Product

March 15, 2013

SMU Analysis of U.S. Exports of Flat Rolled & Long Products

Written by Peter Wright

Written by: Peter Wright

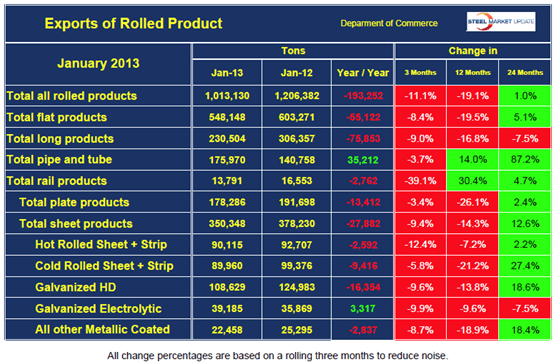

Rolled steel exports in January increased 11.6 percent from December but were down by 193,000 tons from January 2012. The table below summarizes export steel trade by product with trend comparisons. Percentage changes are all on a three month moving average basis to reduce the noise in the data. Total exports in the three months through January were down by 11.1 percent compared to the three months through October. Exports were down by 19.1 percent compared to the three months through January last year and were up by 1 percent compared to two years ago.

In the three months through January, export volumes for all products decreased compared to three months earlier. The decrease was similar across all products except for rail which was down by 39.1 percent. Compared to a year ago, exports were down on all products except rail and tubulars. Compared to two years ago exports were up on all products except longs and electro galvanized sheet. In January 85 percent of total steel exports were destined for our NAFTA partners, 53 percent to Canada and 32 percent to Mexico.