Product

March 21, 2013

February Service Center Shipments and Inventories- USA

Written by Peter Wright

Written by: Peter Wright

There are three information sources which taken together provide a picture of supply and demand in the U.S. steel market. There are the monthly AISI steel shipments, the Department of Commerce trade statistics and the MSCI report of shipments and inventories.

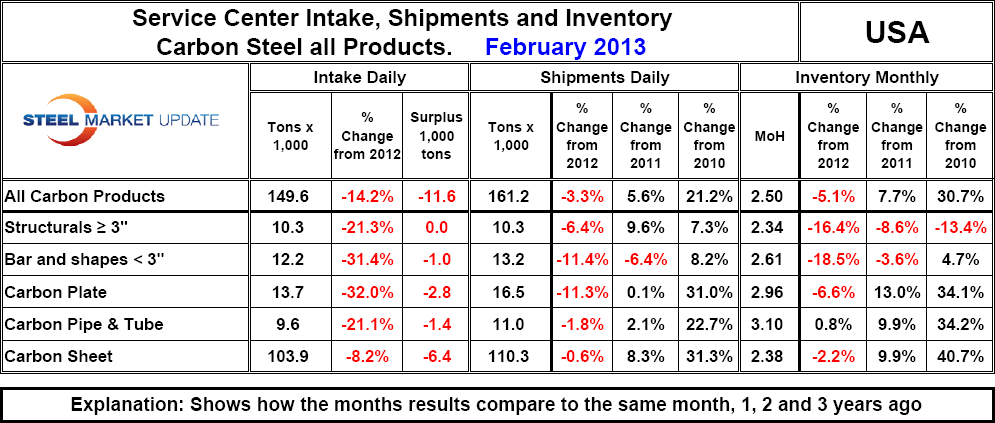

In February total daily carbon steel shipments from service centers declined 3.3 percent from February 2012 but were up by 5.6 percent and 21.2 percent from February 2011 and 2010 respectively.

All five individual product group shipments declined in February year-over-year, bar sized shapes had the largest decline at 11.4 percent and carbon sheet the least at 0.6 percent.

Both shipments and inventories are well below the level they enjoyed before the recession, Fig 1. Daily shipments in total are still only 75.9 percent of the pre-recession level, ranging from 58 percent for structurals to 84.3 percent for sheet.

Both shipments and inventories are well below the level they enjoyed before the recession, Fig 1. Daily shipments in total are still only 75.9 percent of the pre-recession level, ranging from 58 percent for structurals to 84.3 percent for sheet.

U.S. service centers took in 11,600 tons per day less than they shipped in February: over half of this discrepancy was in carbon sheet. Total carbon steel inventories declined 5.1 percent in February year-over-year, only pipe and tube trended in the opposite direction.

Months on hand at the close of February was 2.5, ranging from 2.34 for structurals to 3.1 for pipe and tube. Full details by product group are shown in Table 1.

Note: In Steel Market Update commentaries on service center performance we only discuss daily receipts and shipments because the difference in shipping days per month makes monthly data less meaningful. Also we avoid comparing consecutive months because both seasonal and commercial influences distort the data. All comparisons are made on a year-over-yearbasis to remove some of the monthly noise.