Product

August 16, 2013

Service Center Inventories at Lowest Levels Since December 2010

Written by John Packard

According to just released Metal Service Center Institute (MSCI) data, total steel inventories at the distributors as of the end of July were 7,642,600 tons. This is 12.2 percent below the 8,953,900 tons held by service centers at the end of July 2012.

The daily shipment rate dropped to 157,500 tons per day (22 day shipping month) with service centers shipping 117,000 more tons in July than the previous month (20 day shipping month).

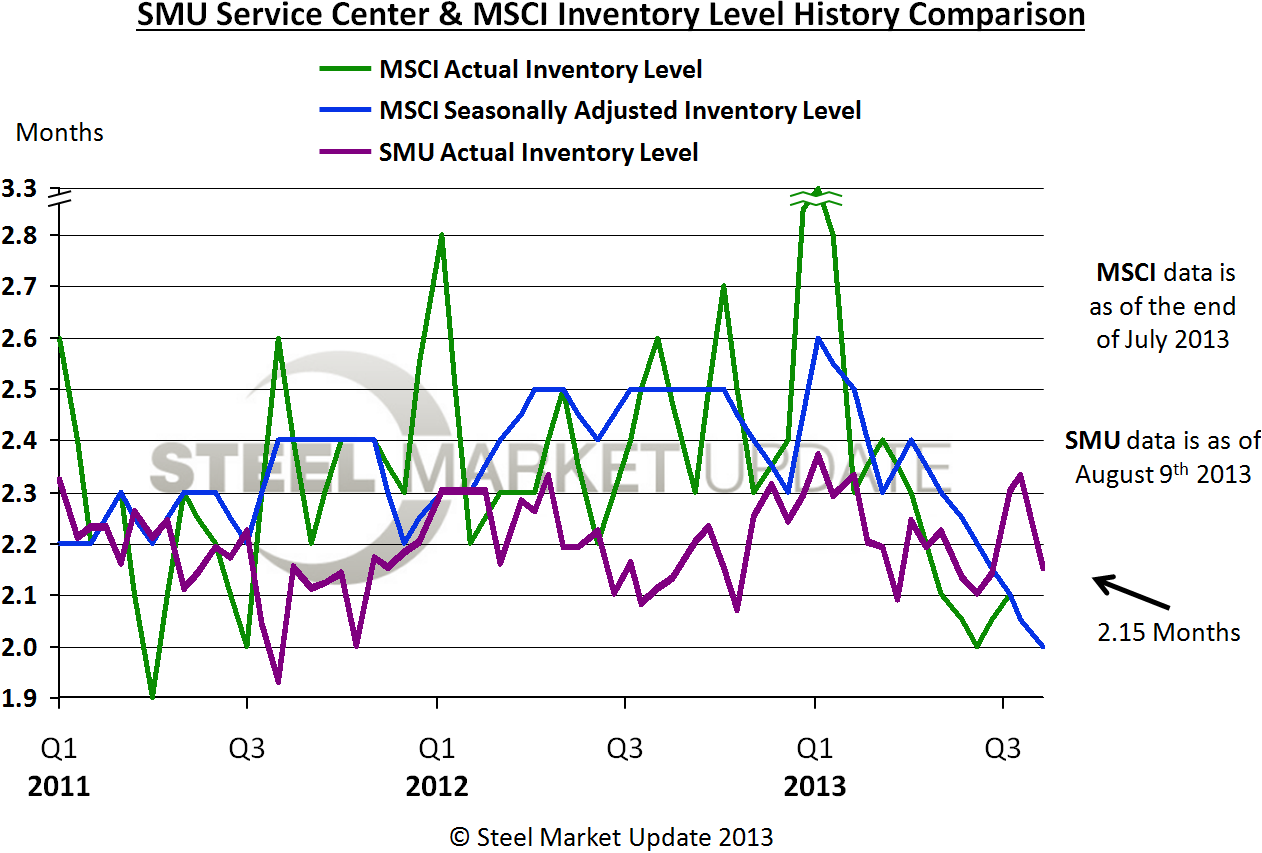

Total steel inventories are at 2.3 months on both a seasonally adjusted and non-adjusted basis.

Since the beginning of the calendar year, service centers in the United States have reduced inventories by 893,400 tons.

Flat Rolled

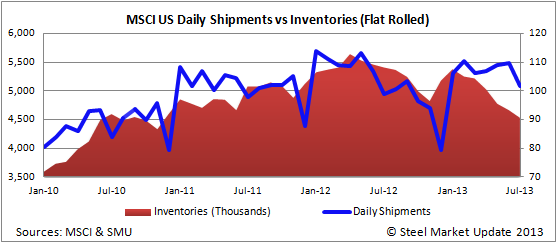

Flat rolled shipments totaled 2,236,300 tons a 7.7 percent improvement over July 2012. However, the daily shipment rate dropped from 109,600 tons per day in June to 101,700 tons per day during the month of July.

Inventories at the service centers as of the end of July stood at 4,534,300 tons or 16.2 percent lower than one year earlier and a decline of 133,600 tons. Months on hand dropped to 2.0 months from the 2.1 months registered at the end of June.

Since the beginning of the calendar year, flat rolled inventories have declined by 846,500 tons.

The following graphic is a comparison of our SMU months on hand from this past week vs. the MSCI data as of the end of July. SMU has been tracking in the low 2 months for quite some time.

Plate

Service centers shipped 335,300 tons of plate during the month of July which is an improvement over the 322,500 tons shipped the previous month. Inventories totaled 993,000 tons as of the end of the month of July which represented a 3.0 month’s supply down slightly from the previous month.

Total plate inventories have now dropped 35,900 tons since the beginning of the year.

Pipe & Tube

Distributors shipped 232,500 tons of pipe & tube products during the month of July. The daily shipment rate was 10,600 tons down slightly from the 11,100 tons shipped per day during the month of June and May.

Inventories stood at 681,700 tons up 9,600 tons from the prior month. Pipe and tube months on hand as of the end of July stood at 2.9 months unadjusted and 3.0 months on a seasonally adjusted basis.

Since the beginning of the year distributors have pipe and tube inventories down 26,000 tons.