Product

August 12, 2013

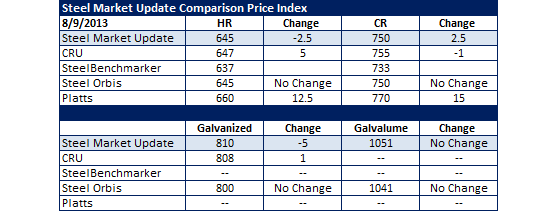

SMU Comparison Price Indices: Have We Reached the Peak?

Written by John Packard

By John Packard

Have flat rolled steel prices reached their peak? We captured mixed results in this week’s analysis of the indices followed by Steel Market Update. Platts Midwest hot rolled and cold rolled coils both shot up $12.50 per ton compared to where we had them one week ago. Steel Orbis numbers did not move. SteelBenchmarker did not provide new pricing and CRU, like SMU showed both slightly higher as well as slightly lower pricing on individual indices. All of the indices except Platts had hot rolled at $645 or $647 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.