Product

August 12, 2013

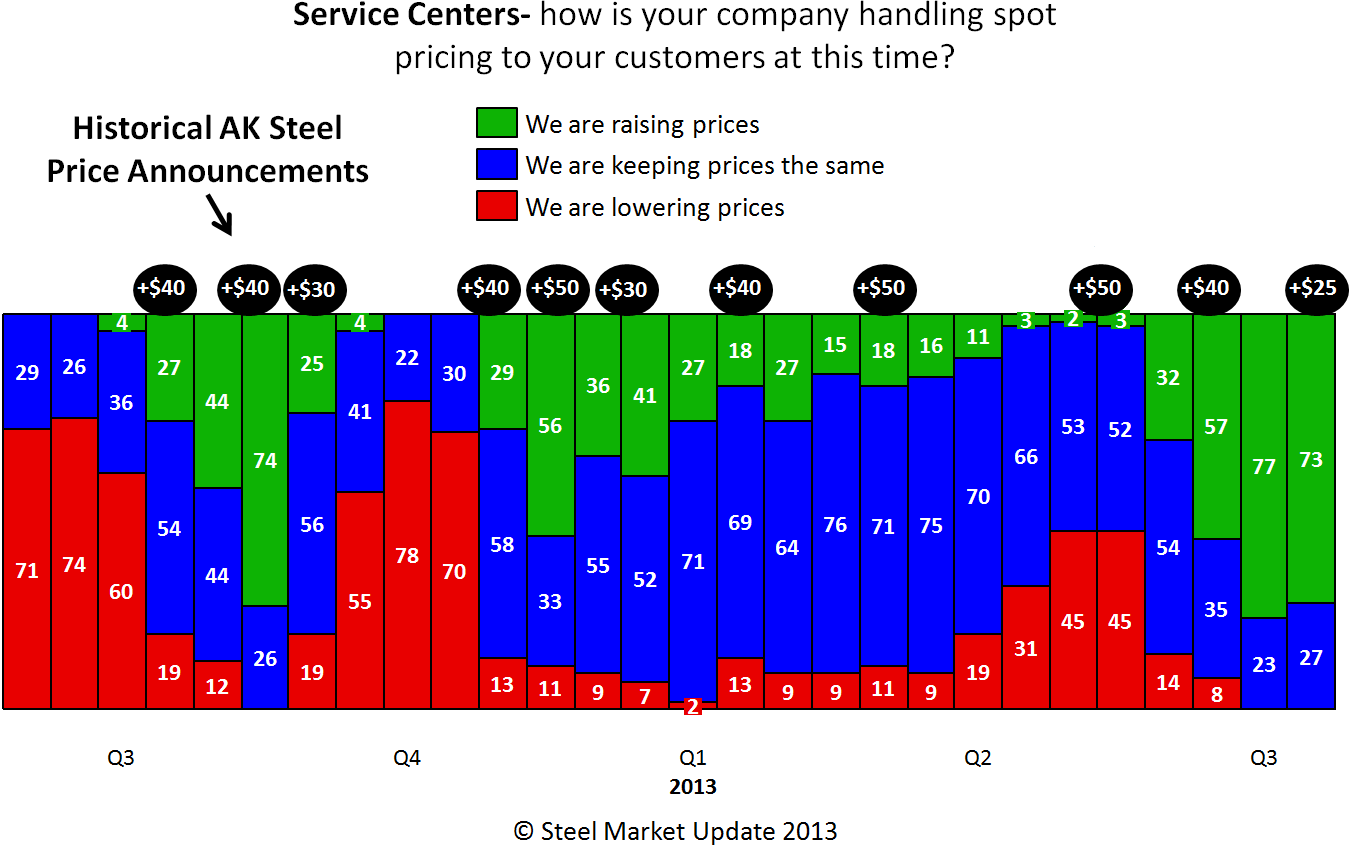

Service Center Spot Prices Rising – Supporting Mill Price Increases

Written by John Packard

One of the key items watched by Steel Market Update is service center spot pricing. Service centers have the ability to support price increases or signal the market that spot increases will fail.

According to the manufacturing companies participating in our mid-July steel market survey, service centers are

pushing for higher prices in the spot flat rolled markets. Since early June SMU has seen the percentage of distributors reported as raising prices move from 6 percent to 42 percent. At the same time those reported as lowering spot prices shrank from 32 percent during the first week of June to the current 4 percent level. This is bullish for inventory values and could very well pave the way for more price increase announcements out of the domestic steel mills.

Steel Market Update (SMU) pressed the issue a little further by asking the manufacturing companies who responded to our survey how much of an increase are they seeing from their service center suppliers. We found the largest percentage was $30-$40 per ton as 76 percent of the manufacturing companies reported results within that window. Only 16 percent of the end user respondents reported $50-$60 per ton and no one was higher than $60 per ton. The balance (8 percent) reported $20 per ton or less

The service centers themselves reported a much higher percentage of the distributors were raising prices as 73 percent told SMU their company was involved in asking for higher spot prices. This is slightly lower than the 77 percent from the first week of June but, as you can see from our graphic, it is the strongest move we have seen since the beginning of 2012. In SMU opinion it is important for the service centers as a group to support higher spot prices if the domestic steel mills have any chance in collecting part, or all of their price announcements. (This article was first written on July 21 and Severstal announced a price increase on July 23 which most of the industry had followed by the end of the month)

The graphic above portrays the service center view of spot pricing trends coming out of the distributors to their end customers. The black circles show the AK Steel price announcements. Those which were successful were followed by an improvement in the percentage of service centers reported to be raising prices. Those which failed (example: early 2013 announcements) did not receive much service center support in the spot market.