Product

August 12, 2013

Service Center Inventory Levels Supporting Price Increases

Written by John Packard

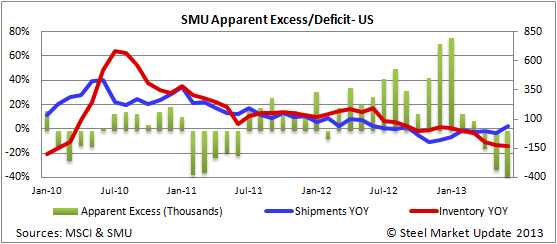

Based on our analysis of the recently released Metal Service Center Institute (MSCI) data the Apparent Deficit for flat rolled increased to 397,000 tons in June. This comes after a 336,000 ton deficit in May and a 157,000 ton deficit at the end of

April. Our analysis of June 2012 indicated service centers at that time were carrying 289,000 tons more inventory (or excess) than what they needed to be balanced.

The deficit increased due to a jump in the daily shipping rate to 109,600 tons per day. This is an improvement over the prior month and is 2,800 tons per day above last June’s shipping rate. At the same time inventories declined to 4,667,900 tons which is almost 15 percent lower than one year ago.

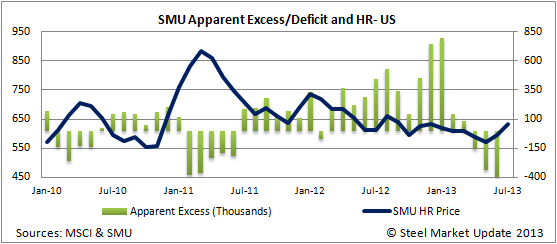

Here is the relationship between our analysis of the MSCI data and how flat rolled steel prices (HRC) have reacted in the past. As you can see there appears to be a correlation between low inventories at the distributors and the ability of the steel mills to collect higher prices.