Product

August 16, 2013

Philly and NY Survey's Post Slower Manufacturing Growth

Written by Sandy Williams

Manufacturing continued to expand in the Philadelphia region in August but with slightly less optimism for the current pace of growth. The general economic index of The Federal Reserve Bank of Philadelphia’s Business Outlook Survey fell to 9.3 this month from 19.8 in July (its highest reading since March 2011) and has been in the expansion range now for three consecutive months.

Demand slowed in August as indicated by a drop of 5 points in the new orders index to 5.3. Shipments, unfilled orders and delivery times all showed negative readings this month suggesting weaker conditions. The employment index dropped 4 points but more firms surveyed reported more increases in hiring than decreases.

Demand slowed in August as indicated by a drop of 5 points in the new orders index to 5.3. Shipments, unfilled orders and delivery times all showed negative readings this month suggesting weaker conditions. The employment index dropped 4 points but more firms surveyed reported more increases in hiring than decreases.

The future indicators still suggest growth in business activity but with less strength.

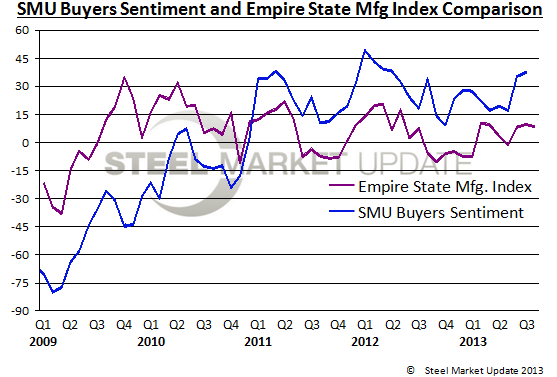

New York manufacturers indicated modest improvement for August in the Empire State Manufacturing Survey. The general business index held relatively steady at 8.2 for the month while new orders and shipments indexes fell, indicating flattening conditions. The number of employees increased in August along with the average workweek, reaching their highest levels in a year.

The outlook for the future was positive with the future general business index rising five points to 37.4. Capital expenditures are expected to pick up while the technology spending index fell six points to 4.8.