Market Data

March 25, 2013

Steel Buyers & Sellers Betting on Sideways Market to Continue

Written by John Packard

Steel Market Update (SMU) conducted our mid-March steel survey this past week. We invited 682 people representing approximately 650 different companies to participate in our survey. Of those responding 49 percent were manufacturing companies, 39 percent were service centers/wholesalers and the balance were trading companies (5 percent), steel mills (4 percent), toll processors (4 percent) and suppliers to the steel industry (2 percent).

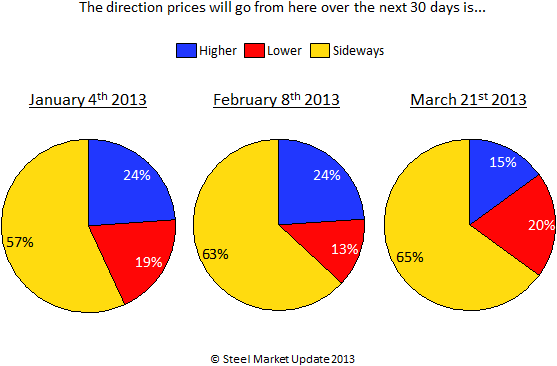

During the survey process we wanted to know what direction our full group believed prices to be heading over the next 30 days. As you can see by the graphic below, those believing prices will move sideways has remained relatively stable with 65 percent of our respondents believing prices will neither move higher nor lower over the next 30 days. A slightly smaller percentage believes prices will move higher (15 percent last week vs. 24 percent at the beginning of both January and February of this year). Those believing prices will move lower grew by 7 percentage points to 20 percent.

The domestic steel mills feel differently than the overall steel market (all groups combined). In a separate question asked only of the steel mills responding to our survey 80 percent believed prices would move higher from here with 20 percent believing they will move sideways over the next 30 days. This is a change from our last survey when 100 percent of the mills reported prices would move higher from that point in time.

Trading companies were asked if foreign prices would move higher, lower or remain the same over the next 30 days. Of those traders responding to our survey half believed foreign steel prices would move lower in the next 30 days. Those believing prices will remain the same came in at 33 percent while 17 percent felt foreign prices would move higher over the next 30 days. One trader left us a comment regarding this question: “We might see them drop as they see the lack of domestic increases sticking. Lead time out of Asia is now August.”

Here are some of the other comments left behind regarding price direction over the next 30 days:

“Customers feel the price will drop, especially when we get into the summer months. I think the price will stay the same because of the competition’s desire to stay busy.” – Service Center.

“Assuming the mills have moved upward from their February lows we anticipate a stall in numbers for the remainder of March followed in April by a slight pullback, though maybe not as low as the February pricing.” – Service Center.

“Sideways at best – probably lower as we get closer to the end of the next 30 days.” – Manufacturing Company.

“The reality is that even with the increases that the mills have announced the net effect to pricing in the market is 0. There have been no increases that have actually made it into the market in fact prices have gone backwards.” – Wholesaler.

“Big gamble depending on direction of scrap. If it tanks in April another limb chopped off the mills credibility tree.” – Service Center.

“The problem is with the service centers. We may see the mills end the back room deals in the next 30 days.” – Trading Company.