Market Data

August 26, 2013

SMU Price Momentum Indicator Adjusted to Neutral

Written by John Packard

On Friday, August 23rd, Steel Market Update adjusted our SMU Price Momentum Indicator from “Higher” to “Neutral.” This change is meant to be an indicator of the direction we expect flat rolled steel prices to move over the next 30 days. Prior to Friday our Indicator was set at Higher for 10.5 weeks going back to the later part of May.

SMU chose to make our adjustment at this time due to market sources advising SMU of weakness at the galvanized conversion mills. This included us seeing an email from one of the conversion mills advising one of their customers that for larger orders the mill would consider “special pricing.”

We also gathered information regarding one of the Canadian hot rolled mills lowering some of their spot pricing – albeit modestly.

On Friday we learned that the U.S. Steel Lake Erie union had reached a tentative agreement with U.S. Steel and would vote at the end of this week to accept or reject the latest proposal. SMU expectation is that the contract will be ratified and the lockout will end. If the vote does go the way we expect then U.S. Steel could bring back production at Lake Erie works over the next 30 days. The Lake Erie Works facility is rated at 2.9 million ton of annual production which would be brought back into the marketplace.

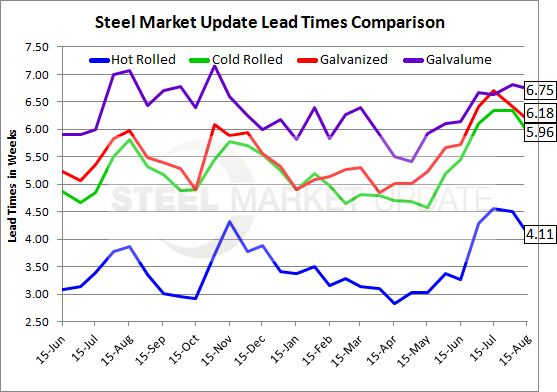

Lead times, we have seen the extension of lead times begin to break and fall back slightly in our latest survey.

Lead times, we have seen the extension of lead times begin to break and fall back slightly in our latest survey.

Hot rolled prices have already been relatively flat over the past five weeks according to our SMU Price Assessments on the product. Hot rolled has ranged from $620-$670 per ton during this time period with averages running from $640-$650 per ton. SMU anticipates this price range and averages to remain intact over the next 30 days.

The spread between foreign steel and domestic steel pricing is within the $100 per ton window considered by many buyers to be an acceptable risk. Later in this issue of SMU, Peter Wright will analyze currency values versus the U.S. dollar and, in many countries our dollar is attractive for them to remain competitive and send steel to our shores. We saw this earlier this month when we evaluated ultra light gauge galvanized prices out of India.

The spread between foreign steel and domestic steel pricing is within the $100 per ton window considered by many buyers to be an acceptable risk. Later in this issue of SMU, Peter Wright will analyze currency values versus the U.S. dollar and, in many countries our dollar is attractive for them to remain competitive and send steel to our shores. We saw this earlier this month when we evaluated ultra light gauge galvanized prices out of India.

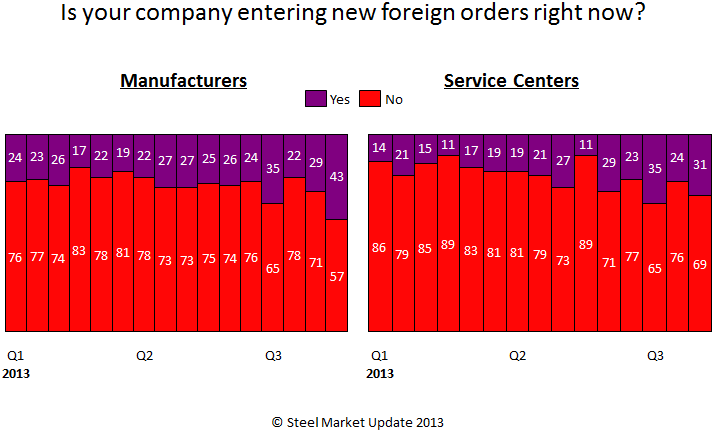

In our most recent survey SMU found the percentage of manufacturing companies making foreign purchases at this time to be troubling for the domestic industry to continue to push price increases.

In our most recent survey SMU found the percentage of manufacturing companies making foreign purchases at this time to be troubling for the domestic industry to continue to push price increases.

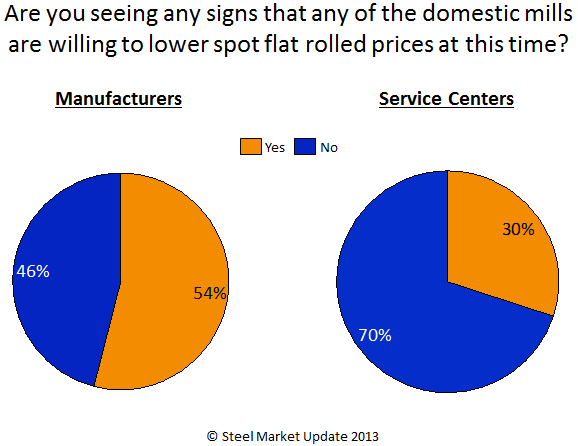

We are not alone in our opinions. Many of the steel buyers with whom we speak on a steady basis feel prices have reached their zenith and will remain at current levels over the next few weeks. We also asked those taking our steel market survey this past week if they were seeing signs of the domestic mills as willing to lower spot prices and we found a majority of the end users as says “yes” with 30 percent of the service centers reporting that they too were seeing signs.

The expectation is for prices to trend sideways as there are still a number of blast furnace maintenance issues at both U.S. Steel and ArcelorMittal along with the Lake Erie union situation which need to be worked through. Our sources advised SMU earlier today that the U.S. Steel Great Lakes blast furnace situations may be rectified and back in action by the end of this week. By early October there could be a significant amount of supply making its way back into the market. We caution buyers to be vigilant, ask questions and don’t assume the market will remain fixed at today’s price levels.

We also note that the domestic mills could make an attempt to push prices higher by announcing a new price increase. This has happened in the past and could well occur again in the coming days. This is another reason to stay close to your sources of supply and evaluate the supply/demand situation should an increase be made.