Product

March 23, 2013

Hot Rolled Coil Futures: The World is Flat…

Written by John Packard

Written by Brad Clark, Director of Steel Trading, Kataman Metals

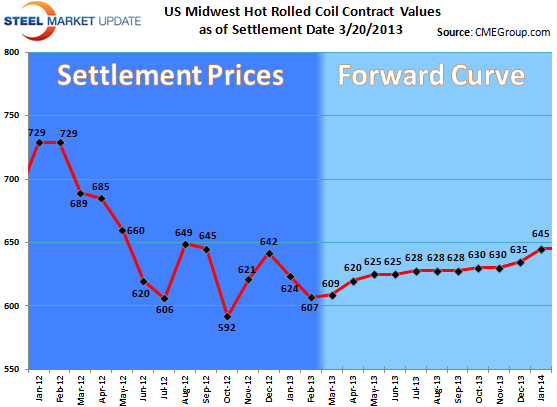

Last week’s $15 drop down the forward curve has done little to spark new trading interest as prices have bounced a touch off the lows around $620. We are now stuck around the $625 range for the balance of 2013. With the spot indices hovering around the $615 per ton mark a forward curve $5-10 per ton above that leaves little trading opportunities. After months of a steep contango down the curve giving hedgers the chance to sell forward at significant premiums to the spot, the current flat shape to the forward curve does nothing to inspire natural sellers. With that said, the physical market looks to be softening again after the latest mini spike in prices with rates heading down to the $600 per ton mark and below. This decline in prices gives buyers in the futures market little inspiration to pay up to $620. The bottom line is that the futures market is now stuck around levels that neither bears nor bulls are happy with. Something needs to give either way to spur more trading as most await that impetus to come from the physical market which at the moment looks extremely fragile.

This past week the futures contracts have traded most periods down the curve which has been good for liquidity even as absolute volumes haven’t been as robust as we have seen the past few months. April has traded between $613-618, q2 has traded between $620-623, q3 at $625 and Nov-Dec at $630 and Jan, Feb at $635.

As we turn to the underlying physical market things continue to look bleak. Demand for steel remains soft, over supply persists in both capacity terms as well as inventory levels. The recent round of price hikes can be considered as failing as prices begin to retreat to sub $600. After a surge in scrap prices at the beginning of March we are already seeing April prices shape up to be down at least $20 per ton. Fundamentally the HRC physical market has traded sideways since mid-January with a mini boom and bust cycle repeating itself when mills capitulate and offer volume deals around $570 and then post price hike announcements to $620. This may seem like volatility is prevalent in the market, but taken on a month on month basis the prices has deviated very little from a $608 mean. On top of this the majority of bulk purchases have been concluded around $580 while significantly less deals concluded at the top of the range at $620. April looks to be another down month for HRC prices.

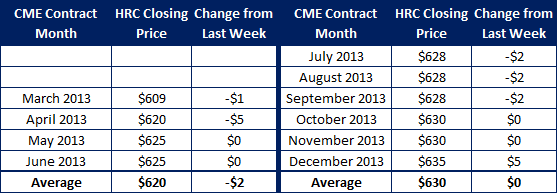

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 3/20/2013 close:

OPEN INTEREST: 13,266 lots (1 lot = 20 short tons)