Distributors/Service Centers

March 25, 2013

Flat Service Center Spot Market Continues

Written by John Packard

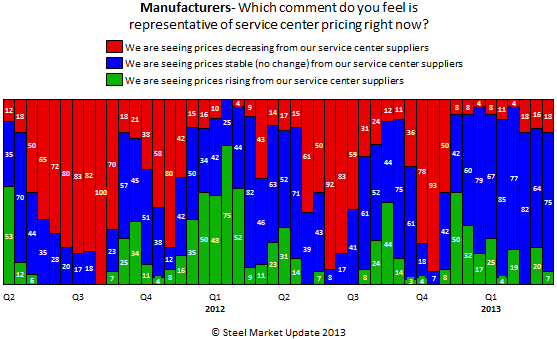

Manufacturing companies continue to report negligible support for higher spot prices by the distribution segment of the flat rolled industry. In our most recent survey, the vast majority of manufacturing companies reported their service center suppliers as providing stable spot prices (75 percent). Only 7 percent were reporting higher spot prices and those reporting lower spot prices out of their suppliers rose a couple of points to 18 percent.

Service centers agreed with the assessment made by the manufacturers with 75 percent of the distributors reporting stable spot prices, 9 percent reported lowering prices and 16 percent reported their spot prices as being higher. As you can see from the graph below the trend for raising prices which began in the 4th quarter 2012 has been steadily declining even though the domestic mills have announced five (5) price increases during this time period.

A number of service centers left behind comments regarding their spot market pricing and the reasons why their company was pricing product in a specific way:

“We are attempting to maintain pricing but the competitive landscape has forced our company to match sub-market pricing in many territories just to simply maintain market share. Plain and simple there is too much steel out there right now.”

“Lowering [prices] or keeping the same. What ever gets the order!! not enough in the schedule to turn an order away.”

“In many cases, we have to decide if we want the order at the cheap price customers are being quoted.”

“Where order size and delivery make it possible. We are taking advantage of manufacturing’s quest for ever increasing inventory turns.”