Product

March 21, 2013

SMU Price Ranges & Indices: Flat to Lower

Written by John Packard

The domestic steel mills continue to struggle to keep the flat rolled steel averages (indices) above benchmark levels. Hot rolled coil, which according to our index rose during the previous two weeks to $615 per ton (average), is now struggling to hold its gains. Other flat rolled items are having their issues and this was highlighted by SDI in their pre-earnings announcement when they spoke to weakness in the galvanized market.

For the 15th week in a row our SMU Price Momentum Indicator is at Neutral as price momentum is muted at best. We are seeing some potential weakening in the numbers as mills are actively negotiating with those who have actual tons to place. There is talk within the industry of another price announcement but most buyers no longer consider the announcements as being serious impediments to the way they intend on purchasing steel going forward.

This is how we see flat rolled spot prices this week:

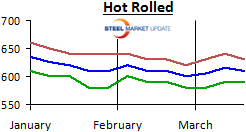

Hot Rolled Coil: SMU range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end of the range decreased by $10 per ton. Our average has declined by $5 per ton compared to one week ago. The trend for HR continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Hot Rolled Coil: SMU range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) fob mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end of the range decreased by $10 per ton. Our average has declined by $5 per ton compared to one week ago. The trend for HR continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Hot Rolled Lead Times: 2-5 weeks.

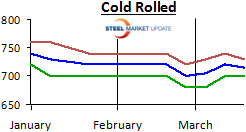

Cold Rolled Coil: SMU range is $700-$730 per ton ($35.00/cwt-$36.50/cwt) with an average of $715 per ton ($35.75/cwt) fob mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end of the range decreased by $10 per ton. Our average is now $5 per ton lower than this time last week. The trend for CR continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Cold Rolled Coil: SMU range is $700-$730 per ton ($35.00/cwt-$36.50/cwt) with an average of $715 per ton ($35.75/cwt) fob mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end of the range decreased by $10 per ton. Our average is now $5 per ton lower than this time last week. The trend for CR continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Cold Rolled Lead Times: 4-7 weeks.

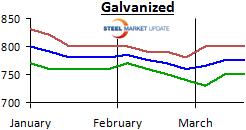

Galvanized Coil: SMU Base Price range is $34.50/cwt-$37.00/cwt with an average of $35.75/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper end of our range remained intact compared to last week. Our average remains the same as one week ago. The trend for galvanized continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Galvanized Coil: SMU Base Price range is $34.50/cwt-$37.00/cwt with an average of $35.75/cwt plus applicable extras, fob mill, east of the Rockies. Both the lower and upper end of our range remained intact compared to last week. Our average remains the same as one week ago. The trend for galvanized continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Galvanized .060” G90 Benchmark: SMU range is $750-$800 per ton with an average of $775 per ton.

Galvanized Lead Times: 4-8 weeks.

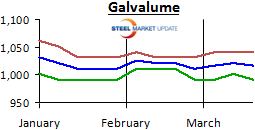

Galvalume Coil: SMU Base Price range is $35.00/cwt-$37.50/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range decreased by $10 per ton while the upper end of the range remained the same as one week ago. Our average has declined by $5 per ton compared to one week ago. The trend for Galvalume continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Galvalume Coil: SMU Base Price range is $35.00/cwt-$37.50/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range decreased by $10 per ton while the upper end of the range remained the same as one week ago. Our average has declined by $5 per ton compared to one week ago. The trend for Galvalume continues to be Neutral as the market struggles for identity. We are watching lead times, negotiations and supply/demand as well as cost pressures to see if any one item (or a combination of factors) could move pricing in one direction or another. Until then SMU remains at Neutral.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU range is $991-$1041 per ton with an average of $1016 per ton.

Galvalume Lead Times: 4-8 weeks.