Product

March 21, 2013

February Residential Construction, Permits and Starts

Written by Peter Wright

Written by: Peter Wright

The housing market is important to steel producers and processors for a number of reasons, some of which are not obvious. Not a lot of steel is consumed in wood framed houses but housing starts also lead sales of appliances and other steel items. Starts also positively affect ancillary non-residential construction such as schools and infrastructure. Steel consumption is driven by the growth of GDP, which is driven by consumer confidence which drives consumer spending, which drives job growth, which drives consumer spending…. This is either a virtuous or destructive spiral. Fortunately at present the spiral is heading upwards. All three indicators, confidence, spending and employment are important indicators of steel’s market direction. However, at the present time they are not the root cause of change in the steel market. At SMU we believe that housing as a proxy for the wealth effect is the real driver.

RealtyTrac released its Q4 and Year-End 2012 U.S. Foreclosure & Short Sales Report on February 28th. Foreclosure-related sales accounted for 21 percent of all U.S. residential sales during the year, down from 23 percent of all sales in 2011 and down from 28 percent of all sales in 2010. Properties not in foreclosure that sold as short sales in 2012 accounted for an estimated 22 percent of all residential sales – bringing the total share of distressed sales to 43 percent. Short sales are those where the sales price is below the estimated amount of all outstanding loans for a given property.

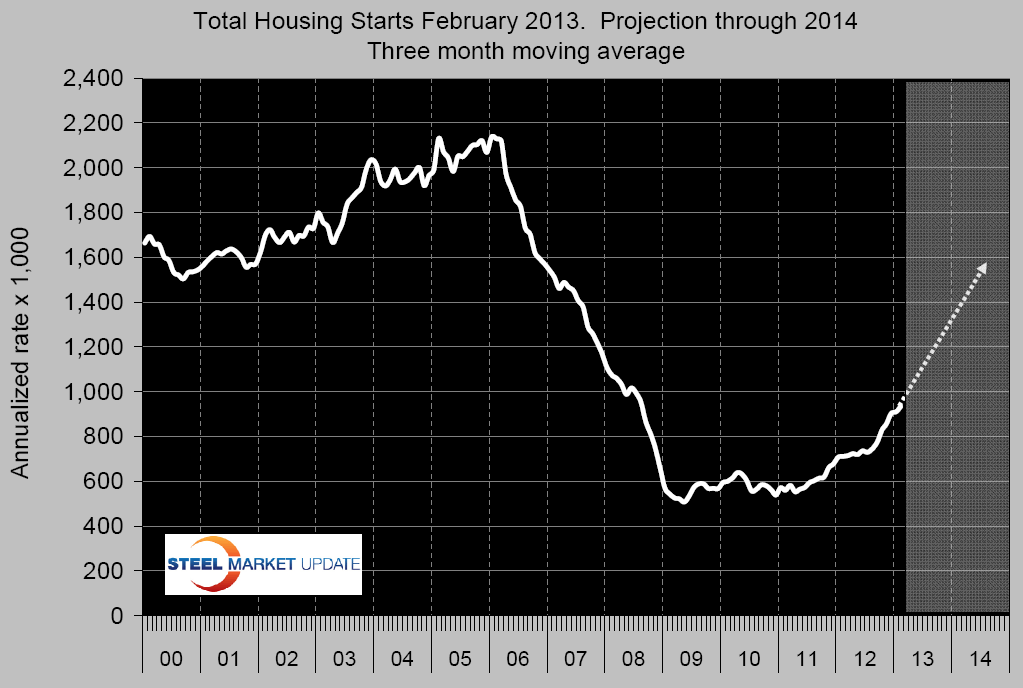

Home prices are rising and foreclosures are falling, both of which are improving the consumer’s financial view There is still a long way to go but in spite of this, residential construction is booming and a projection of the present growth rate indicates that a full recovery will have occurred by mid next year, Fig 1. For this analysis a full recovery is considered to be 1.6 million units per year which ignores the bubble years when loans were pushed at unqualified borrowers.

Home prices are rising and foreclosures are falling, both of which are improving the consumer’s financial view There is still a long way to go but in spite of this, residential construction is booming and a projection of the present growth rate indicates that a full recovery will have occurred by mid next year, Fig 1. For this analysis a full recovery is considered to be 1.6 million units per year which ignores the bubble years when loans were pushed at unqualified borrowers.

The following table describes the February data for residential permits and starts and compares those results on a three month moving average with the same period a year ago both nationally and regionally. On this basis, total permits and starts were up by 33.0 percent and 31.6 percent, respectively. The difference suggests that residential construction will slow during the next few months but not by much. Multi-family construction continues to lead single family as it has done since the recovery began. By far the greatest volume of units is in the South, but the West has the fastest growth rate. Permits are leading starts for both single and multi-family units in the Mid West but there is some slowing in the cards for other regions.

Overall the February housing report suggests that this sector will have a very positive effect on future steel market conditions.