Analysis

March 23, 2013

NAR: Existing Home Sales Healthy in February

Written by Sandy Williams

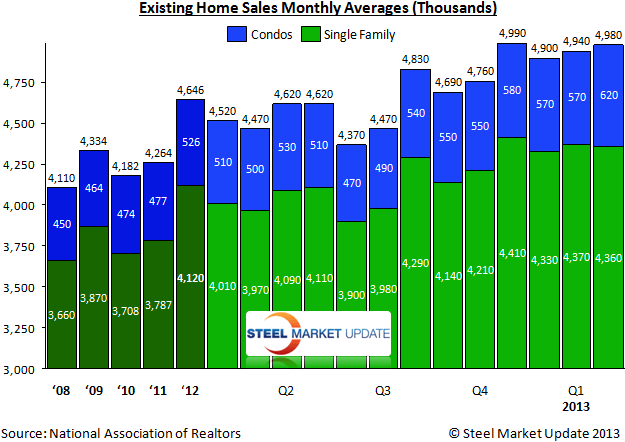

Existing home sales in February are at their highest level since November 2009 according to data released by The National Association of Realtors. Existing home sales increased 0.8 percent to a seasonally adjusted rate of 4.98 million in last month, a 10.2 percent increase over the level seen in February 2012.

Prices have also shown a substantial gain, rising 11.6 percent in February, the strongest growth rate since November 2005. A rise in home prices leads to a rise in consumer spending which is an indicator of economic growth. Low interest rates below four percent have contributed to consumer affordability.

“Job growth in the improving economy and pent-up demand are causing both home sales and rental leasing to rise. Though home prices are rising much faster than rents, historically low mortgage rates are still making home purchases affordable,” said Lawrence Yun, NAR Chief economist. “The only headwinds are limited housing inventory, which varies greatly around the country, and credit conditions that remain too restrictive.”

“Job growth in the improving economy and pent-up demand are causing both home sales and rental leasing to rise. Though home prices are rising much faster than rents, historically low mortgage rates are still making home purchases affordable,” said Lawrence Yun, NAR Chief economist. “The only headwinds are limited housing inventory, which varies greatly around the country, and credit conditions that remain too restrictive.”

The inventory of existing homes at the end of February rose 9.6 percent to 1.94 million homes for sale—a 4.7 month supply at the current sales pace. Listed inventory is down 19.2 percent from a year ago.

Foreclosures and short sales were 2 percent higher than in January and accounted for 25 percent of February sales, but were down from 34 percent a year ago.

Regionally, the South and West saw a 2.6 percent increase in sales in February. Existing home sales fell 3.1 percent in the Northeast and 1.7 percent in the Midwest but continue to show growth over the same period in 2012.