Product

August 26, 2013

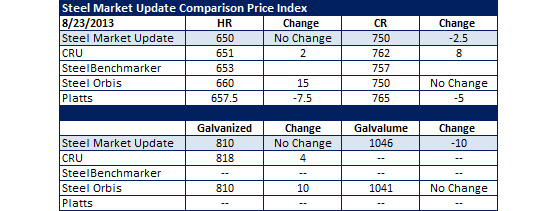

SMU Comparison Price Indices: A Little of This, A Little of That

Written by John Packard

We got a taste of everything this past week from the various steel indexes we monitor on a regular basis. Platts, which recently has been on the leading edge of higher flat rolled steel prices, scaled their numbers back on both hot rolled and cold rolled this week. CRU budged ever so slightly higher on hot rolled (+$2), cold rolled (+$8) and galvanized (+$4). Steel Orbis, which is normally the lowest priced index on our totem pole, moved their hot rolled number up $15 and galvanized up $10 – on cold rolled and Galvalume they remained where they were. SteelBenchmarker was not in the game last week as they only produce their numbers twice per month.