Market Data

August 22, 2013

SMU Steel Buyers Sentiment Index Jumps to Highest Level This Year

Written by John Packard

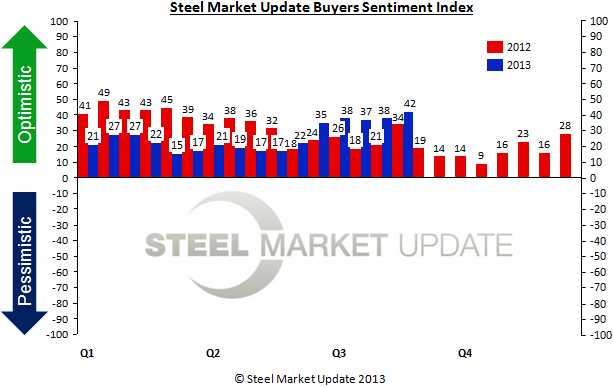

Buyers and sellers of flat rolled steel expressed their growing optimism through our Steel Market Update (SMU) steel survey. The SMU Steel Buyers Sentiment Index registered +42 which is the highest level so far this year exceeding the previous high of +38 posted at the beginning of the month. Our index is now at the highest levels seen since January through March 2012 when we recorded Sentiment as ranging from a low of +43 to a high in the middle of January at +49, which continues to be the highest index recorded since SMU began measuring Sentiment in November 2008.

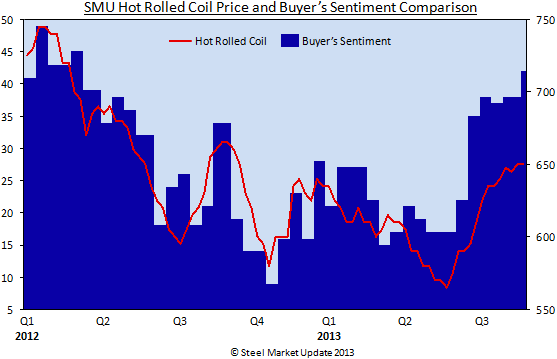

SMU Steel Buyers Sentiment has been improving right along with spot flat rolled steel pricing. Sentiment bottomed at +17 during the middle of May. A week later the domestic mills began announcing (and collecting) price increases. The service centers began to support spot price increases in their resale markets by late June and our Sentiment Index increased to +35. We have not seen any wholesale erosion in prices which has provided support to those buying and selling steel in this market environment.

Steel Market Update also looked at the data from a three month moving average (3MMA) perspective. This smooth’s out any gyrations which might be contained in the data. Over the past few months our 3MMA has improved from +21.83 in mid-June to +27.67 in mid-July and the current 3MMA is +35.33. This is our highest reading for the 3MMA since the middle of May 2012 when we measured it at +37.33.

Usually those most negative about current market conditions will provide feedback during the survey process. On this survey we found those sharing their opinions about the market to be much more optimistic than normal.

Currently in the mist of the grain bin season with good crop projections. Manufacturing Company.

Business remains steady. Manufacturing Company.

Business remains steady. Manufacturing Company.

Considering Washington is anti manufacturing we are holding our own. Service Center.

On balance demand is relatively strong. Midwest Service Center.

Demand the same as last several months. Only thing that has changed is the supply side price. Service Center.

Future Sentiment Remains at +49

SMU Future Steel Buyers Sentiment Index remained at +49 which is well within the optimistic range of our index. Buyers and sellers of steel remain confident in their company’s ability to be successful three to six months out into the future. As one of our respondents put it, “Positive breeds positive.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 660 North American companies to participate in our survey. Our normal response rate is approximately 120-170 companies. Of those responding to this week’s survey 50 percent were manufacturing companies (up from the previous survey’s 49 percent), 37 percent were service centers/distributors (down from 41 percent at the beginning of August) and the balance was made up of steel mills, trading companies, toll processors and suppliers to the industry (such as paint companies).

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.