of the last fifteen months, led the increase of $0.7 billion or 0.6 percent to $117.1 billion.

This Census Bureau report released on Monday is further confirmation that the manufacturing sector continues to show positive growth.