Market Data

March 23, 2013

Industrial Production & Capacity Utilization in “Goldilocks Zone”

Written by Peter Wright

Industrial Production and Manufacturing Capacity Utilization – February 2013

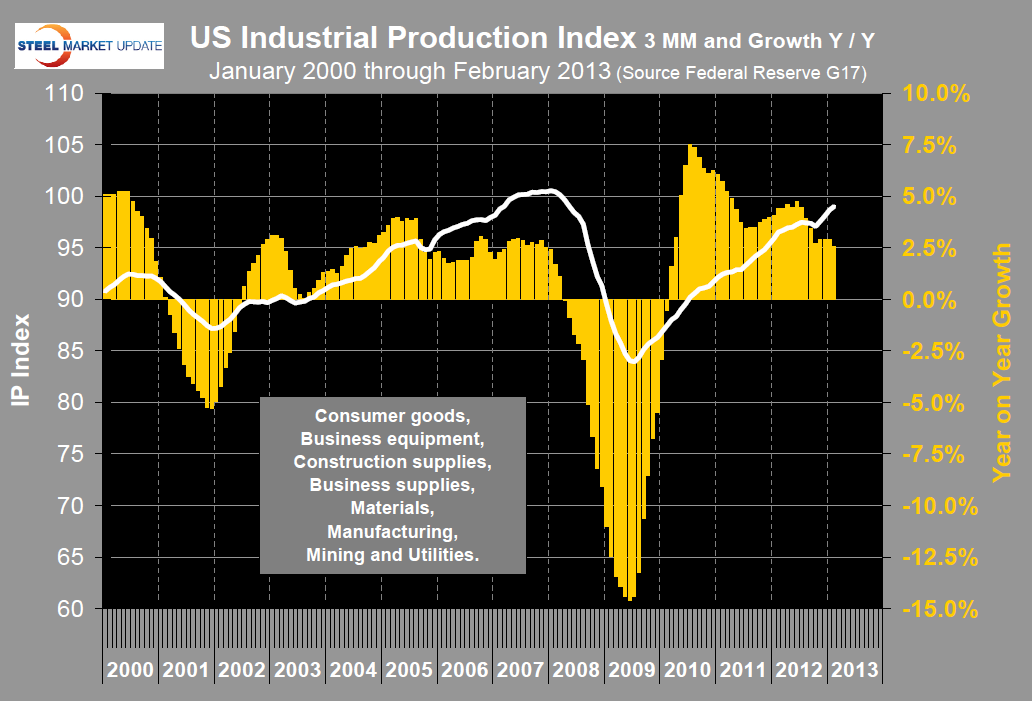

Federal Reserve statistics for February 2013 indicate that manufacturing is in a “Warm” growth mode which confirms the Institute of Supply Management’s manufacturing index, orders for durable goods and the rate of growth of manufacturing employment. In three months through February IP grew 2.6% year over year, a growth rate that has been almost unchanged for five months. By this measure IP is now within 1.5% of its all time high in January 2008.

Moody’s Analytics reported as follows on March 15th; “Industrial production increased a solid 0.7% in February, and the important details related to manufacturing were positive. Manufacturing production increased 0.8% in February, with production of motor vehicles and parts increasing 3.6% and other production up 0.6%. The manufacturing data reported for earlier months were revised higher. Away from manufacturing, utilities output rose an additional 1.6%, but mining production, which has been soft lately, fell 0.3%. Overall this was a positive report that suggests that manufacturing is gaining traction thanks to a turn in the inventory cycle and decent growth in final demand.”

Moody’s Analytics reported as follows on March 15th; “Industrial production increased a solid 0.7% in February, and the important details related to manufacturing were positive. Manufacturing production increased 0.8% in February, with production of motor vehicles and parts increasing 3.6% and other production up 0.6%. The manufacturing data reported for earlier months were revised higher. Away from manufacturing, utilities output rose an additional 1.6%, but mining production, which has been soft lately, fell 0.3%. Overall this was a positive report that suggests that manufacturing is gaining traction thanks to a turn in the inventory cycle and decent growth in final demand.”

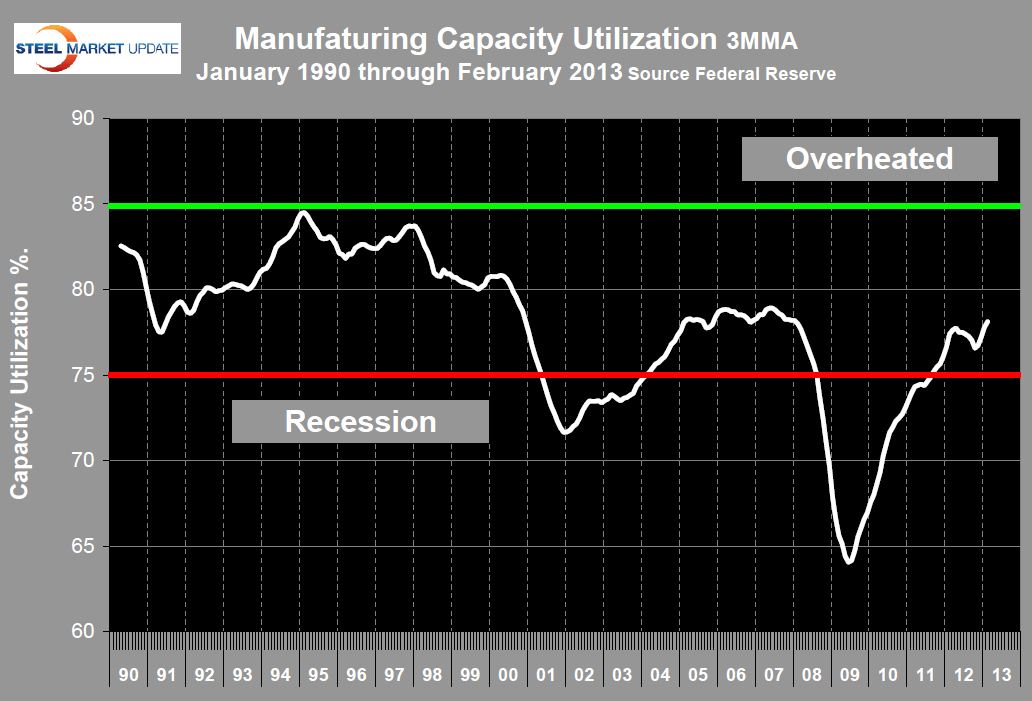

Manufacturing capacity utilization is in the Goldilocks zone, neither too hot nor too cold. Utilization in three months through February was 78.11%, up 1% year on year.

Steel consumption in the US is heavily driven by manufacturing and construction activity. Manufacturing was the prime mover in the first stage of recovery from the recession and is now in a stable growth mode. Construction has taken over as the primary growth engine with both the housing and non residential sectors expanding nicely.

Steel consumption in the US is heavily driven by manufacturing and construction activity. Manufacturing was the prime mover in the first stage of recovery from the recession and is now in a stable growth mode. Construction has taken over as the primary growth engine with both the housing and non residential sectors expanding nicely.