Product

March 18, 2013

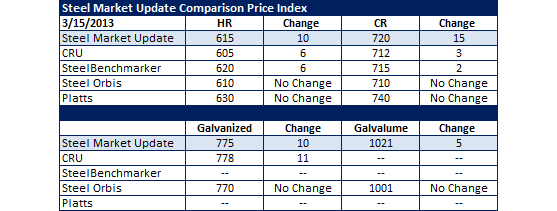

SMU Comparison Price Indices

Written by John Packard

All of the indices followed by Steel Market Update had benchmark hot rolled above $600 per ton with all being above $610 per ton with the exception of the CRU. With the exception of Platts – which has been higher than the other indices for a number of weeks recently – cold rolled could be covered by a $10 spot ($710-$720). The spread on galvanized was even tighter at $8 per ton. We continue to see a wide spread ($20 per ton) between SMU and Steel Orbis on Galvalume.